Asian Biotechies Walk Into A Bar

The Newsletter of InScienceWeTrust Community

| |

|

T-cell Engager for Autoimmunity; 1Q2024 Biopharma Scorecard; One More Gene Therapy Approved for Hemophilia

Issue 43; 2024-04-28

| |

|

Summary

A small clinical trial of 6 patients with rheumatoid arthritis treated with CD19xCD3 T-cell engager Blincyto was published on Nature Medicine, which sent the stock of Cullinan Therapeutics 30% higher and added $300M+ market cap to the company. Our guest contributor Charlene Liao, a veteran drug developer and CEO of Immune-Onc Therapeutics, shares the intriguing scientific history behind this seminal study, the well-timed capital market maneuvers, and alleged personal connections among the key players of this story.

1Q2024 earnings poured in last week, our editor Angus Liu provides recap on J&J’s Carvykti/Tecvayli duality, Novartis’ mixed quarter, Roche’s 20% pipeline contraction, Biogen’s slow ramp up of blockbuster hopeful Leqembi, Merck’s strongest Keytruda quarter, Gilead’s total exit of CD47-targeting magrolimab and a major writing-down of Trodelvy, AstraZeneca’s 7% beat vs consensus highlighted by China’s 13% growth, and Sanofi talking up Dupixent’s new market in obstructive pulmonary disease vs AbbVie’s a 40% year-to-year loss of Humira revenue.

Pfizer received the approval of BEQVEZ, the AAV gene therapy for severe hemophilia B, with a $3.5M price tag. Our editor Jiaming Zhuo put this approval in the context of lukewarm market reception to other hemophilia gene therapies, namely CSL’s Hemgenix and BioMarin’s Roctavian. His commentary reviews the development journey of BEQVEZ and a potential commercial surprise due to Pfizer’s established commercial capability.

Other global biotech news includes BioCentury’s rebuttal to the recent JAMA paper that claims most recently approved oncology drugs via accelerated approval path have not shown clinical benefits; a new AI drug discovery company was launched with $1bn in their bank account and some heavy weights in our industry; the inspiring story of the 20-year journey of tovorafenib from discovery to the approval to treat pediatric low-grade glioma; and why the ~60% slowdown of biotech startup formation vs its peak is probably a good thing.

Bioverse episode 9 will feature Jimmy Li, the CEO of WuXi XDC; Jing Fan, the

CEO of Hopstem Biotechnology, and one expert in radiopharmaceutical. Follow our event page for registration information soon.

Please send us your comment and feedback to partnership@iswtb.com

| | |

|

Targeted Immune Cell Depletion for Autoimmune Diseases

On April 16, Cullinan Oncology announced rebranding to Cullinan Therapeutics and repurposing their CD19xCD3 bispecific antibody CLN-978 exclusively for autoimmune diseases, with the first indication being systemic lupus erythematosus. They also announced closing of $280M PIPE at the same time.

It was a huge raise considering that CLN-978 has only treated 3 B-NHL patients in phase 1 dose escalation, all at the lowest dose of 30 μg subcutaneously, resulting in 1 Complete Remission (CR), 1 Stable Disease (SD) and 1 Progressed Disease (PD), and that CLN-978 has yet to file an IND with the FDA divisions under the Office of Immunology and Inflammation in Q3’24.

So what sparked interest in the idea? A confluence of factors:

1. Targeted immune cell depletion is a validated approach for treatment of autoimmune diseases, as demonstrated by the blockbuster drug Ocrevus for multiple sclerosis (MS), my first IND at Genentech in 2003, which is a humanized anti-CD20 capable of depleting B cells.

2. More recently, CD19 directed CAR-T cell therapy, which also deplete B cells, has shown impressive efficacy in treatment of SLE as first reported by Professor Georg Schett in Nature Medicine Oct 2022. Dozens of CAR-T and CAR-NK cell therapy companies pivoted to autoimmune space.

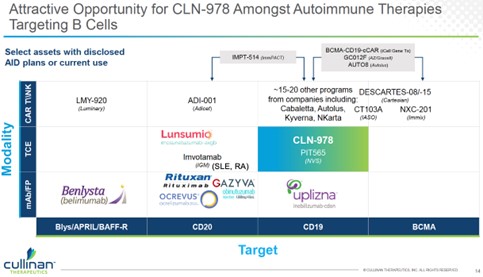

3. Despite promising outcomes with B-cell-depleting cell therapies, multiple challenges exist to limit broad uptake in autoimmune diseases. This leaves a large opportunity gap for B-cell directed antibodies, including T cell engagers (TCE). Please see the figure below, modified from Cullinan investor deck.

|  | | |

|

Cullinan was co-founded by Dr. Patrick Baeuerle, who got his PhD at Ludwig Maximilian University (LMU) of Munich in Germany before conducting his postdoc training at the Nobel Laureate David Baltimore’s lab in MIT. Patrick was my first industry boss at Tularik before returning to Germany to hold the CSO position of Micromet. At Micromet, Patrick developed blinatumomab (CD19xCD3), the first bispecific T-cell engager (BiTE) which enabled Micromet’s acquisition by Amgen for $1.16 billion in 2012.

Blinatumomab was approved for relapsed or refractory acute lymphoblastic leukemia under BTD and accelerated approval program in 2014, aka (BLINCYTO®). Due to the short half-life and adverse events including cytokine release syndrome (CRS), dosing and administration of Blincyto is very complicated: A single cycle of treatment is 42 days (28 days of continuous intravenous infusion followed by a 14-day treatment-free interval). Hospitalization is recommended for the first 3 days of the first cycle and the first 2 days of the second cycle due to fever, IRR and CRS etc.

On April 26, Cullinan stock closed higher, >30% up. Why?

-

Amazingly Prof Georg Schett was also the first one to publish, on April 26, 2024, again in Nature Medicine, “Bispecific T cell engager therapy for refractory rheumatoid arthritis”. This publication reported 6 rheumatoid arthritis (RA) patients treated with Blincyto, a CD19xCD3 bispecific antibody, with impressive outcome. Notably, the dosing and administration is modified but still in an inpatient setting as continuous intravenous infusion: 9 μg/day for 5 days, followed by a second cycle 9 days later (each cycle is 2 wks with 5 days on and 9 days off).

- Dr. Patrick Baeuerle is the “father” of Blincyto and CLN-978 (both are CD19xCD3 bispecifics) and former CSO of Micromet (Blincyto) and Cullinan (CLN-978), leading to a strong positive read-through between Blincyto and CLN-978.

- CLN-978 has improved half-life with addition of an anti-human serum albumin (anti-HSA) VHH antibody. It is formulated for subcutaneous administration, potentially improving the convenience compared with Blincyto.

In reflecting the sequence of events and the active players here, I observed the following:

- German connections: Both Prof. Georg Schett and Dr. Patrick Baeuerle are Germans. A separate group of German investigators, at Patrick’s alma mater LMU, submitted a case report of Blincyto for treatment of systemic sclerosis (SSc) on April 18, 2024, and this paper was accepted on the same day!

-

3 papers in scientific journals timed with business transactions: Prof Georg Schett’s Blincyto for RA paper was submitted in Dec 2023 and accepted on April 1, 2024; Prof Baeuerle and his successor CSO at Cullinan published an opinion piece in J. Exp. Med. on April 8, 2024 titled “CD19-directed T cell–engaging antibodies for the treatment of autoimmune disease”; Cullinan closed $280M PIPE on April 16; Blincyto for SSc case report was submitted and accepted on April 18 (available online 22 April 2024); Blincyto for RA paper published on April 26, 2024; Cullinan stock closed >30% higher on April 26, giving the PIPE investors a handsome and immediate return!

— Charlene Liao, President & CEO of Immune-Onc Therapeutics

| | |

|

1Q2024 biopharma earnings recap

Among the Big Pharma companies that have reported so far, J&J matched Wall Street’s expectations with $21.4B group wide sales. Sales from the Legend Biotech-partnered CAR-T therapy, Carvykti, have been flat in the past two quarters (Q3: $152M; Q4: $159M; Q1: $157M). J&J attributed the miss to “phasing and timing of orders,” assuring investors that the BCMA CAR-T therapy will continue to grow sequentially, especially in the second half of 2024, as the partners expand their capacity, Fierce Pharma reports. Meanwhile, the BCMA bispecific Tecvayli is gradually catching up (Q3: $112M; Q4: $126M; Q1: $133M), as J&J cited “very strong uptake and rapid adoption” across major markets.

Novartis’ $11.8B sales in Q1 handily beat consensus by 4%, even though three cancer drugs—Pluvicto, Kisqali and Scemblix, all of which have important new indications lined up in earlier treatment settings—all slightly disappointed, Fierce Pharma reports. Sales of radioligand therapy Pluvicto, at $310M, came 3% below estimates and now had two weak quarters back to back. Novartis said the number of on-treatment patients suffered from a previous shortage, during which new patient starts were put on hold. The company is preparing for a long-delayed FDA filing for Pluvicto in pre-taxane PSMA-positive metastatic castration-resistant prostate cancer. Meanwhile, Novartis has proposed former Bristol Myers Squibb CEO Giovanni Caforio as its new chair for next year, raising questions of a possible shift in BD strategy. Novartis CFO said Caforio’s nomination does not signal any change in strategy, but also said “there will be other discussions” when he joins in 2025.

Roche recently launched a rethinking of its pipeline, which has led to a 20% reduction of new molecules since Q3 2023. In the latest cut, Roche has nixed Hanmi’s oral RAF inhibitor belvarafenib and RG6286, an LY6G6DxCD3 bispecific candidate in colorectal cancer, Fierce Biotech reports. On the sales front, bispecific eye drug Vabysmo continued its strong performance despite Regeneron and Bayer’s launch of high-dose Eylea. Vabysmo’s Q1 sales grew 43% sequentially, reaching CHF 847M, which demolished analysts’ consensus of CHF 700M, Fierce Pharma reports.

At Biogen, Eisai-partnered Alzheimer’s disease drug Leqembi remains a hot topic. Facing skepticism among doctors and a slow uptake ($19M sales in Q1), Biogen said it’s increasing its U.S. sales force for Leqembi by 30%, although the base number was unknown. As a neuroscience juggernaut, Biogen is now seeking deals outside the high-risk therapeutic area, CEO Chris Viehbacher said, Fierce Biotech reports. Biogen, which recently bought cellular metabolism and inflammation specialist Reata Pharmaceuticals, will not likely pursue big M&As this year, although the CEO didn’t rule it out.

For Merck & Co., newly approved pulmonary arterial hypertension (PAH) treatment Winrevair (sotatercept) was highlighted as a potential blockbuster that the company identified from the outside to help it navigate the Keytruda LOE. “Strategic business development focused on the best external science remains an important priority,” CEO Rob Davis said on the firm’s Q1 call. For now, Keytruda still made up 44% of Merck’s Q1 sales, which totaled $15.8B ahead of consensus, Fierce Pharma reports. The PD-1 inhibitor grew sales by 20% YoY and was responsible for nearly 90% of the entire company’s revenue increase. China contributed $1.7B to Merck’s Q1 sales, good for 3% growth YoY.

Oncology is also a focus at Gilead, but the California biotech experienced several setbacks there in Q1. The company has ditched the CD47 antibody magrolimab, which was the centerpiece in the $4.9 billion acquisition of Forty Seven in 2020, Fierce Biotech reports. It had previously first stopped developing the drug in blood cancers after seeing patient deaths in phase 3 trials. Now, all solid tumor trials have been removed from Gilead’s pipeline. Meanwhile, Gilead also took a $2.4 billion impairment charge around the TROP2 antibody-drug conjugate Trodelvy after the phase 3 flop in previously treated non-small cell lung cancer earlier this year, Fierce Pharma reports. Nevertheless, the company believes the full dataset gives it confidence in the drug’s potential in NSCLC and will share more on its plan when the results are presented at ASCO 2024. Gilead also expects multiple readouts and clinical updates for Trodelvy as AstraZeneca and Daiichi Sankyo’s rival TROP2 ADC, Dato-Dxd, nears an FDA decision.

Speaking of AstraZeneca, after a series of transactions across cell therapy (Gracell), radioligand therapy (Fusion) and vaccines (Icosavax), CEO Pascal Soriot said the company is largely done with platform deals, but that doesn’t mean BD will completely stop, Fierce Pharma reports. AZ just posted a strong Q1, with its $12.7B sales beating consensus by 7%. The biggest surprise came from SGLT2 inhibitor Farxiga, which delivered a 45% growth YoY and handily beat consensus projection by 19%. AZ attributed the performance to the launch of its authorized generic, which expanded the patient pool with a cheaper option. Farxiga has resisted generics in several countries, but AZ warned it expects inclusion in China’s VBP later this year. China returned to double-digit growth for AZ, at 13%, by constant exchange rate, or 9% as reported. Fierce Biotech reported some pipeline culls.

Between the two inflammatory disease drugmakers, Sanofi is counting on a potential upcoming launch in chronic obstructive pulmonary disease as Dupixent’s “next major growth pillar,” and AbbVie continues to see a sales free-fall from Humira. Dupixent already has a strong reputation with pulmonologists thanks to its asthma and rhinosinusitis approvals, but Sanofi CEO Paul Hudson warned that it would take some time to drive awareness and diagnosis of COPD with type 2 inflammation, Fierce Pharma reports. As for AbbVie, Humira dipped nearly 40% YoY to $2.3B, as the company tries to maintain market share against biosimilars with steep discounts, Fierce Pharma reports. Skyrizi, in what AbbVie called a “clear market leader” in the U.S. biologics psoriasis market, chalked up $2B in Q1 sales. Rinvoq, with $1B sales in Q1, just topped Dupixent in a head-to-head study in atopic dermatitis. About 20% of patients simultaneously achieved nearly complete skin clearance and no to little itch after taking Rinvoq, compared with 9% of those on Dupixent.

—Angus Liu

| | |

|

Charting the Course: Pfizer's BEQVEZ Approval and the Quest for Gene Therapy's Commercial Viability in Hemophilia

Pfizer's first gene therapy, BEQVEZ™ (fidanacogene elaparvovec-dzkt), received FDA’s approval last Friday for adults with moderate to severe hemophilia B. Utilizing an AAV vector, Beqvez delivers a functional copy of the factor IX gene, whose expression restores the patient’s ability to clot blood and effectively addresses the persistent challenge of excessive bleeding characteristic of hemophilia B.

The approval of BEQVEZ was anchored by the pivotal Phase III BENEGENE-2 study, an open-label, single-arm trial involving 45 male patients. The results revealed a significant reduction in bleeds post-treatment, with a median of zero bleeds (ranging from 0 to 19) compared to 1.3 (ranging from 0 to 53.9) in the SOC Factor IX prophylaxis arm, after a median follow-up period of 1.8 years.

BEQVEZ's journey began a decade ago when Pfizer licensed it from Spark for $20M upfront and $260M milestone payment. Despite its recent approval, Pfizer faces a daunting challenge in making gene therapy financially viable. Despite its hefty price tag of $3.5 million, equivalent to CSL/uniQure's Hemgnix approved for the same indication in 2022, the commercial outlook appears bleak, mirroring the underwhelming performance of gene therapies in hemophilia thus far.

Sales of Hemgenix haven’t been large enough for CSL to break out in its IR presentation. Similarly, BioMarin's Roctavian, a comparable gene therapy for hemophilia A, generated a mere $3.5 million in sales in 2023 and a meager $800,000 in the first three months of 2024, prompting considerations of divestment (see previous newsletter). This trend underscores the challenge in establishing the economic viability of gene therapy, particularly in the realm of hemophilia. Despite being touted as long-lasting alternatives with potential financial benefits for the healthcare system, their high prices have not translated into substantial sales. This is partly due to the effectiveness of the SOC in hemophilia management and lingering concerns regarding the long-term safety and durability of gene therapy.

Pfizer, as the first major pharmaceutical company to venture into hemophilia gene therapy, holds a considerable advantage with its robust commercial capabilities. It remains to be seen whether Pfizer can reverse the trend and demonstrate gene therapy's economic viability through improved sales performance. (Press Release, Fierce) — Jiamin Zhuo

| | |

Global Biotech News

BioCentury recently published an article titled “Drive-by analysis of accelerated approval is intellectual malpractice.” The piece criticizes misleading conclusions drawn from cancer drug accelerated approvals. While some drugs didn’t demonstrate overall survival benefits in confirmatory trials, it’s essential to recognize that this doesn’t necessarily mean they lack clinical benefit1. The study’s presentation at the American Association for Cancer Research (AACR) meeting sparked debate and media attention. “Absence of evidence isn’t the evidence of absence”, was the key message of this BioCentury rebuttal article. — Leon Tang

Former Stanford University President Marc Tessier-Lavigne and renowned chemist David Backer co-founded AI drug discovery powerhouse Xaira with $1bn funding support led by Arch Ventures and Foresite Labs. Xaira Therapeutics, a new AI drug discovery powerhouse, has secured $1 billion in funding. Xaira combines machine learning, data generation, and therapeutic product development to revolutionize drug discovery. — Leon Tang

Tovorafenib received accelerated FDA approval for relapsed or refractory BRAF-altered pediatric low-grade glioma (pLGG). Day One Biopharma’s R&D head Sam Blackman provided a brief recount of the successful clinical development in the past few years on the latest Biotech Hangout. Atlas Ventures’ Bruce Booth published a LinkedIn post that recounts the key events in tovorafenib’s 20-year journey and concludes “It takes a village... or at least a collaborative ecosystem... to bring drugs to patients”. — Leon Tang

Bruce Booth from Atlas Ventures publishes an opinion piece that identifies a meaningful contraction of biotech startups in 1Q2024, a 50 to 60% reduction compared to its peak in 2021, and the author believes this contraction in venture creation is a healthy dynamic for the sector. Asked by me to comment on the NIH director’s recent comment that lack of funding is the largest limiting factor for bench-to-bedside efforts, (a.k.a clinical trials), the author replied, “I'm very skeptical that it’s simply a lack of funding that's limiting clinical trials. Right now patient recruitment/enrollment, and broader clinical operations issues at clinical research sites, are more limiting than capital, IMO. Esp in super competitive categories like lymphoma and leukemia..” — Leon Tang

| | |

To Travel Far, Travel TOGETHER | |

InScienceWeTrust Community is a registered 501(c)(3) nonprofit in New Jersey, USA | | | | |