S&P 500 Index Lost 2.4% In 3Q2023; Latest Inflation And Economic News

Updated Published Friday, September 29, 2023 at: 7:07 PM EDT

Updated Published Friday, September 29, 2023 at: 7:07 PM EDT

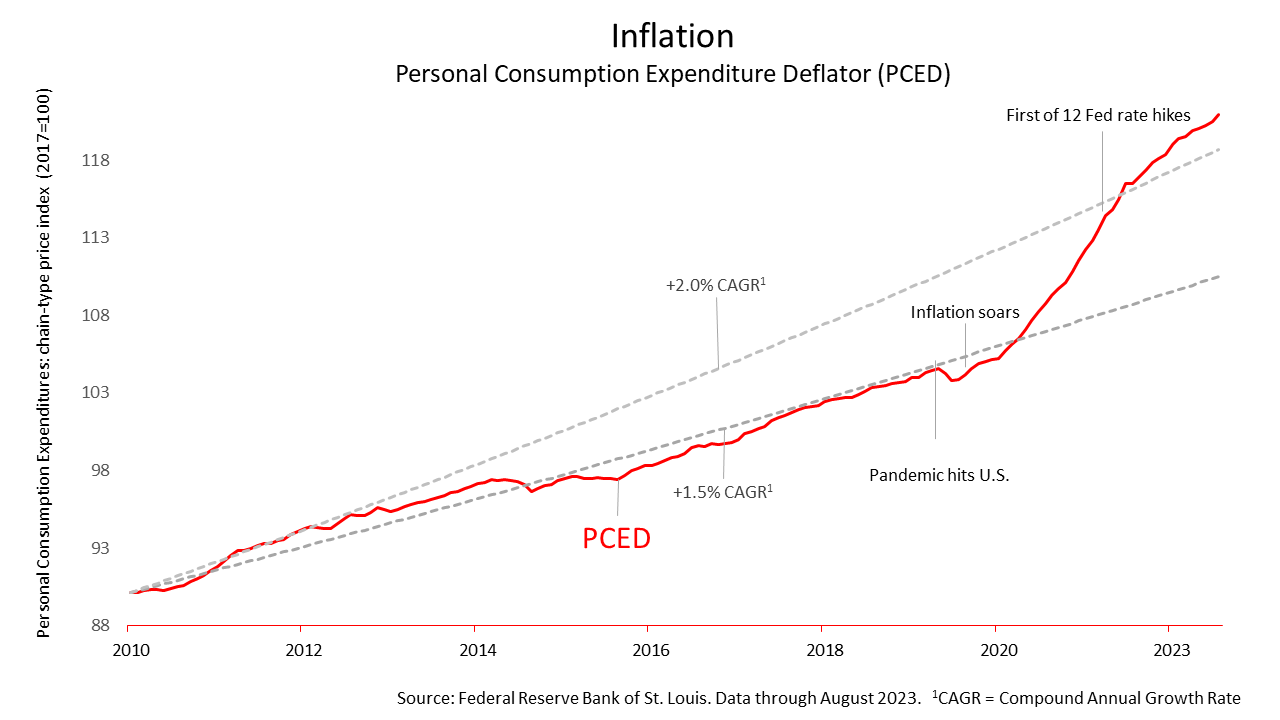

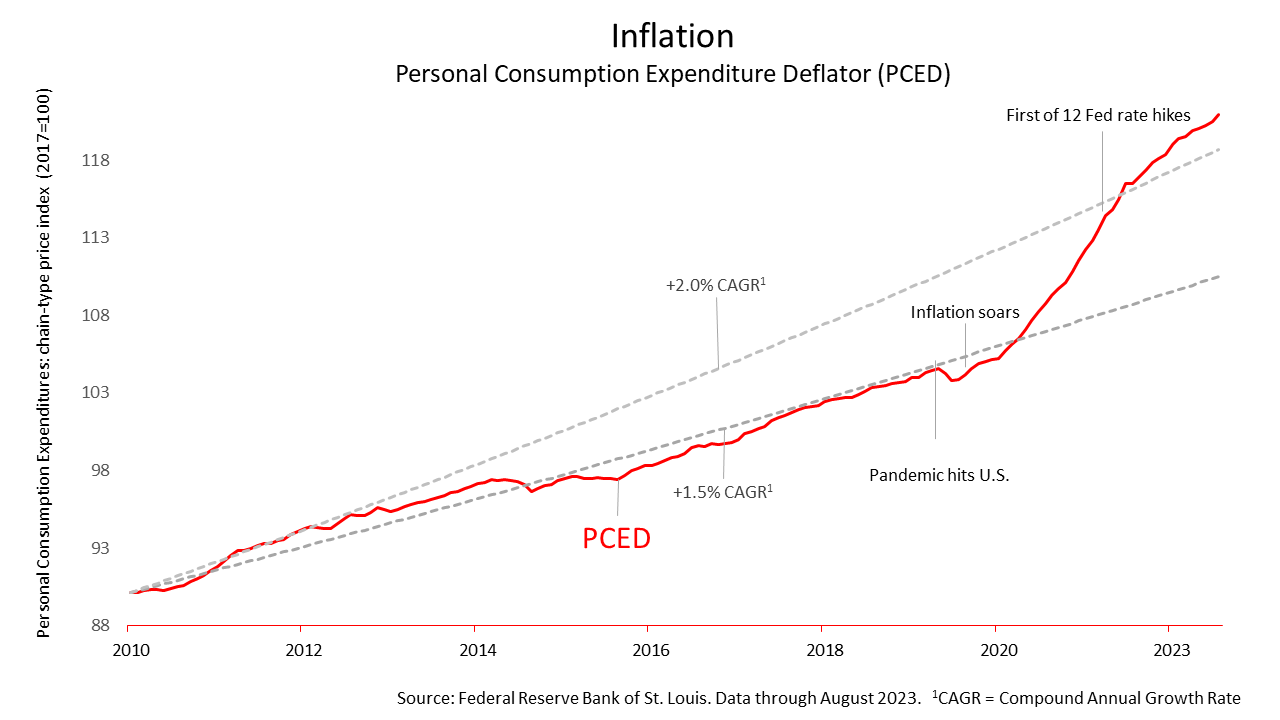

Excluding energy and food prices, inflation rose by a scant one-tenth of 1% in August, as measured by the Federal Reserve Board’s preferred inflation benchmark. However, because gasoline prices rose sharply in August, the PCED index of inflation -- including energy and food expenses -- rose in August by four-tenths of 1%.

Released Friday morning by the Bureau of Economic Analysis, the monthly PCED report shows the 12 rate hikes implemented by the Fed since March 2021 have snuffed out the high-inflation mindset that peaked 18 months ago.

The red line in the chart above shows the PCED index of inflation hugged the 1.5% annualized inflation rate, shown in the lower dotted gray line, for a decade, but began soaring two months after the pandemic struck the U.S. in February 2020 and accelerated for about 18 months. Since last summer, after shooting through the 2% long-term annualized rate, the PCED index has moderated and is nearing the Fed’s target rate for inflation.

With PCED inflation at about 2% in the three months through August, it is uncertain if another rate hike will be announced on November 1, after the Fed interest rate policymakers’ next meeting.

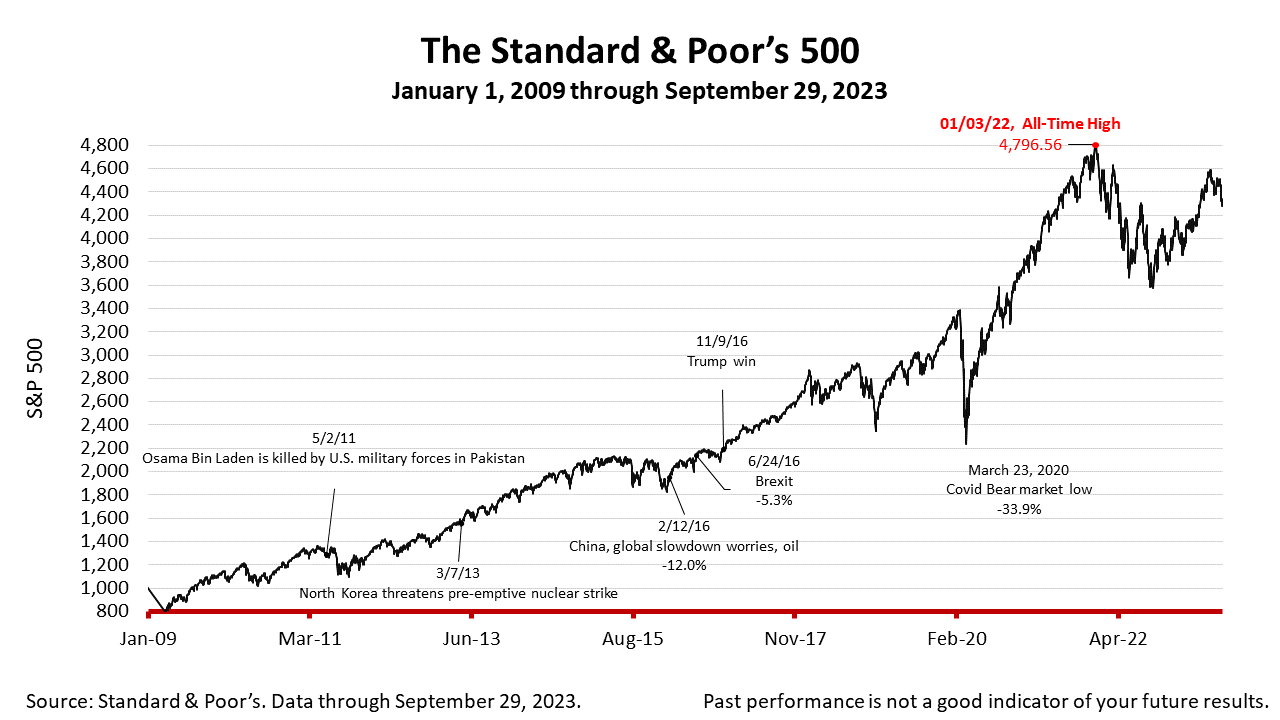

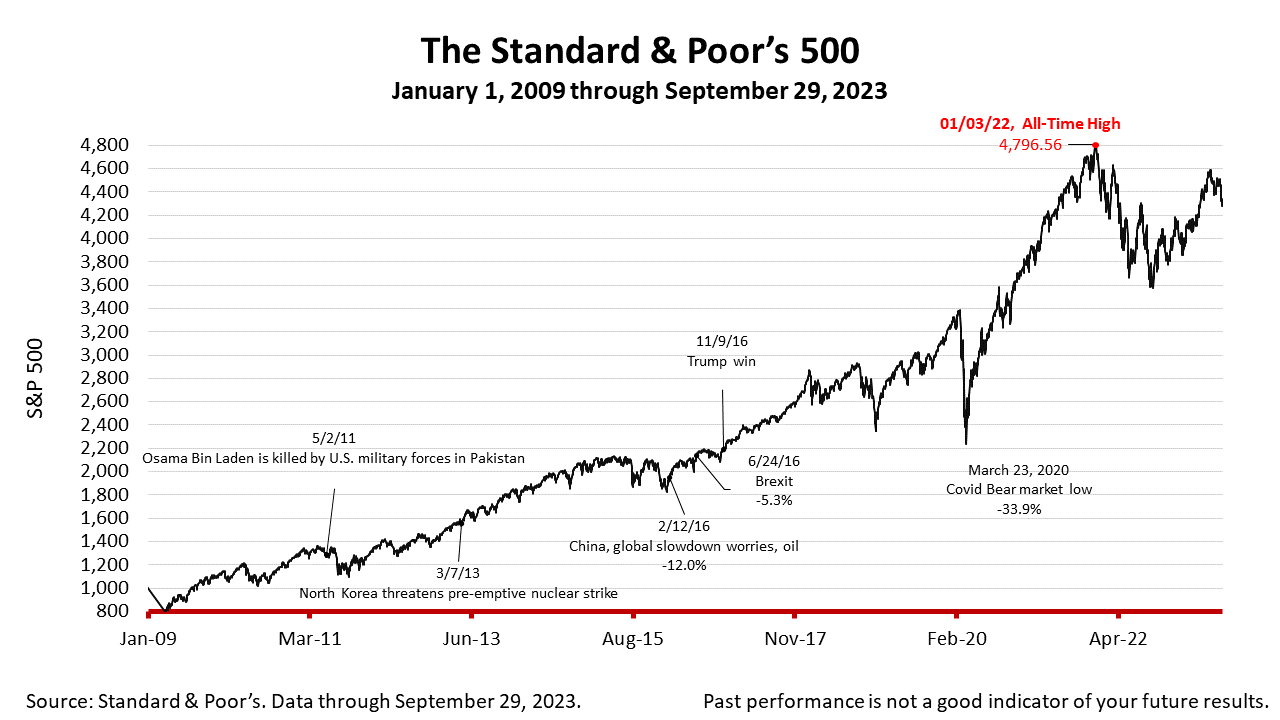

The third quarter ended Friday when the Standard & Poor’s 500 stock index closed Friday at 4288.05, a loss of about 2.4%.

That was down -0.27% from Thursday and -0.74% lower than a week ago. The index is up +91.65% from the March 23, 2020, bear market low and down -10.60% from its January 3, 2022, all-time high.

Amid stock market uncertainty, remember that the S&P 500 index rose 8.7% in the second quarter of 2023 and 7% in the first quarter of 2023 – much stronger quarterly gains than 2.5% averaged annually on large-company stocks since 1926. Moreover, economic growth is strong:

The Atlanta Fed’s GDPNow algorithmic-driven forecast model projects third quarter economic growth is rising at a 4.9% annualized rate, much higher than what was “normal” before the pandemic.

- The New York Fed’s GDPNow algorithm projects a less-robust but still-strong growth rate for 3Q of 2.1%.

With inflation under control and no recession on the horizon, the post pandemic era of anomalies is beginning to end but uncertainty is palpable. It’s a goldilocks situation for long-term investors.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.