|

|  |

|

LAST DAY FOR EARLY REGISTRASTION to LOT's 21st Annual Leadership Development Conference

CBI's Leaders of Tomorrow group will hold their 21st Annual Leadership Development Conference on March 30 & 31 at Hyatt Place in West Des Moines. Today is the last day to register at the early rate!

Conference speakers are:

• Jeff Plagge, Superintendent - IA Div. of Banking

• Lisa Cole, VP/Sr Relationship Mgr - FHLB

• Brad Spears, Member Relationships Director - FHLB

• James Boyd, VP, Information Security - SHAZAM

• Jim Reber, President & CEO - ICBA Securities

• Brittany Lumley, Managing Director of Government Affairs, LS2 Group

• Iowa Secretary of State Paul Pate

• Rowena Crosbie, President and Founder - Tero International

***Featured Event: CBI Social Gathering - Thursday, March 30 from 4-7 pm***

CBI will host a special entertainment and networking opportunity at Smash Park for LOT members, non-member guests from their bank, and CBI Endorsed, Associate and Affiliate members. Attendance at the social is included in full Conference registration fees, or pay a flat fee to attend only this event.

Register TODAY for early pricing! Visit our website or view the Event Guide for the agenda, presentation topics and more information on speakers. Call 515-453-1495 or email Pretty Patel at ppatel@cbiaonline.org with questions.

| REGISTER NOW |

|  | |

Save the Date: Attend CBI's 6th Legislative Reception

To be held Wednesday, March 29 from 5:00-7:00pm Central, CBI's Legislative Reception provides a forum for Iowa’s independent community bankers to discuss with legislators how policy changes and regulations are impacting their businesses.

Join us at this complimentary reception to meet Iowa's legislators, state leaders and fellow community bankers. RSVP and further details coming soon.

| |

The 2023 Money Smart Week Poster Contest is NOW OPEN

CBI's 2023 Money Smart Week Poster Contest is officially open! Elementary students in 2nd through 6th Grades are eligible. Students should design a poster to answer the question "Why is it important to know about money?"

Prizes offered are a $600 Certificate of Deposit for the First Place winner, and $300 Certificates of Deposit for the Second and Third Place winners. Prize CDs will be set up at the banks that submitted the winning posters, and are funded by the CBI Education Foundation.

Sponsoring the Poster Contest is open to all community banks in Iowa. We have compiled a free Marketing Kit to assist you in hosting the contest at your bank. Register your bank to participate and download the free materials. Registering helps CBI inform the public as to which Iowa community banks are sponsoring the 2023 Poster Contest in their area.

Display poster entries in your bank during 2023 Money Smart Week, April 15-21, 2023. Please submit all Contest entry posters to the CBI office for judging postmarked no later than Friday, April 28.

Winners will be chosen and notified by May 9, and announced to the public by May 12. Visit our website for more about the Poster Contest, or email Krissy Lee at klee@cbiaonline.org with questions or to request customized marketing materials.

| |

| |

CBI Member banks banded together to build a new daycare center and ease the local childcare crisis

Earlier this year, Fairfield, Iowa welcomed its newest business, the Cambridge Little Achievers Center. The 14,000-square-foot, state-of-the-art childcare center opened Jan. 16, and will ultimately serve up to 185 children, ages six weeks to 12 years.

CBI Member Banks Iowa State Bank & Trust Co. and Libertyville Savings Bank stepped in to finance the construction of the center; Iowa State Bank & Trust arranged the finance package. Area businesses and organizations made five-year pledges, so the donors can pay the funding over time. The annual pledge payments means the cost of constructing the center will be paid in full within five years, with no debt. Iowa State Bank & Trust Chairman David Eastburn referred to the deal as another example of "two local banks working together to serve their community".

Five organizations pledged between $100,000 and $1.25 million, including the top donor CBI Affiliate Member Cambridge Investment Research, which is headquartered in Fairfield. “One of our core values is commitment—and part of the longer definition of that is commitment to our community,” Amy Webber, president and CEO of Cambridge Investment Research.

The childcare industry is in crisis—making the opening of a new daycare center newsworthy—and there’s been little progress to solve this problem at the federal level.

| Read more.... |

| |  |

| |

Butler Hegedus named Forty Under 40 Alum of the Year

Kim Butler Hegedus, executive vice president and chief lending officer of CBI Member Community State Bank, has been named the Business Record’s Forty Under 40 Alum of the Year for 2023.

Butler Hegedus, who considers herself an “accidental banker,” joined Community State Bank in 2018. She began her banking career as an intern at the then Hawkeye Bank. That led to a full time job, and after subsequent positions at regional banks, Butler Hegedus returned to her community banking roots and has helped Community State Bank reach record growth and profits. In her current role, she has also helped lead the creation of a leadership development program for bank employees.

Butler Hegedus is also known for her involvement in the community. She is the co-founder of DSM Financial Executive Women, past chair of the Association of Business and Industry, board president of Variety the Children’s Charity, a board member at On With Life Foundation, and a member of the Des Moines Area Community College Foundation.

Each year, one previous Forty Under 40 honoree is selected by the Business Record for the award, and Butler Hegedus, a member of the 2001 Forty Under 40 class, will be recognized at this year’s Forty Under 40 celebration, scheduled for Thursday, March 30, at Prairie Meadows.

| Learn more. |

| |

|

Iowa Capitol Update: Week 9 - March 9, 2023

Excerpted from the LS2 Group newsletter

View the Iowa Legislature Bill Tracker - Week 9

Senate passes government reorganization bill

Gov. Kim Reynolds’ proposal to reorganize the state’s executive branch cleared its first hurdle this week as it passed the Iowa Senate.

The 1,500-plus-page bill, SF 514, will consolidate Iowa’s executive cabinet agencies from 37 to 16. Among the 16 state departments, the bill creates one new agency — the Iowa Department of Insurance and Financial Services. It would also move the Office of the Consumer Advocate under the attorney general’s office.

“Serving the needs of Iowans efficiently and effectively is state government’s primary responsibility, and Iowans rightfully expect nothing less,” Gov. Reynolds said in a media release this week. “For too long politicians have only promised to reduce the size and cost of government, but today the Iowa Senate took an important step forward to making it a reality.”

Supporters say the legislation will modernize Iowa’s executive branch in an efficient manner, while opponents argue the bill is a “power grab” that consolidates power under Gov. Reynolds and Attorney General Brenna Bird.

The bill now goes to the Iowa House for consideration.

| |

|

State Auditor, Senate Republicans spar over legislation

A bill which passed the Iowa Senate this week set off a confrontation between State Auditor Rob Sand and Senate Republicans.

The bill, SF 478, would restrict the state auditor’s ability to access information pertaining to income tax returns, medical records, academic information, law enforcement records, and more. It passed 33-16 along party lines.

Among the provisions in the bill, the state auditor’s office would be required to obtain written consent from the subject of an investigation in order to view information in an audit. The subject of the audit could simply deny the request, effectively rendering the auditor powerless.

Sand, the only remaining Democrat elected to statewide office, argued that it was a dangerous, pro-corruption bill. | Keep reading.... |

| |  |

|

Hands free bill clears Senate committee

A bill that would restrict the use of electronic devices by drivers in a moving vehicle cleared the Senate Ways and Means Committee this week, advancing to the full chamber.

The bill, SF 207, would require electronic devices to be operated hands free, with the exception of a touch to activate voice commands. A similar bill failed to advance in the Iowa House before the first funnel deadline.

Hands free legislation was floated during last year’s legislative session but failed to garner enough support. SF 207 will now go to the full Senate for consideration.

| |

|

House members raise concerns with CFPB’s 1071 rule

Several members of Congress expressed concerns with the community bank impact of the Consumer Financial Protection Bureau’s pending rule implementing Section 1071 small-business reporting requirements.

During a House Financial Services Subcommittee on Financial Institutions hearing on CFPB reform, Rep. Roger Williams (R-Texas) said the 1071 rule would harm relationship banking. Rep. Young Kim (R-Calif.) said the rule would harm the minority- and women-owned small businesses it is designed to help.

The CFPB has said it plans to issue a 1071 final rule by March 31. The CFPB agreed to the deadline as part of a lawsuit designed to compel the bureau to finalize the rulemaking.

FDIC issues guidance on Fair Hiring in Banking Act

The FDIC released a Financial Institution Letter on amendments to Section 19 of the Federal Deposit Insurance Act under the Fair Hiring in Banking Act.

Section 19 prohibits individuals who have been convicted of certain offenses from participating in the affairs of FDIC-insured institutions. The new law made several changes to Section 19 related to certain older offenses, designated lesser offenses, criminal offenses involving dishonesty, and more.

The FDIC said it will take several related actions this year, including revising its Section 19 application form, industry guidance, and implementing regulations.

HUD issues final rule allowing 40-year FHA loan term

The Department of Housing and Urban Development (HUD) has published a final rule [88 FR 14252] amending its Single Family Mortgage Insurance regulation at 24 CFR Part 203 to allow for mortgagees to recast the total unpaid loan for a new term limit of 480 months. Increasing the maximum term limit to 480 months will allow mortgagees to further reduce the borrower's monthly payment as the outstanding balance would be spread over a longer time frame, providing more borrowers with FHA-insured mortgages the ability to retain their homes after default.

This change will also align FHA with modifications available to borrowers with mortgages backed by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), which both currently provide a 40-year loan modification option.

This final rule adopts HUD's April 1, 2022, proposed rule without change. The rule becomes effective May 8, 2023.

| |  |

| |

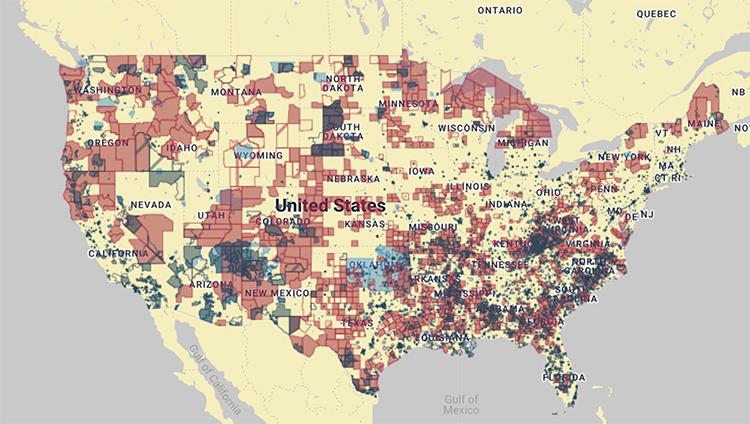

SBA updates HUBZone map

The SBA announced a new Historically Underutilized Business Zone (HUBZone) preview map, which shows that hundreds of firms in newly released designated underserved areas will become eligible to apply for HUBZone certification, enabling them to compete for billions of dollars in federal contracts set aside for HUBZone-certified firms, to create jobs, and to improve the economy in their communities.

The HUBZone preview map shows changes that are scheduled to take effect on July 1, 2023, reflecting updates from the 2020 U.S. Census. HUBZones are designated based on economic and population data from the Census Bureau and other federal agencies, using a formula established by Congress. The map update highlights growth opportunities for small businesses in more than 20,000 HUBZone areas across the United States and Territories, including 3,732 newly qualified communities.

At the same time, according to the new map, many currently HUBZone-designated areas will no longer qualify for participation in the program because they have outgrown their disadvantaged status thanks to increased employment, increased average incomes, or other signs of positive economic development. To provide a sufficient off-ramp for communities losing this designation, the expiration of their HUBZone status is being extended until July 1, 2026, providing firms and communities additional time to transition.

A map of current HUBZones can be found HERE.

| | |

|  |

|  |

| |

|  |

|  |

|

|

John Russell

Retiring as north central Iowa market president, effective April 14

Bankers Trust

Graig Stensland

Promoted to north central Iowa commercial lending team leader,

Bankers Trust

Bill Fischer

Retiring as commercial lender, effective March 31

Farmers State Bank - Waterloo

| |

|

Lisa McQuillen

Promoted to senior vice president, director of culture

F&M Bank - Manchester

Katie Hubbard

Promoted to assistant vice president, board secretary

F&M Bank - Manchester

Cody Naber

Promoted to assistant vice president

F&M Bank - Manchester

| |

|

Whitney Rave

Promoted to cashier

F&M Bank - Manchester

Amy Lynch

Appointed to the board of directors

Cedar Rapids Bank & Trust

Include your employee updates!

Email klee@cbiaonline.org.

| | |

|

CBI attempts to publish as many different viewpoints as possible to provide you with information on what is being said and read in the banking industry. CBI does not necessarily endorse or support the opinions given in these third-party news sources. Send news from your bank or company to CBI by contacting Krissy Lee, Communications Director at klee@cbiaonline.org. ©2023 Community Bankers of Iowa. You are receiving this message because you are a listed recipient of Community Bankers of Iowa's communications. | | | | |