ISSUE 115, January 26, 2024 | |

| |

|

SOYBEANS

Joe Foley, Merchant

| |

|

Soybean futures have retraced most of the selloff following the most recent WASDE report, which projected U.S. carryout stocks to increase 35 million bushels, to 280mln bu. March futures traded all the way down to 12.01, before rallying back up to 12.50. Technically oversold, futures were primed for a bit of a comeback with the speculative community (funds/managed money) short, cash premiums appreciating following slow farmer marketings, and to some extent still a wide range of estimates on the size of the Brazil crop. The latter was pegged @ 157mmt by the USDA, although some observers are 145-150mmt. Brazil is approaching 8-10pct harvested now, with very poor yields in the north dragging the overall production estimates lower. Cash values in Brazil have been dropping fast however, with prices (landed to N. China) well in excess of 1.00/bu cheaper than U.S. offers for February and later positions. This is a seasonal phenomenon, but the magnitude of the selloff in Brazil suggests that the farmer there is undersold and/or China’s buying has been slow in response to poor (although improving) hog margins. Until we see a major shift in weather for South America, price rallies will likely be short-lived. |

|

Corn prices along with soybeans have regained most of the losses following the USDA January WASDE report. February weather forecasts for S. America have turned a little drier, although there is rain in the forecast for mid-February. Argentina’s corn production is widely Expected to reach at least 55mmt, which is more than 20mmt above last year’s drought-stricken fiasco. Indeed, we are seeing Argentina capture export demand to Korea for April shipment that we’d hoped would have been a U.S. PNW affair. N. Dakota had a massive crop this past year (543 million bushels with a 143 b.p.a. yield), and we have been actively shipping shuttles to the PNW for export. We don’t expect this to last beyond April, however, as Argentina harvest will be full throttle. Late summer competition from Brazil will basically, leave the U.S. with its captive Mexico, Latin America and maybe some Japan business. Brazil is 7-8pct planted on their winter corn crop so the next several months will be critical. Crop prospects are widely expected to be down sharply from last year’s 137mmt record crop. But again, Argentina is likely to pick up the slack. Look for choppy markets ahead with the funds heavily short, U.S. planting discussions around the corner, yet a burdensome projected carryout serving as significant headwinds. |

| |

|

BARLEY

Ryan Statz, Merchant

| |

|

|

Barley markets continue to feel the pressure brought on by the backlog of product in the system. We have railroad issues slowing movement that wants to leave the market and we have an uptick of supply that wants to move into the system (better weather easing interior truck logistics). Simply put, maltsters are ballooning because of the pressure being put on them from the inbound and outbound sides. To relieve some of the pressure, they have backed off from taking and buying more inbound completely for the time being. Does this continue into the spring or is the pressure only short-term? That is the million-dollar question right now.

We know the supply is there, it’ll come down to getting the product out the door. This situation is also affecting new crop programs. An unexpected shock to the supply chain is forcing many maltsters to re-forecast how much ‘23/24 marketing year inventory will be carried forward to the new crop marketing year (‘24/25). As such, new crop programs are slow to come out. We hope this changes soon...

As these programs do get rolled out (hopefully soon!), please stay in touch with your CGI representative about planting and marketing options that will ultimately add value to your operations and marketing plans.

|

| |

COLUMBIA GRAIN

PRODUCER SOLUTIONS

Phil Symons

|

|

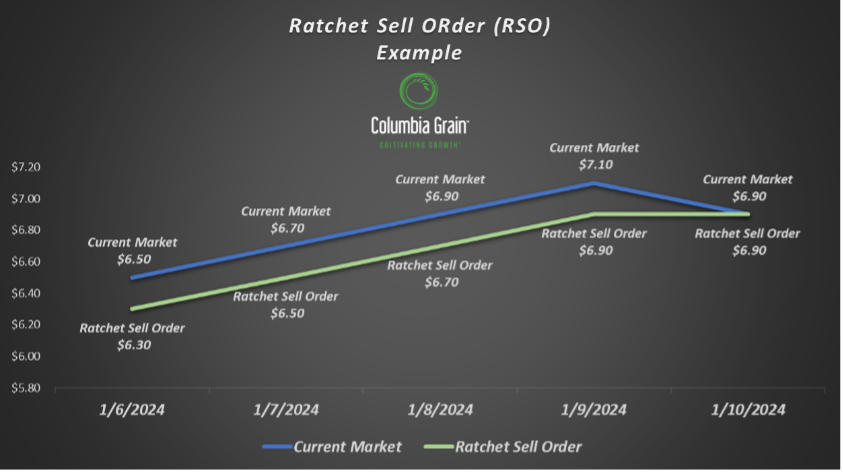

I wanted to circle back on the Ratchet Sell Order (RSO) once again – we talked about this type of sell order in the last newsletter, but I can’t stress enough the importance of protecting or creating a floor to your cash / futures sales. We have seen historically high prices over the last two years, as a result the old saying of “The cure for high prices, is high prices” and this is exactly what have seen. On the last Monthly USDA S&D report we continue to see world stocks of basically all commodities build, resulting in the markets sliding down rather dramatically. So, the importance of protecting and creating a floor price has become a real marketing aspect this year.

Ratchet Sell Order (RSO): places an order to sell a set amount of grain below the current market price and acts as a safety net if prices fall. If the market does not fall to your below-market selling price, the RSO ratchets higher by your specified increment as the market moves higher.

Let’s say today’s price for Soft White Wheat is $6.50, which you are happy with, but you also think the market is going higher and are willing to risk 20 cents (you specify the increment you are willing to risk, this can be any increment you would like it to be). You would place an order to sell 20 cents below-market at $6.30 with a ratchet function to “ratchet” the sell order up by 20 cents every time the market moves up by 20 cents.

|  | |

To take the example a bit further, let's say today the Soft White Wheat price is $6.50 and you place an order to sell 5,000 bushels at $6.30 – tomorrow the market moves to $6.70, your ratchet order would move to $6.50 – the next day the market moves to $6.90, your ratchet order would move to $6.70 – the day after that the market moves to $7.10, your ratchet order now moves up to $6.90. If you see the market has moved from its original price of $6.50 to $7.10 and you are happy with selling your grain at the current market value of $7.10, you can cancel your ratchet order and sell at the current market price of $7.10.

If, on the last move to $7.10, you do not cancel the RSO and sell at the current market and the market moves back to $6.90 the following day, your RSO is triggered, and you would sell 5,000 bushels at $6.90.

A Ratchet Sell Order is a great tool to give you a safety net under the market while allowing you to participate if the market moves higher – be sure to get in touch with your local merchandiser or buyer to discuss all your marketing options.

| | |

|

DURUM

Ryan Statz, Merchant

| |

|

|

Because of affordability issues stemming from currency volatility and sheer financial tightness, importers buying patterns have changed in a big way. Cheaper/non-routine supply continues to come out of the woodwork to load buyers up in massive waves. Sure, imported supply needed to be higher because of the quality and production issues felt by importing regions, but the push from others has been impressive. Through the first 27 weeks of the marketing year, the EU has imported a record amount. Most of which has come from non-routine sources which has taken US/Canadian markets by surprise. With the marketing year clock dwindling, export forecasts from North America look to be in question. If forecasts are NOT hit, carry-out stocks will bleed into next year’s supply. Yes, it is still early with planting a few months out, but if other non-routine origins want now to be a part of the durum export game, North America could be in a situation of over supply... quite astonishing coming off ‘23/24’s production wreck.

All in all, the trend has been lower, and markets will need some jolt to push things higher…either that comes with more droughty concerns (would take more time) or a wave of unexpected demand to hit markets.

|

| |

|

CANOLA

Sean Ferguson, Merchant

| |

|

|

The canola market has remained weak over the past few weeks. Canola exports out of North America remain roughly 30% lower YoY, although there is hope of exports picking up as it is being reported that cargos of canola were traded to China this past week; despite this newfound business, it will take a significant jump in export business to finish the year remotely close to last year’s export value. ICE canola is becoming more price competitive globally as the spread between ICE canola and Matif rapeseed futures has come in over the past few weeks (the spread is currently trading around -$5/MT USD). The last time we saw the spread between these two futures trade at this level was December of 2022. Funds continue to extend their record canola short week after week. The latest CFTC report pegged funds at a record 133.7k contracts short. The market will continue to watch South America closely over the next few months as any change in production will surely influence global oilseed/vegoil values.

The CAD/USD off the heels of a weaker CAD. Falling crude oil values and dovish rhetoric from the Bank of Canada have not boded well for the CAD.

|

| |

|

HARD RED

WINTER WHEAT

Kevin Mone, Merchant

| |

|

|

There’s a lot to reflect on as we come to the end of the first month of 2024. Financial markets and cash markets are both seeing outsized, exaggerated moves due to uncertainty. The global macro situation remains largely a question mark. The Federal Reserve is making decisions not seen since the 1970’s. Russia and Ukraine remain at war. The El Nino weather conditions continue to cause unusual weather patterns across the Americas. Mildly bullish news, that in normal conditions might have moved the market slightly, seem to be being exacerbated by this uncertainty.

With the March rebounding $ .46/bu since Wednesday, it seems like we might be seeing our first bullish movement in the futures market since mid-December. $6.30 will prove to be a critical resistance/support point. The 50-day moving average is 6.31. If it can be surpassed, our next resistance points will be the psychological resistance at $6.50, the 100-day moving average at $6.61 and the 200 day at $7.35. With the bullish move in the front contract, the KWH/KWK spread has come in slightly from -.05 to -.0025. With 15 trading days until the termination of the March contract, all eyes will be on that spread. Managed money added 4,426 contracts to their short position last week. They closed out with an aggregate short of 38,652 contracts.

Basis continues to firm in the upper tier as exports remain unexpectedly strong. It’ll be interesting to see if this recent rally in futures dulls international demand. The US dollar has also started off the year with a rally. The DXY index is up 2.5% this month, largely driven by a more “dovish” view on rate cuts. US domestic destination markets also firmed since our last report. This seems to be largely freight-driven as demand remains tepid at best. Rail performance will likely continue to be an issue and a major driver of prices into domestic markets.

|  | |

|

The weather this week is a nice respite from the last several weeks of frigid temperatures across the Northern tier. Despite limited snow cover and lows in the -30’s (Before wind chill), it appears that the crop has survived the cold snap. Only time will tell on the true extent of damage. The next 30 days of temperatures looking unusually mild. Daily highs aren’t predicted to go below freezing in large parts of Montana until February. It will be interesting to see how these sharp, hot/cold temperature swings will impact the crop this year. It’s certainly a factor to keep an eye on. The current El Nino conditions are also something that should be watched closely as we get further into the growing season. NOAA estimates a 73% chance conditions will remain through June 2024. This means hotter, dryer temperatures in Montana. Conversely, Kansas and rest of the Wheat Belt often get higher precipitation during El Nino years.

As we go into February, it seems like weather and the dollar will be two key things to watch. The Federal Reserve Open Market Committee won’t be meeting next month but if they more aggressively indicate further rate cuts, we could see a reversal in the dollar’s current bullish trend. The same goes for a break in the current weather patterns. A sudden cold snap could quite quickly be a catalyst for a continued bull run in the futures complex.

|

| |

|

SPRING WHEAT

Rudy Weitze, Merchant

| |

|

|

Spring wheat futures have seen a nice rebound following a sizable sell off and funds increasing their already sizable short. For the month of January, front month Minneapolis futures have fallen 9 cents and shown a range of 29 cents. The bleeding on the board finally seemed to stop when we hit the 680 level, and we’ve seen a bit of a rally since. You might be asking, why are we rallying? Quite frankly, there isn’t a great reason other than the market being technically oversold. Funds added to their short last week, and they now mark themselves at nearly 30,000 contracts short.

Cash markets have certainly firmed up based on rail delays, logistics, and the cost of secondary shuttle freight. Mills have good coverage for JFM, but poor performance by railroads and cold weather have exploded spot markets. Most mills are looking out to AMJJ today but the lack of farmer selling seems to make it a moot point. We’re still in a bit of a holding pattern with mills and farmers at a stalemate, but each side believes the other will need to move first. Export markets for spring wheat are still steady from a volume perspective, but we have seen a slight pop in values with rail freight delays. This rally in the board is an excellent opportunity to take some risk off the table and take advantage of these firm basis levels. If you’re still not a huge fan of these futures prices, a producer solutions contract could be used to gain a sizable premium vs the current market.

|

| |

|

INTERNATIONAL

Shun Watanabe, Merchant

| |

|

|

Very quiet in the bean world. Chinese crushers have pretty much covered all Feb. demand and most of Mar. demand, but still largely open for April onwards. Upcoming Chinese New Year celebrations seem to be improving the domestic soybean meal demand as end users start to increase stocks which has allowed crush to rise, although weak economic data might cap pork demand. Feel like still take a few weeks before markets comes back and expect for hand-to-mouth purchasing, mainly from Brazil.

Weather is unchanged in Brazil but turns drier for Argentina. A temporary threatening pattern in Argentine weather should keep meal the stronger product, with a few months of weather left to determine the crop size there. In the corn front, Koreans did hold a few tenders but based on levels traded, it seems business was done mainly as Argentine origins. PNW corn is clearly losing the competition and Argentina continues to find home to the Asian destinations. The big question moving forward is that farmer selling still very poor in Argentina and market is heavily short.

Not much change in the wheat export market that limited demand with regular buyers such as Japan/Philippines/Taiwan/Korea. Especially on the nearby position such as March, cash basis was firmer due to winter storm hit the Northern US with uncertainties on the logistics/export capacity. Canadian CWRS offers continue to be competitive against our HRS values.

|

| |

|

WHITE WHEAT

Steve Yorke, Merchant

| |

|

White wheat markets continue to be trapped in a very tight range; 6.45-6.55. Business has picked up in the past couple of weeks, but we are still in need of more if we are going to hit the USDA export estimate of 155MBU. This will only happen if we see some significant swing business hit our markets. We need Yemen/CCC GOV tenders, China or Indonesia to jump into the market soon. All of these destinations are likely to buy in the next couple of months but who they will buy from is the big question and if it is China how much they will buy. Big IF’s moving forward as always! Chicago futures have rallied in the past few sessions mainly on money flow as there is little new fundamental news in the markets. Japan bought HRW overnight in its weekly tender and export sales for the week were within the expected range, no surprises. I don’t see white wheat breaking out to the upside in the next couple of weeks unless this demand picture changes drastically. We are starting to see grower selling pick up a touch as we climbed back to 6.50 but there is still a big chunk left in the country to buy. This will pressure the market unless we start to see some of the swing business we have been talking about. As always call our buyers to place orders or discuss market strategy for old and new crop. |

| | | |