|

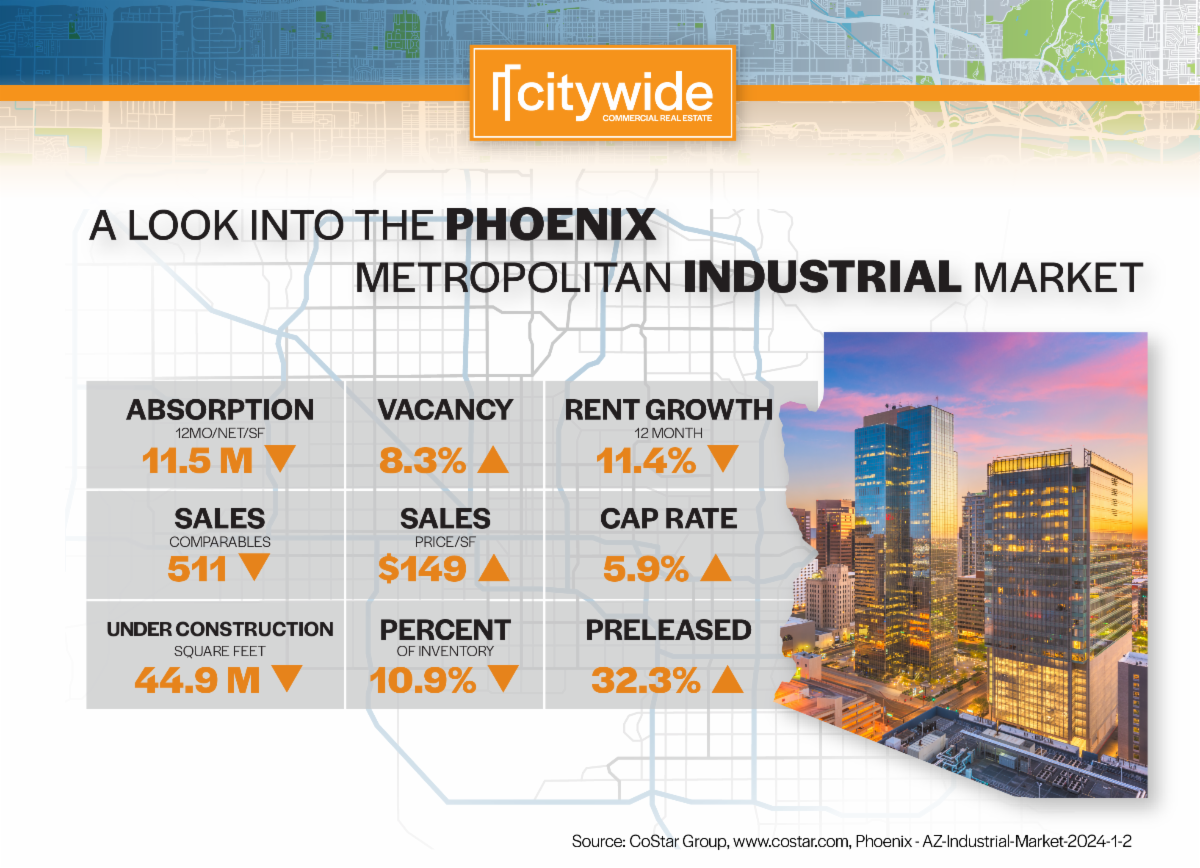

The Phoenix industrial market is experiencing a shift due to a surge in new construction, with developers completing a record 8.9 million SF in 23Q3. This has led to a spike in vacancy to 8.4%, erasing occupancy gains made during the pandemic. Despite some moderation in leasing volume, the substantial supply pipeline, currently at 44.9 million SF under construction (10.0% of the market's total square footage), remains the main driver of higher vacancies. About two-thirds of the space under construction is unleased, expected to further increase vacancy as projects come online.

The Loop 303 corridor in Phoenix's West Valley has been a construction hotspot, with over 24 million SF completed since 2020. However, challenges may arise in leasing during 2024 due to a decline in imports at Southern California ports in 2023 and rising industrial availability in the Inland Empire.

Phoenix also sees momentum in advanced manufacturing, particularly with investments in semiconductor, battery, electric vehicle, and solar industries. This contributes to a vibrant high-tech assembly ecosystem, keeping Phoenix's net absorption stronger than most markets.

Rent growth is normalizing with a 1.7% increase in average asking rents in 23Q3, a slowdown from the 4%+ gains in early 2022. Despite this, the Valley remains one of the nation's strongest rent growth markets, with rates increasing by 11.4% over the past 12 months.

The strong rent growth in recent years has resulted in substantial losses for tenants who signed before 2021, attracting value-add investors. Deals with at least a 20% mark-to-market opportunity are popular, and newly delivered properties with lease-up potential are in demand. Pricing on stabilized deals above $80 million has weakened, influenced by increased financing costs. Newly built properties in 2021 and 2022 generally fetched pricing in the $145/SF to $155/SF range, while deals from this year traded closer to $125/SF to $135/SF.

|

|

|

|

|

|

$860,000 • 2,368 SF Office Suite

34224 North 27th Drive, #138 • Phoenix, Arizona |

|

|

$1,560,000 • 7,225 SF Building • 0.7 AC Lot

8662 North 78th Avenue • Peoria, Arizona |

|

|

|

|

$6,000,000 • 15,444 SF Building • 3.2 AC Lot

7314 North 110th Avenue • Glendale, Arizona |

|

|

$1,100,000 • 6,000 SF Building • 0.32 AC Lot

2315 East Washington Street • Phoenix, Arizona |

|

|

|

|

$695,000 • 3,050 SF Industrial Condo

9299 West Olive Avneue • Peoria, Arizona |

|

|

$750,000 • 65,200 SF Lot

Lower Buckeye & Litchfield Roads • Goodyear, Arizona |

|

|

|

|

$1,000,000 • 2,716 SF Office Condo

4365 East Pecos Road • Gilbert, Arizona |

|

|

$1,400,000 • 5,842 SF Building • 0.38 AC Lot

1425 North 26th Avenue • Phoenix, Arizona |

|

|

|

|

|

Seller/Landlord Representation

We work with you to develop a plan and strategies that will increase the value of your property before bringing it to market.

Buyer/Tenant Representation

We will help you identify purchase or lease options and guide you through the entire process. |

|

|

|

|

|

|