Asian Biotechies Walk Into A Bar

The Newsletter of InScienceWeTrust Community

| |

|

Asian Biotech Comes of Age: Akeso/Summit's Keytruda Killer, Asian Support Behind Candid Tx Debut, A Chat with Asian Biotech Deal-Makers

Issue 62; 2024-09-15

| |

|

Summary

The past week was filled with headline grabbing news, especially those related to Asian biotech or Asian biotechies:

- Summit/Akeso’ “Keytruda killer” lived up to the expectation and dominated the headlines of all major biotech news outlets, which we elaborated with a commentary.

- Candid Therapeutics debuted in the red hot T-cell engager for autoimmunity space, backed by Asian innovations, capital, and talents. Our commentary reveals the strong Asian support behind Candid’s impressive launch.

- Yesterday, a few very experienced Asian biotech executives shared their insights on the global landscape of investment, deal-making, and partnership, under the new reality shaped by inflation reduction act and biosecure act in the biotech epicenter Kendall Square.

BioVerse 13 continued the success streak of our webinar series, and this one was particularly timely after the launch of Candid Therapeutics, whose Phase 1 BCMA-targeted T-cell engager was developed by David Gu’s company EpimAb Biotherapeutics. In addition, Proteologix CEO David Shen told the backstory behind his $850M acquisition by JNJ, while Kaveri Pohlman provided rich context of why I&I is so attractive. Watch the webinar replay here and read the summary here.

Please send your questions and suggestion to partnership@iswtb.com

| | |

|

Akeso, Summit’s ivonescimab handily beat Keytruda

Detailed data presented at WCLC24 confirmed that Akeso and Summit Therapeutics’ PD-1/VEGF bispecific ivonescimab decisively beat Merck’s Keytruda in the phase 3 HARMONi-2 trial in Chinese patients with first-line PD-L1-positive non-small cell lung cancer, Fierce Pharma reports.

On the study’s primary endpoint of progression-free survival, ivonescimab led to a large 49% reduction in the risk of progression or death. The median PFS was 11.14 months for ivonescimab, versus 5.82 months for Keytruda, translating into a difference of 5.32 months.

The magnitude of PFS benefit was consistent across key patient subgroups, including those whose tumors were squamous (50%), nonsquamous (45%), PD-L1-high as defined by TPS>=50% (52%), PD-L1-low (46%), and patients with brain metastases (45%).

| | |

|

“These results highlight ivonescimab’s potential as a new standard of care” in first-line PD-L1-positive NSCLC, Dr. Caicun Zhou from Shanghai Pulmonary Hospital, who leads the HARMONi-2 trial and president-elect of IASLC, said in a statement.

“If these benefits are confirmed, it is possible that the therapeutic harmony we’ve had in this first-line space may finally come to an end, and I think that’s a disharmony that we all should be rooting for,” Dr. John Heymach, chair of thoracic/head and neck medical oncology at MD Anderson Cancer Center, said during a discussant presentation at WCLC24.

Summit, which in-licensed ivonescimab’s ex-China rights in multiple key territories in late 2022 for $500 million upfront, has seen its stock price jump nearly 1,110% so far this year.

Granted, ivonescimab still needs to prove itself in a global phase 3 trial. But even a detailed look at the HARMONi-2 data suggests the drug indeed has true potential to replace Keytruda as the new standard of care.

Being able to treat squamous NSCLC sets ivonescimab apart from Roche’s combination of Tecentriq and bevacizumab, which has an FDA approval alongside chemo in first-line nonsqumous NSCLC. Thanks to a lung bleeding safety problem, bevacizumab is contraindicated in squamous cancer.

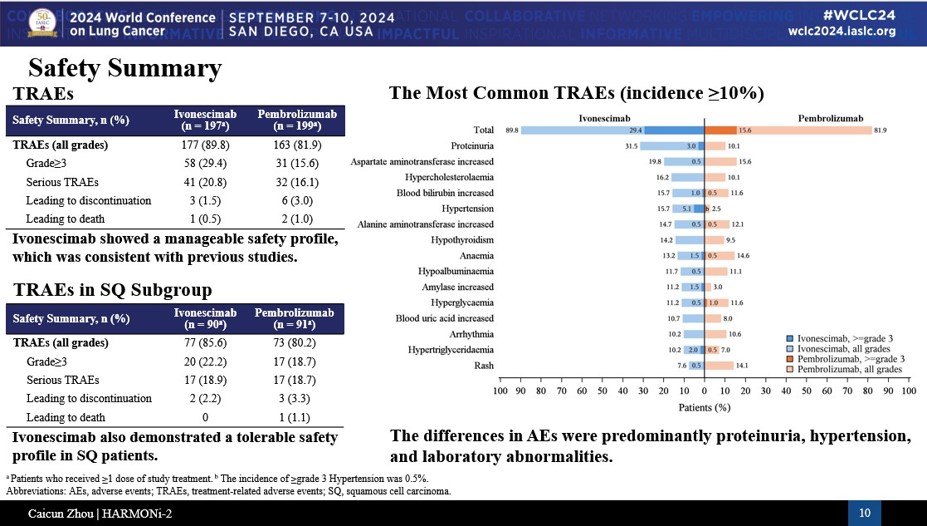

In HARMONi-2, hemorrhages were recorded in 14.7% of ivonescimab patients, including in 1% at grade 3 with no more serious cases. The rates were 11.1% and 0.5% for Keytruda. The grade 3 hemorrhage cases reported for ivonescimab were actually in nonsquamous patients.

Reasonably, VEGF-related adverse events were higher in the ivonescimab arm, most notably proteinuria at 31.5% and hypertension at 15.7%, versus 10.5% and 2.5% for Keytruda, respectively. But no VEGF-related events were above grade 3, and no treatment discontinuations happened because of them.

|  | | |

|

In an interview with Fierce Pharma, Akeso CFO Dr. Bing Wang explained that the PD-1 component of the bispecific helps anchor the drug to tumors, whereas a standalone anti-VEGF drug would move more freely in the blood, causing side effects. Besides, Wang noted that ivonescimab forms soluble complexes with VEGF dimers, further enhancing binding affinity of ivonescimab to PD-1, as described in this Journal for ImmunoTherapy of Cancer article.

While the VEGF adverse events all look very manageable in HARMONi-2, Leerink Partner analysts noted that Asia uses anti-VEGF drugs way more often than Western countries does, especially in lung cancer. The team therefore wondered whether ivonescimab can maintain that discontinuation profile in a global trial.

As Fierce Pharma and Dr. Heymach both pointed out, Keytruda performed as expected in HARMONi-2, using the phase 3 KEYNOTE-042 trial in the same treatment setting as reference. Some people may point to Keytruda’s PD-L1-high data in the KEYNOTE-024 trial to suggest Keytruda underperformed in HARMONi-2. But Leerink analysts argued that Keytruda may have outperformed in KEYNOTE-024 because “prognosis of enrolled patients was impacted by trial design that required central confirmation of PD-L1 status.”

One key missing piece in the HARMONi-2 release is overall survival data. For now, Akeso and Summit declined to share any information on that analysis, saying it was too immature. In a previous note before the detailed HARMONi-2 presentation, Citi analyst Wangbin Zhou highlighted the potential impact from subsequent therapies, arguing that a PFS improvement of around 40% would likely eventually give ivonescimab a “clinically meaningful” OS benefit above 20%.

Based on HARMONi-2’s results, Summit is starting the global phase 3 HARMONi-7 study pitting ivonescimab against Keytruda in first-line PD-L1-high NSCLC, Summit’s co-CEO Maky Zanganeh told Fierce Pharma in a separate interview.

Both Zanganeh and Summit’s co-CEO/executive chairman Bob Duggan were leaders that sold Imbruvica developer Pharmacyclis to AbbVie in 2015. This history raises the question of whether the team might pull a similar deal with a Big Pharma company for Summit. Besides, challenging Keytruda, which made $25 billion sales worldwide last year, seems like too big a task for a small firm like Summit to undertake.

In his interview with Fierce Pharma and CNBC, Duggan said he’s now focused on moving ivonescimab forward in clinical development rather than looking for an exit.

In a “100-meter-race, we’re at the 10-meter mark now,” Duggan told Fierce. “We will accelerate, not decelerate. We have access to the funds [and] access to people that are as good as or better than any Big Pharma, and we’re all-in on this.” – Angus Liu

| | |

|

Asian Assets, Capital, and Talents Back Candid Therapeutics’ Impressive Launch

I&I is the hottest field in deal-making and company building. 20 out of 50 M&A in recent 12 months were in I&I, which amounted to over $30Bn upfront payment. T-cell engagers for autoimmune diseases are particularly intriguing among investors and biopharma external R&D teams.

| | |

|

Although the jury is still out for the debate of Car-T vs TCE, investors and biopharmas seem to prefer TCE to Car-T, which is reflected on the recent the stock market performance and recent deal flow of TCE and Car-T companies in this space, which was elaborated by a previous deep-dive article.

Candid Therapeutics was launched with the perfect combination of pipeline, capital, and management team, in the hottest space of T-cell engagers for autoimmune diseases. One can easily see the 3 essential ingredients essential for most successful biotech startups, but I’d argue Candid Therapeutics is also a historic success for Asian biotechies, and let me explain from the three dimensions:

Asian biotech companies built the pipeline: Phase 1 BCMA-targeted TCE CND106 originated from EpimAb Biotherapeutics, a private biotech with most of its operation in China. Phase 1 CD20-targeted TCE CDN261 originated from Genor Biopharma, a Hong Kong-listed public biotech.

Asian investors played significant role in the multi-stage fundraising: Candid therapeutics’ eye-popping $370M debut grabbed the headline with one of the best syndicate in our industry: Venrock Healthcare Capital Partners, Fairmount, TCGX, and venBio Partners led the round and built the syndicate, which includes 19+ reputable biotech investment funds around the world. CND106 was acquired from Vignette, which was created by Foresite Capital, Qiming Venture Partners, Samsara BioCapital, and Mirae Asset Capital Life Sciences, most of which have large Asian LP base, GP workforce, and a large percentage of Asia-based portfolio companies. Similar story is applied to CND261, which was acquired from TRC2004, a newco built by Two River and Third Rock Ventures, around the asset from Genor Biopharma.

A world-class management team largely made of Asian talents: TCE for autoimmunity space is VERY crowded. For example, BCMA TCE space has 23 assets in development. Candid Tx is in the first wave but certainly not the front runner - Tecvayli is approved in oncology and has initial data published in NEJM. “What we wanted to do was to set up the company in a way that positioned us to be able to get first to market”, said Ken Song with Fierce Biotech. This is Ken’s 4th company, right after his $4.1 M&A of last company RayzeBio.

Candid Therapeutics’ CMO Timothy Lu, a MD/PhD physician scientist whose last job was the CMO of DICE Therapteutics that was acquired by Eli Lilly for $2.4Bn for their I&I franchise. Interestingly, both Timothy Lu and Ken Song received their medical training at UCSF. Their CTO Bernie Huyghe and CFO Arvind Kush, an South Asian American, both have impressive backgrounds.

The strong support of Asian innovations, capital, and talents behind Candid Therapeutics’ impressive launch prove Asian American talents and Asian-led companies are entering the central stage of the global biotech industry. Headline-grabbing events like this will inspire more Asian investors, young Asian professionals, and Asian students to dedicate their career to the life sciences industry, where one will always aspire to Do Well by Doing Good. — Leon Tang

| | |

|

BioSpark Annual Conference: Panel Discussion on Business Partnerships and Collaboration

On September 14, the first BioSpark Annual Conference in Boston featured Leon Tang moderating a panel discussion on "Business Partnership and Collaboration." The distinguished panelists included Chong Xu, Ph.D., a partner at F-Prime Capital; Erica Wang, Esq., founder of Veritas Law; John Wang, Ph.D., SVP at Simcere Pharmaceutical Group; and Marian Nakada, Ph.D., VP of Venture Investment at JJDC, JNJ.

Key Insights on Collaboration with Big Pharma

The discussion began with the panel confirming that large pharmaceutical companies will continue to rely on small biotech firms for innovative assets to replenish their pipelines. John revealed that big pharma often targets up to 50% of late-stage assets from external sources. Marian emphasized that small biotech companies, leveraging their agility and focus, must ensure their innovations align with big pharma’s needs and produce high-quality data.

Strategies for Successful Collaborations and Deals

When discussing how to establish successful collaborations or business development deals with big pharma, Chong suggested that securing initial funding from a pharmaceutical company's venture branch can be an effective strategy. This often increases the likelihood of future collaboration. Marian noted that companies are generally acquired rather than sold, so creating assets that are crucial to sustaining a pharmaceutical company's franchise can be a significant advantage during negotiations. Additionally, leveraging competition to secure better terms can be beneficial. The panel agreed that small biotech firms should consider a "dual process" approach, seeking both funding and collaboration with big pharma simultaneously. For instance, Progeologix successfully used its Series B funding round as leverage during M&A discussions with JNJ, resulting in an $850 million cash deal. Erica, an experienced biopharma lawyer, highlighted that licensing agreements require both parties to work together to ensure the success of the "baby product." She frequently observes that collaborations fall apart not due to scientific issues, but due to misaligned objectives. Therefore, effective alliance management is crucial for achieving successful outcomes.

Funding Preferences in the Current Market

The panel also addressed funding preferences, such as IPOs and PIPEs. Chong stressed that, given the current macroeconomic challenges and backlog pressures on biotech IPOs, small biotech firms should prioritize raising funds by any means necessary and not overly concern themselves with dilution. "Life is much simpler with more money!" Erica reminded the audience that NASDAQ imposes stricter requirements, which raises the bar to prevent potential "pump and dump" activities.

Hot Therapeutic Areas

Regarding the most promising therapeutic areas, the panel highlighted immunology & inflammation (I&I), metabolic diseases, radiopharma, in vivo Car-T, and Alzheimer's disease. Conversely, investors are wary of gene and cell therapies, although cell therapies have recently shown promise in autoimmune diseases. Marian also noted that immuno-oncology (IO) in oncology is losing its appeal due to the lack of reliable translational animal models, limited monotherapy efficacy, and unclear combination strategies.

Impact of the Inflation Reduction Act (IRA)

The panel discussed the potential impact of the Inflation Reduction Act (IRA) on the biotech sector. Both investors noted that while the IRA has not yet significantly affected early-stage investment decisions, it might prompt strategic adjustments in the future. John emphasized the importance of selecting initial indications wisely, while Chong advised biotech firms to be strategic in development, such as designing two molecules for different indications. Erica highlighted the complexities the IRA introduces into commercially reasonable efforts (CRE) and royalties in collaboration agreements.

BioSecure Act and Its Implications

Finally, the panel explored the potential passage and impact of the BioSecure Act. All panelists believe it will pass, though they noted that companies will need time to adapt. The Act may lead to partial or full decoupling from Chinese CDMOs, but full decoupling is unlikely to happen quickly. Eric noted that the bill has evolved, with the latest version including a grandfather clause allowing companies until 2032 to phase out relationships with Chinese CDMOs. Compliance will become more complex, particularly in contractual negotiations.

John mentioned that while the Act might not immediately affect day-to-day operations, it has already caused hesitation among non-Chinese investors and companies. Marian added that many biotech companies dependent on WuXi and other Chinese CDMOs are now seeking alternatives, leading to the emergence of new companies to fill the gap. The industry is already adjusting its supply chains in anticipation of the potential new regulations, even before they take effect. — Jiamin Zhuo

|  | | |

BioVerse 13 continued the success streak of our webinar series, and this one was particularly timely after the launch of Candid Therapeutics, whose Phase 1 BCMA-targeted T-cell engager was developed by David Gu’s company EpimAb Biotherapeutics. In addition, Proteologix CEO David Shen told the backstory behind his $850M acquisition by JNJ, while Kaveri Pohlman provided rich context of why I&I is so attractive. Watch the webinar replay here and read the summary here. | | |

|

Sponsorship Needed!

We have planned the webinar until February 2025, and we are looking for sponsors and strategic partners to promote our future episodes. Follow our event page here and send your inquiry to partnership@iswttb.com to learn more.

| | |

To Travel Far, Travel TOGETHER | |

InScienceWeTrust Community is a registered 501(c)(3) nonprofit in New Jersey, USA | | | | |