|

National Small Business Week

April 28 – May 4

Did you know there are 31 million small businesses in the United States, which make up roughly 99% of all businesses in the country? In Nevada County, small businesses make up the largest tax revenue base.

People have come from all over the world and started out as small-scale business owners in the hope of living the American Dream. Many came to Nevada County during the Gold Rush hoping to get rich, but it was the businesses that formed to support the miners and mining companies that brought heart to Nevada County.

In 1953, the Federal Government created the Small Business Administration to help and counsel small business owners so they might prosper and grow into sustainable businesses in the future. In 1963, after a proclamation from President John F. Kennedy, the first National Small Business Week (NSBW) was celebrated to honor the top entrepreneurs in every state.

Small Business Week not only offers a platform to showcase small businesses and the entrepreneurs who dare to dream and create, but it is also a time we, as consumers, can conscientiously choose to patronize local establishments. Whether it is to indulge in a cup of artisanal coffee, browse handmade crafts, attend a performance or local event, or savor delicious menus at a local restaurant, every purchase becomes a vote of confidence in the dreams of small business owners.

As we honor the past, embrace the present, and envision the future, let’s continue to champion the dreams of small business owners whose hard work and dedication are largely responsible for strengthening the fabric of our county.

Be a part of the celebration! During this week use your social media platform to share your favorite small business. From heartfelt testimonials to vibrant snapshots of storefronts, the digital sphere can become one more way to spread appreciation and encourage our residents to buy local.

On May 4, the Small Business Administration and SCORE will cohost the National Small Business Week Virtual Summit. Please see the training section below to find out how to register.

| |

Kimberly Parker, CalEd CEO Gurbax Sahota, and ERC ED Gil Mathew | |

2024 CalEd Conference focuses on

elevating opportunities for Economic Development

I was excited to attend the 2024 California Association for Local Economic Development (CalEd) Annual Conference, themed "Elevate.” Gil Mathew, Executive Director of the Nevada County Resource Council was also in attendance which allowed us to participate in a wide variety of sessions.

Over 400 economic developers, government employees, consultants, California State office representatives, and economists from all over the state participated in a vast range of sessions aimed at offering valuable insights into economic development strategies and opportunities. The conference served as a platform for professionals to learn, network, and discover innovative approaches to enhance local economies and communities.

Information from sessions, one-on-one meetings, time with consultants, and networking with colleagues provided a wealth information that I will share with you in the coming months. Topics covered included Public/Private Partnerships, Financing and Funding Strategies, Rural Workforce Trends, Developing an Effective Tourism Strategy, and more.

As the staff for your Nevada County Economic Development office, a key role I play is connecting you to services, resources, data, funding, grants, etc. that you don’t have time to look for on your own. Upcoming e-news editions will share tips, opportunities, contacts for services, and more from the conference.

If you need something now, please feel free to reach out to my office at kimberly.parker@nevadacountyca.gov or (530) 470-2795. I’d be happy to schedule an in-person appointment or chat with you on the phone.

| |

|

Choosing the Right Legal Structure

for Your Business

Choosing the right legal structure for your business is a crucial decision that impacts liability, taxes, and operational flexibility. Here's a breakdown of the most common options:

Sole proprietorship is the simplest form of business ownership, where an individual owns and operates the business. It offers complete control and minimal paperwork. However, the owner is personally liable for all debts and obligations of the business, which means personal assets are at risk.

A Limited Liability Company (LLC) combines the flexibility of a partnership with the limited liability of a corporation. Owners are called members and enjoy protection of their personal assets from business liabilities. LLCs are relatively easy to set up and offer flexible management structures. They also provide pass-through taxation, where profits and losses are reported on the owners' personal tax returns.

Partnerships involve two or more individuals sharing ownership of a business. There are two main types: general partnerships and limited partnerships. In a general partnership, all partners share equally in profits, liabilities, and management responsibilities. In a limited partnership, one or more partners have limited liability but also limited control over the company's operations. Partnerships offer flexibility but also expose partners to personal liability.

A C Corporation is a separate legal entity from its owners (shareholders). It offers limited liability protection to shareholders, meaning their personal assets are typically not at risk for business debts. C Corps are subject to double taxation, where the corporation is taxed on its profits, and shareholders are taxed on dividends received. They offer flexibility in ownership and can issue different classes of stock.

An S Corporation is similar to a C Corp but with a special tax status that allows profits and losses to pass through to the shareholders' personal tax returns, avoiding double taxation. S Corps have restrictions on ownership and are limited to 100 shareholders. They offer liability protection and can provide tax advantages for small businesses.

Each legal structure has its own advantages and disadvantages, so it's important to consult with legal and financial professionals to determine the best fit for your business needs and goals.

Look for Part 2 in the May e-newsletter on steps to take when setting up your legal structure.

| |

SAVE THE DATE FOR THESE FANTASTIC EVENTS!

Earth Day in Nevada City, April 21.

Sierra Small Business Development Center Capital Summit, April 30.

Nevada County Economic Resource Council's Tour of Nevada County, May 9.

Nevada County Farm Bureau Agricultural Tour, May 15.

Nevada County Economic Resource Council's Economic Summit, September 19

| |

CELEBRATING BUSINESS IN NEVADA COUNTY | |

|

Meet Cloud Bear

Healing Arts

Cloud Bear Healing Arts, located at 550 Searls Avenue in Nevada City, provides healing practices for pets and people.

Dr. Mimi Vishoot, a 1994 graduate from UC Davis School of Veterinary Medicine and a 2021 Canine Rehabilitation Institute Certified Veterinary Acupuncture Therapist, provides medical acupuncture, therapeutic laser, qigong healing, and massage treatments for pets.

With training and certifications from qigong teachers Robert Peng, Ken Cohen and locally renowned Homer Nottingham, Mimi also provides qigong healing treatments, classes, and workshops for people.

Over 25 years of experience helping pets and people as a general veterinary practitioner give Mimi a beautiful balance of skills and compassion to continue healing pets and people with these more specialized, gentle, integrative modalities.

All of her work is meant to complement and enhance well-being and overall

quality of life in conjunction with diagnostics and recommendations from

primary veterinary and human medical practitioners.

Cloud Bear Healing Arts’ services are by appointment.

550 Searls Ave., Nevada City, CA 95959

(530) 559-9437

For more information, click here.

| |

For lease:

350 Crown Point Circle

648 - 5,737 SF of Office Space Available in Grass Valley

$1.25 /SF/Month

Property Type: Office

Property Size: 14,847 SF

| |

|

Four vacant, nicely finished office suites, varying in size from 1,120 to 1,458 available are now in the prestigious Whispering Pines Business Park.

Built in 1991, the property is maintained and in excellent condition. Here is an opportunity to immediately occupy highly professional office space in Nevada County. Various floorplans can accommodate a variety of businesses with views out to a beautiful, pastoral environment.

PROPERTY FACTS

Building Type - Office

Year Built - 1991

Building Height - 2 Stories

Building Size - 14,847 SF

Building Class - B

Typical Floor Size -7,400 SF

Parking - 60 Surface Parking Spaces

Jon Blinder

Coldwell Banker

Commercial

Grass Roots Realty

530-272-7222

blinderj@pacbell.net

Click here to view details.

| | |

FUNDING AND GRANT OPPORTUNITIES | |

| |

MUSEUM GRANT PROGRAM

The Museum Grant Program has approximately 27.7 million available and may be awarded over multiple rounds depending on the competitive pool.

Funding shall be prioritized for museums severely affected by COVID-19 and that serve historically underserved communities or students subject to Title I of the Federal Elementary and Secondary Education Act.

Additionally, projects must meet one of the following priorities:

- serving pupils and teachers at schools eligible to be served under Part A of Title I of the federal Elementary and Secondary Education Act,

- serving children in low-income communities,

- supporting museums in engaging or collaborating with underserved communities,

- advancing preservation of at-risk cultural and natural collections and historic buildings,

- improving access,

- supporting the ethical stewardship of culturally sensitive art and artifacts, including, but not limited to, engaging in consultations with California Indian tribes or repatriation, or

- educating the public about critical issues affecting Californians.

Proposal submission deadline is 5:00 p.m. on May 22, 2024.

Click here to access the grant guidelines.

| | | |

| |

Arts in California Parks

Local Parks Grant Program

This new multi-year grant program intends to create local community connections to California’s rich and diverse cultural history and natural areas outside of California’s state park boundaries. Eligible projects will enhance connections to local cultural history, local parks, open space or natural areas through community events, programming or installations that help to build sustainable community connections, health and well-being. The Local Parks Grants Program will be managed and administered by Parks California.

This program supports the “Outdoor Access for All” initiative led by Governor Gavin Newsom and First Partner Jennifer Siebel Newsom, along with the Natural Resources Agency’s “Outdoors for All” initiative, and California State Parks’ Reexamining Our Past Initiative.

Minimum Requirements

- Eligible applicants are 501(c)3 organizations, California Native American Tribes, Native 7871 Organizations, Land Trusts, Fiscally Sponsored Community Organizations, Foundations, and Local Government Agencies (City, County, Regional).

- Applicants must facilitate a partnership between nonprofit(s), artist (s) and local public park manager(s). Partnerships may include 501c3 non-profit organizations, California Native American tribes, foundations, land trusts and/or local governments.

- Projects must bring art and nature together as a catalyst for community connection in local parks.

- Projects must contribute to community connection, health, well-being and/or placemaking.

- Projects must be open to the general public.

-

Projects must take place at a local park.

2024/2025 Grant Cycles

Planning and Development Grants - 8-month grant cycle - October 2024 – May 2025

Support the early stages of project development with a focus on building partnerships, artist selection and developing project plans.

Implementation Grants - 12-month grant cycle - October 2024 – September 2025

Support the execution of community engagement, art and culture programs with a well-defined partnership.

| |

|

GFO-23-313 – Deployment of Decarbonization Technologies and Strategies for California Industrial Facilities (INDIGO Program)

Grantor: CA Energy Commission

Purpose:

The purpose of this solicitation is to deploy advanced decarbonization and/or grid support technologies at California industrial facilities to promote electrification and reduce GHG emissions produced by the industrial sector.

Description:

This solicitation will target technologies that have the potential to demonstrate cost-effectiveness and scalable to multiple industrial facilities with potential to increase confidence for adoption.

Eligibility Requirements

Eligible Applicants:

- Business, Nonprofits, Other Legal Entities, Public Agencies, Tribal, Government

Applications are open to existing industrial facilities located in California and to utilities, equipment manufacturers, energy service providers, aggregators, and developers who are implementing cutting-edge, emerging technologies in California industries. The applicant may include multiple industrial facilities located in California in one application.

| |

Eligible Geographies:

Food and beverage industries and related support facilities that are receiving funding for the same project, or portions of the same project, from the CEC’s Food Production Investment Program (FPIP) are ineligible for funding from the INDIGO Program or to use funds received from FPIP as match funds.

Matching Funding Requirement:

Match funding is required in the amount of at least 25% of the requested INDIGO funds.

Be sure to make the articles short and concise as people tend not to read much more than a couple of paragraphs.

The application deadline is 6/3/24 23:59.

The expected award announcement is July 2024.

The period of performance will be until funds expire.

Total estimated available funding: $46,2000,000.

Expected number of awards: Dependent

Estimated amount per award: Dependent

For questions about this grant, contact: Kevyn Piper, 1-916-827-9241, kevyn.piper@energy.ca.gov

Click here to view the grant guidelines.

| | |

|

Don't miss the tremendous array of trainings

being offered over the next month.

| |

The following trainings are courtesy of the Sierra Small Business Development Center at: (530) 582-5022. | |

|

Buy or Sell Your Business

Are you ready to pass on the torch by selling your business in the future? Have you considered acquiring a business instead of starting one?

Buying and/or Selling Your Business is for people looking to sell their business in the next 2 to 3 years as well as people interested in purchasing a business in lieu of starting one or as a means to enter new markets, add new products and drive profits through added revenue.

April 23: 10:30am-12:00pm

For class information and to register click here.

| |  |

|

Marketing for Success

This Marketing webinar is built on Steve Roth’s 40+ years in consumer and industrial marketing, brand development, market research, and reaching customers through all types of media from television and radio, to print, the web, and social media.

The webinar focuses on understanding and identifying the businesses’ core users, its Heavy User Group, and then building a marketing strategy to talk with those people and build a relationship with them.

This webinar is a must for anyone interested in learning about how to build long-term competitive advantage versus the competition through Marketing.

May 7: 10:30am-12:00pm

For class information and to register click here.

| | |

|

Cash Flow in the Hospitality Industry

This seminar covers the role of cash flow in your small business so that you can manage it and drive your business to more stability with less stress. After this seminar you'll know how to identify and free up your cash flow bottlenecks and predict the next one to avoid it.

April 29: 2:00pm - 4:00pm

Click here for class details.

| |  |

|

Expansion Capital for Profitable Businesses More than Two Years Old!

This webinar is designed to help businesses that are profitable and with more than two years in active operations understand how to raise capital, equity and debt, to facilitate future growth.

April 30: 10:30am - 12:00 pm

Click here for class details.

| | |

The following training is offered by SCORE | |

|

Simple Steps for

Exiting Your Business

Ensure the Future

of Your Business

By taking into consideration succession planning, retirement planning and state planning, business owners can begin to develop a strategy to secure their future and future of their business.

Want your business to thrive for generations to come?

The statistics on businesses surviving through multiple generations are staggering. Just making it through the second generation is a milestone event for a business. Making it through the third generation is rare and making it to the fourth generation is almost unheard of.

The good news is business owners can buck these trends with proper planning. This three-part series workshop, developed by MassMutual and SCORE, will help you plan the next stage for your business, for yourself, and for generations to come.

This is an online course allowing you to learn on your own time.

For online class information click here.

| |  |

|

Summer Hiring - Compliance Considerations and Tips for Success

Experiencing an increase in demand during the summer can be exciting for small business owners, but finding the right hire to meet that demand can be challenging.

During this webinar, SCORE instructors will dive into the fundamentals of hiring a seasonal worker. It will highlight strategies you can use to hire the right employee fast while staying compliant with regulations. From posting job listings to on-the-job training, they cover everything you need to know about the hiring process.

Learning objectives:

- How and where to put your job postings

- What new hire paperwork do you need

- What to consider when determining Wages

- The different types of employee classification

- What to consider when training your employee

ONLINE LIVE EVENT:

April 18: 1:00pm-2:00pm

For class information and to register click here.

| | |

|

National Small Business Week

FREE Virtual 2-Day Summit

Tuesday, April 30 – Wednesday, May 1, 2024.

This year’s event will include virtual educational presentations by experts, exhibit booths, free business resources, multiple peer-to-peer networking rooms, and expert business advice from SCORE mentors.

The event is free to attend for both established and aspiring business owners.

The 2-day event is free to attend, but registration is required to access all the value the virtual event has to offer:

- Action-driven content that can be applied to your business immediately.

- Expert business advice to help you navigate your business journey.

- Downloadable business resources to collect for future use.

- Networking opportunities to connect with business owners from across the country.

For class information and to register click here.

| |

| |

Penn Valley Rodeo

Way back in 1956, a handful of local ranchers staged a one-day rodeo behind the old Fire House to help fund Penn Valley’s volunteer firefighters.

The Penn Valley Rodeo became an annual event and continued until 2004 when rodeo attendance declined, and the rodeo was discontinued.

At that time, Penn Valley residents and rodeo fans formed the Penn Valley Community Rodeo Association (PVCRA) to preserve the rodeo tradition in Penn Valley.

PVCRA produced its first rodeo in May 2005. It has since added Summer Fun Gymkhanas and a Fall Fest.

PVCRA produces quality family entertainment in the western tradition with two nights of pro rodeo, Friday and Saturday.

The Rodeo is the third weekend in May.

Click for more details.

Penn Valley Rodeo Parade!

Saturday, May 18, 2024

Presented by the:

Penn Valley Area Chamber of Commerce

Staging:

- 12:00 pm at Western Gateway Park (18560 Penn Valley Drive, Penn Valley, CA 95946)

- Parade Starts Promptly at 2:00 pm ~Rain or Shine~

- Please COMPLETE and RETURN the Entry Form ASAP

- Due to the arrangement of the Parade line-up, the Rodeo CANNOT ACCEPT ENTRIES ON PARADE DAY!

Click for details and entry form.

| |

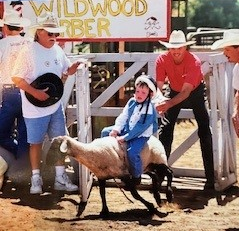

Mutton Bustin

Mutton Bustin’ started in the 1980s and has been widely popular in the small-town rodeo circuit. This event is not only a crowd-pleaser but also a way to introduce the younger generation to the world of rodeo and rough stock riding.

The rider must be 4-7 years old, and the maximum weight is 55lbs. There will be lottery sign-ups opening in the first week of May. Stay tuned for more info and make sure you keep your eyes peeled! The spots fill up quickly!

In order to improve the fairness of their Mutton Busting entry process, the PVCRA Board is changing their Mutton Busting entry process to a Lottery System. Please complete and submit the form on the link below to be entered into the lottery entries starting April 16th. You may enter two siblings on the form. Lottery Winners will be notified the first week of May.

Friday check-in by 5:00pm

Saturday check-in by 5:00pm

Click for rules and information for entry.

| | | | |