CURRENT MARKET PERSPECTIVE | |

|

AAPL OFFICIALY PART OF AI TRIUMVIRATE

FRENCH DEBT CREATES STORM CLOUDS OVER EU DEBT

Click All Charts to Enlarge

| |

AAPL EXPLODES OUT OF TRADING RANGE - AAPL exploded out of its trading range as its aggressive buyback program continues. The Price lift is seen as a vote of confidence that AAPL has officially become a sustainable part of the AI Triumvirate leadership along with Nvidia & Microsoft. | |

|

1 - SITUATIONAL ANALYSIS

BANKING TROUBLES IN EUROPE!

French President Emmanuel Macron's decision to abruptly call a national election in two weeks based on the serious blow inflicted from last week's EU election appears to have backfired on him. The EU Bond market suddenly borders on crisis as French-German Bonds spreads have exploded higher on fear of a potential Socialist French Parliament not interested in abiding by the 3% Debt-to-GDP EU Governance Rule. It will be a very busy weekend in EU Banking circles.

- French ETF's (EWQ) have been gaping lower and lower. This is at the most oversold levels since Sept 2022.

- European banks (SX7E) have become very oversold almost immediately.

CHART TOP RIGHT: The Fear & Greed Index has dropped quickly to 38! Is it reflecting, though knowing something is terribly wrong, a fear of missing out (FOMO) on the rally continuing?

CHART BOTTOM RIGHT: The BoA Bear-Bull Indicator is at the highest levels in awhile. Still not yet a "clear" contrarian sell, but it is getting there!

CHART BELOW: BoA's Global Risk-Love Indicator stands at 92 percentile and suggests investors exercise caution and focus on managing Risk.

| |  |

| |

The crowd is very long and in need of downside protection. We are seeing skew catch rather aggressive "bids". | |

The average percentile of 16 different equity focused sentiment indicators though not at all time highs is elevated especially against a longer term weakening trend. | |

|

"AS GO THE FINANCIALS, SO GO THE BANKS: AS GO THE BANKS, SO GO THE MARKETS"

MATASII FINANCIAL STOCK INDEX

We continue to keep an eye on both the Bank and Financial stocks to give us an early signal of market direction. We have been showing the banks over the last few weeks, but the Financials now appear to be giving a clearer signal.

- The MATASII Financial Index stocks has begun to exhibit a potential continuation triangle pattern.

- The Elliott Wave analysis supports an "E" wave higher as part of a potential ABCDE pattern.

- Momentum (bottom pane) has found long term support and needs to be watched to see if it breaks shorter term overhead resistance, shown by a dotted descending orange momentum trend line.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

2 - FUNDAMENTAL ANALYSIS

FORWARD PE'S & EPS

Should we believe the 12 Month Forward Earnings per Share estimates, remembering that it is all based on a cap weighted S&P 500 driven by the Magnificent Seven? Especially as the Magnificent Seven is increasingly driven by three component stocks (Apple, Nvidia and Microsoft) all hinging their net growth outlooks on AI? That may not be outright gambling, but then it is not prudent investing - it is better termed speculation!

| |

|

LIQUIDITY

We are seeing a less supportive liquidity trend picture for equities when we define it as (Bank Deposits +MMMF) /(Bank Loans Ex-Real Estate + Commercial Paper). As you would expect, VIX tends to rise when liquidity tightens - which it has.

| |

|

S&P 500 vs FED BANK RESERVES

There are two glaring problems with the chart below:

- The "Jaws-of-Death" will be closed at some point.

- We have a major Divergence which is always a warning to be taken seriously!

| |

|

DOW THEORY

In last week's Newsletter we outlined our growing concerns with the Trannies within the DOW Theory (LINK). The gap between Transports and SPY is only getting wider and wider. Is tech so powerful that we can dismiss from "all" PROVEN old relationships? NOTE: More Divergence!

| |

|

MARKET DRIVERS

As goes NVDA, so goes the MAG-7, As Goes Mag-7 so goes The Market.

| |

NVDA - Daily

CHART RIGHT: NVDA stock Y-o-Y% change tracks the growth rate of revenue & EBITDA revisions. Both look to have peaked (Revenue shown to the Right)?

- NVDA continues to reach for new highs!.

- NVDA's lift this week pushed through the pre-split upper channel boundary trend line which now aligns with the black dotted rising mid-channel trend line shown below.

- The Dotted Black Trend line in the MATASII Proprietary Momentum Indicator (lower pane below) is suggesting a potential Divergence has been set up. This is normally seen as a warning to the downside that is ahead if the Divergence isn't removed by a movement higher in Momentum.

- At some point the major unfilled gaps (at much lower levels) must be filled. NVDA therefore may no longer become a Short to Intermediate Long Term hold, but rather a position trading stock as others entering the space and force margins to contract.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

MAGNIFICENT 7

Magnificent 7 is up a magnificent 24% YTD (chart right), contributing >50% of SPX return (NVDA alone = 25%) as monopolistic mega tech monopolizes performance..

Total CAPEX + R&D for the Magnificent Seven this year is expected to total $348bn. (Think about that for a second.)

Here’s another way to frame it - the Magnificent 7 is reinvesting 61% of their operating free cash flow back into

CAPEX + R&D!

- The basket of 'Magnificent 7' stocks soared for the 7th week in the last 8 (and the best week in the last 8) before pulling back ever so slightly at Friday's close.

- We continue to be concerned about the momentum Divergence signal that has been occurring for some time (bottom pane). Continued caution advised.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

"CURRENCY" MARKET (Currency, Gold, Black Gold (Oil) & Bitcoin) | |

|

10Y REAL YIELD RATE (TIPS)

Real Rates reached our initial overhead resistance level of 2.25% before falling off hard as part of our expected "X" leg lower (chart right). Wednesday's CPI pushed real rates towards previous lows.

| |

CONTROL PACKAGE

There are TEN charts we have outlined in prior chart packages, which we will continue to watch closely as a CURRENT Control Set:

-

US DOLLAR -DXY - MONTHLY (CHART LINK)

-

US DOLLAR - DXY - DAILY (CHART LINK)

-

GOLD - DAILY (CHART LINK)

-

GOLD cfd's - DAILY (CHART LINK)

-

GOLD - Integrated - Barrick Gold (CHART LINK)

-

SILVER - DAILY (CHART LINK)

-

OIL - XLE - MONTHLY (CHART LINK)

-

OIL - WTIC - MONTHLY - (CHART LINK)

-

BITCOIN - BTCUSD - WEEKLY (CHART LINK)

-

10y TIPS - Real Rates - Daily (CHART LINK)

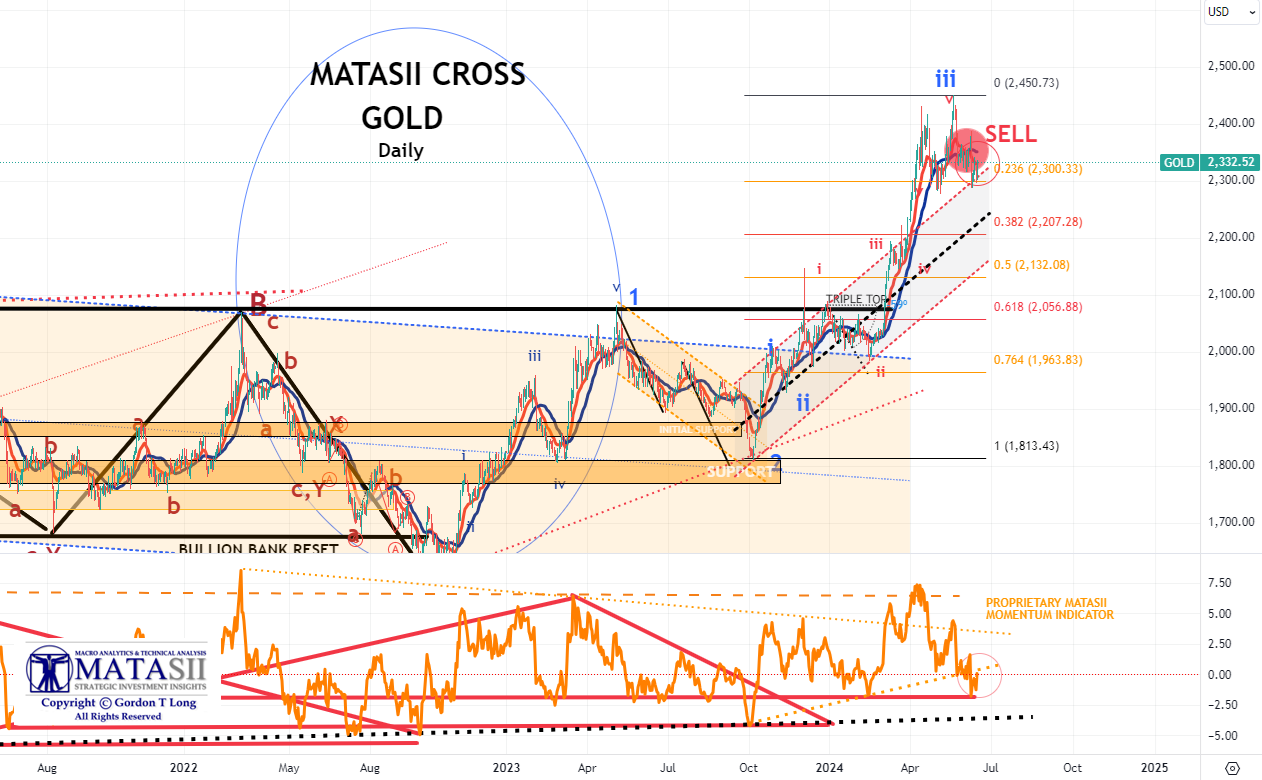

GOLD - DAILY

- Gold continues to weaken as inflation pressures weaken and yields fall.

- The Elliott Wave count still suggests a strong likelihood of a minimum retracement of 38.2% and the 100 DMA.

- Momentum support (lower pane) shows gold has found an important support line. it should be noted there is another longer duration trend support slightly lower (dotted black line).

- Though the MATASII CROSS has given an initial SELL signal on the Daily chart, we caution it may be short lived!

|  | |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

CHART RIGHT: Is the market finally ready for a break out? Low volume pre-summer vacation break-out moves can be "frustrating".

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

-

The S&P 500 (CHART LINK)

-

The DJIA (CHART LINK)

-

The Russell 2000 through the IWM ETF (CHART LINK),

-

The MAGNIFICENT SEVEN (CHART ABOVE WITH MATASII CROSS - LINK)

-

Nvidia (NVDA) (CHART LINK)

| |

S&P 500 CFD

- The S&P 500 cfd rose aggressively this week through its long term upper trend channel boundary line. (NOTE: see Thought Experiment note below.)

- However, the MATASII Proprietary Momentum Indicator (middle pane) appears to be showing signs of weakening within a Divergence pattern with price and stopped by its overhead momentum resistance trend line.

- We also have an excess RSI level, though it could go slightly higher and sustain itself in the near term.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

S&P 500 - Daily - Our Thought Experiment

OUR CURRENT ASSESSMENT IS THAT THE INTERMEDIATE TERM IS LIKELY TO LOOK LIKE THE FOLLOWING

NOTE: To reiterate - "the black labeled activity shown below, between now and July, looks like a "Killing Field", where the algos take Day Traders, "Dip Buyers", the "Gamma Guys" and FOMO's all out on stretchers!"

- The S&P just hit a new all time high this week.

- However, the MATASII Proprietary Momentum Indicator appears to be showing signs of weakening (lower pane) with firm support quite a bit lower.

- The Divergence in Momentum (lower pane) needs to be noted along with a clear long term ending wedge.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

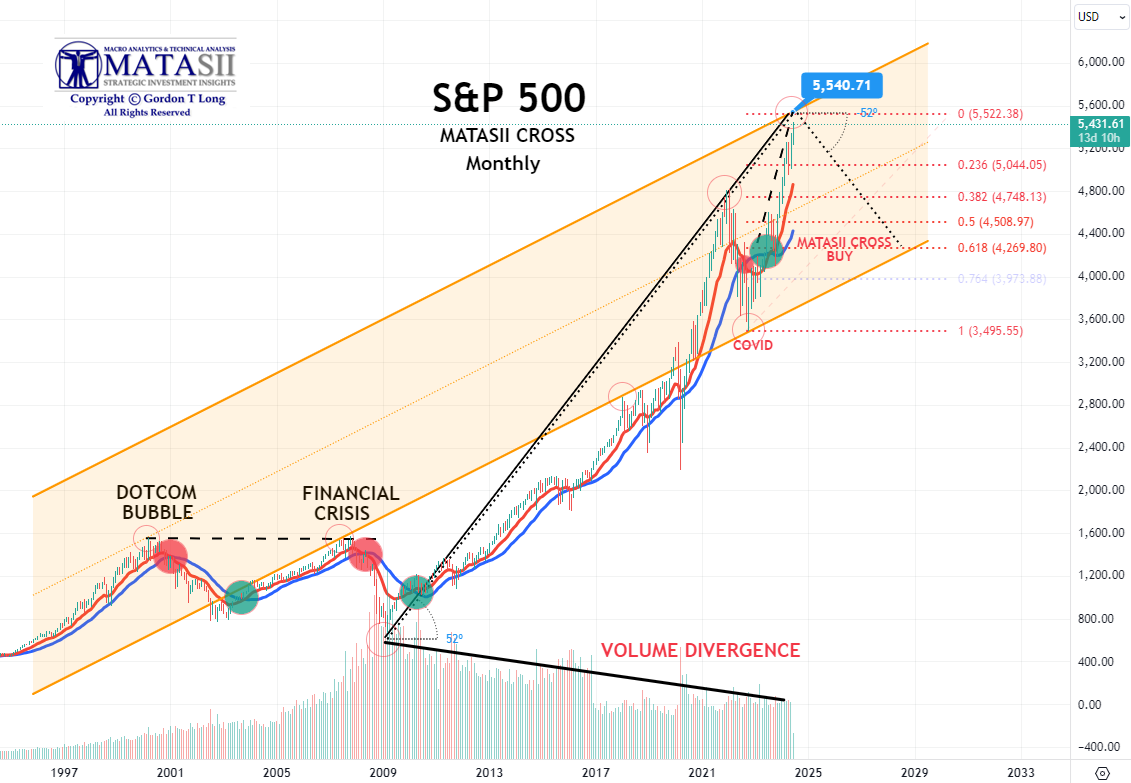

S&P 500 - Monthly - Our Thought Experiment

- We continue to move towards our target of 5540 shown here and on our daily chart (above).

|  | |

STOCK MONITOR: What We Spotted

MONDAY

- Stocks ultimately largely traded in the green despite risk-off in Europe following the EU Parliamentary elections over the weekend, which saw the Far-Right parties make notable gains, with French President Macron ultimately calling a snap election.

- US Equities clawed back earlier losses once cash trade got underway in quiet trade with attention turning to the Apple (AAPL) WWDC event, which ultimately confirmed its partnership with OpenAI, but only briefly supported AAPL stock which sold off over 2% on Monday.

- T-notes bear steepened with weakness following on from JGB and EGB pressure overnight and in the European morning, but lows in T-notes were seen in the wake of the weak 3yr auction before paring slightly into settlement.

- There was little reaction to the mixed NY Fed Survey of Consumer Inflation expectations, which saw the 1yr ease, 3yr unchanged, and 5yr rise.

- Crude prices were bid throughout the session on geopolitics and optimism around Summer fuel demand, while gold and silver attempted to recover some of the steep losses incurred on Friday in the wake of the hot NFP. Attention now turns to the US CPI and FOMC on Wednesday.

INFLATION BREAKEVENS: 5yr BEI +0.7bps at 2.298%, 10yr BEI +1.0bps at 2.318%, 30yr BEI +0.9bps at 2.324%.

REAL RATES: 10Y -- 2.1476%

STOCK SPECIFIC

- Microsoft (MSFT) announced a new all-digital version of its Xbox Series X and S consoles, as well as new game releases including Call of Duty and Doom, in its annual Xbox Games Showcase.

- Southwest Airlines (LUV): Elliott Management has taken a USD 2bln stake in Southwest Airlines (LUV) and plans to engage with management. Barclays maintains its equal weight rating on LUV, but added that potential activism could “bring a fresh air for the storied, once low-cost airline”.

- Apple (AAPL) announced Vision OS2, and the expansion of Apple Vision Pro to eight new countries including China, and Japan. Introduced tap to pay, such that, users can send money to other iPhone users by tapping the phones together. In addition, Apple confirmed its partnership with OpenAI, integrating ChatGPT.

- KKR & Co. (KKR), CrowdStrike Holdings (CRWD), and GoDaddy (GDDY) will replace Robert Half International (RHI), Comerica (CMA), and Illumina (ILMN) in the S&P 500, respectively, on June 24th.

- Vista Outdoor (VSTO) received a USD 2bln plus offer from an alternative party for the Kinetic Group. It also separately announced the rejection of MNC Capital’s latest indication of interest.

- Cognizant Technology Solutions (CTSH) will purchase Belcan for c. USD 1.3bln in cash and stock.

- Tesla (TSLA) CEO Elon Musk says on X, “No Model Y refresh” is coming out this year.

- Moderna (MRNA) announced that its Phase 3 trial of MRNA-1083, a vaccine against influenza and COVID-19, has met its primary endpoints, resulting in higher immune responses than the licensed comparator vaccines used in the trial.

- Biogen (BIIB) announced that the FDA has accepted SBLA for monthly LEQEMBI IV maintenance dosing, which is intended for the treatment of Alzheimer's disease in patients with mild cognitive impairment or mild dementia stage of disease.

- Huntington Bancshares (HBAN) expects modest NII growth in Q2 and accelerating expansion in 2H24 and 2025.

- Morgan Stanley (MS) CEO says changes in rates environment is lasting, and higher for longer interest rates are good for business.

- Eli Lilly (LLY): US FDA Advisory panel unanimously vote in favour that available data shows LLY’s Donanemab is effective for treating Alzheimer’s disease with mild cognitive impairment and mild dementia.

- FedEx (FDX) raised its quarterly dividend by 10% to USD 1.37/shr.

- Intel (INTC) halted construction of a new factory in Israel, according to the Israeli Press Calcalist.

- Uber (UBER) lost its appeal to overturn California’s gig worker status law.

- Boeing (BA): Israel’s El AI chose BA’s 737 MAX to renew its short-haul fleet, and will buy 30 BA 737max aircrafts in a deal valued at USD 2-2.5bln, with deliveries to start in 2027.

- Apollo (APO) and Kyndryl Holdings (KD) are reportedly in a joint bid for DXC Technology (DXC), according to Reuters citing sources.

TUESDAY

- Stocks were ultimately mixed on Tuesday with outperformance in the Nasdaq and the index buoyed by Apple (AAPL) (+7%) after an upgrade from DA Davidson in the wake of the WWDC event on Monday.

- Meanwhile, morning weakness around French election uncertainty had unwound once Europe had left for the day, while a slump in UST yields took US indices to session highs.

- Treasuries were bid across the curve with notable upside seen after the stellar 10yr auction, which saw a 2bp stop through and a jump in indirect demand.

- The Euro continued to underperform in FX on political uncertainties, while moves elsewhere were rather contained with all eyes turning to key risk events on Wednesday; Fed and CPI. Crude prices saw marginal gains on Wednesday, while OPEC left world oil demand forecasts unchanged. But the EIA raised forecasts for both 2024 and 2025, with attention after hours on private inventory data.

INFLATION BREAKEVENS: 5yr BEI -2.9bps at 2.267%, 10yr BEI -2.3bps at 2.292%, 30yr BEI -1.7bps at 2.303%.

REAL RATES: 10Y -- 2.1123%

STOCK SPECIFIC

- Autodesk (ADSK) Q1 (USD): earnings, revenue and margins beat expectations.

- Nextera Energy (NEE) reaffirms its adj. EPS for 2024, 2025, 2026; now expects 2027 EPS to be in the range of USD 3.85-4.32

- Crown Castle (CCI) implements operational changes and updates FY24 guidance; FY adj. FFO USD 6.91-7.02 (exp. 6.92), adj. EBITDA 4.134-4.193bln (exp. 4.165bln). Is reducing staffing levels from its fiber segment by over 10% of current levels.

- Apple (APPL) plans to integrate other AI models, such as Google (GOOG) Gemini, in the future - as was alluded to in the WWDC.

- Zscaler (ZS) announced a collaboration with Nvidia (NVDA) to accelerate AI-powered co-pilot technologies, is to deliver gen-ai powered zero trust security innovations with NVDA; also strengthened its partnership with Google (GOOGL).

- Tesla (TSLA) CEO Musk said on X he will ban Apple (AAPL) devices at his company if Apple integrates Microsoft-backed (MSFT) Open AI at the OS level. Separately, TSLA's bid to dismiss claims that it was overstating its vehicle's self-driving capabilities was dismissed by a Californian judge.

- General Motors (GM) board approved a new USD 6bln share repurchase authorization and increased its common stock dividend from USD 0.09 to 0.12/shr. Expects Q2 earnings to be better than Q1, but cuts 2024 top-end goal for Ultium production to 250k from 300k

- Rio Tinto Plc (RIO) said it will buy Mitsubishi's 11.65% stake in Boyne Smelters (BSL) for an undisclosed sum.

- Spotify (SPOT) is to introduce a more expensive subscription tier; which will cost at least USD 5 more per month, according to Bloomberg.

- Regeneron (REGN) expects data from its obesity drug trial in 2025.

- Axsome Therapeutics (AXSM) is a new short Culper Research.

- Apple (AAPL) announced Affirm (AFRM) payment products are expected to be available to Apple Pay users in the US later this year.

- Fortinet (FTNT): Chinese hackers breached 20k FortiGate systems worldwide, much larger than previously known, according to BleepingComputer.

- Johnson & Johnson (JNJ) reached a USD 700mln settlement with most US states for alleged deceptive marketing of Talc-containing products.

- Boeing (BA) to open a location in Daytona Beach; plans to start hiring for about 200 high-paying engineering jobs this year and expects to nearly double that total over the next few years.

- Apple (AAPL): US Justice Department says four additional states join the Justice Department suit against AAPL for monopolizing smartphone markets.

- Paramount (PARA): Shari Redstone NAI decides to stop discussions with Skydance, according to WSJ.

- GameStop (GME) Chair Cohen won a USD 16bln lawsuit re. his Bed Bath and Beyond investment, via social media - unconfirmed.

WEDNESDAY

- The cooler-than-expected inflation data set the tone for the day with stocks closing well in the green with T-Notes firmer across the curve and the buck in the red.

- The softer-than-expected inflation metrics saw money markets revert to fully price in two 25bp rate cuts this year, albeit back to 1 after the Fed. The focus then turned to the FOMC, which saw rates left unchanged as expected, with only a slight tweak to the statement to acknowledge "modest further progress" on inflation, vs "lack of further progress" beforehand.

- The focus, however, was on the dot plot, which saw the median pencil in just one rate cut in 2024, on the more hawkish side of expectations. While the 2025 dot was raised, 2026 was unchanged but the longer run median view ticked up.

- There was only a slight reaction, with the Dollar coming off lows and Treasuries off highs but stocks were quite resilient.

- Nonetheless, the pressure in bonds ensued with Powell's press conference, which largely stuck to the script. Although the Chair stressed they need more confidence inflation is returning to target.

- Yields were still lower by c. 5-9bps across the curve and money markets now price in c. 45bps of easing throughout the year.

- Elsewhere, oil prices settled in the green but off highs with pressure seen after a surprise inventory build.

- Attention turns to US PPI and the 30yr bond auction on Thursday.

INFLATION BREAKEVENS: 5yr BEI -7.3bps at 2.189%, 10yr BEI -5.7bps at 2.235%, 30yr BEI -3.5bps at 2.267%

REAL RATES: 10Y -- 2.02%

STOCK SPECIFIC

- Oracle (ORCL) - Gives bullish AI commentary in its Q4 report. Within its earnings report, it missed on EPS and revenue, with the next quarter profit view more or less in line.

- Oracle (ORCL) and Alphabet (GOOG) - Google Cloud announced a ground-breaking multicloud partnership in which OpenAI selected Oracle Cloud infrastructure to extend Microsoft's (MSFT) Azure AI platform.

- Autodesk (ADSK) - Better than expected FY25 guidance.

- GameStop (GME) - Announced it has completed its "at-the-market equity" offering program, where it sold 75mln shares valued at c. USD 2.137bln.

- Casey's General Stores (CASY) - Earnings and revenue beat accompanied by higher than expected FY25 EBITDA guidance.

- Rentokil Initial (RTO) - Peltz's Trian has amassed a significant stake in the Co.

- FedEx (FDX) - Plans to cut 1.7-2k jobs in Europe and is expecting to save between USD 125-175mln on an annualized basis beginning in FY27.

- Paramount (PARA) - Shari Redstone's NAI decides to stop discussions with Skydance, according to WSJ. PARA says it is focusing on streamlining the organization, reducing non-content costs, optimizing the asset mix, and divesting some businesses to help pay down debt.

- Target (TGT) - Increased its quarterly dividend by 1.8% to USD 1.12/shr (prev. 1.10).

- Caterpillar (CAT) - Lifted its quarterly dividend 8% to USD 1.14/shr, and adds USD 20bln to its current buyback authorization.

- Elevance Health (ELV) - Exec said Medicare earnings are growing this year, making it clear the company is making money in Medicare.

- Toshiba (6588 JT) - To invest USD 650mln in semiconductors with an eye to EVs and the electric grid, will expand a semiconductor plant near Osaka, and will open a new production line in Japan's Ishikawa prefecture, according to Nikkei.

THURSDAY

- Stocks were mixed on Thursday (SPX +0.3%, RUT -0.9%, DJIA -0.2%) amid two-way action, as they were initially buoyed by dovish US data prints, before selling off later in the session, before clambering well off the lows into settlement.

- Meanwhile, the tech-heavy Nasdaq 100 (+0.4%) continued to outperform as it was buoyed by Nvidia (NVDA) (+3.5%), stellar Broadcom (AVGO) (+13%) earnings and Tesla (TSLA) (+2.7%) CEO Musk noting that both Tesla "shareholder resolutions are currently passing by wide margins".

- Back to the data, US PPI was cooler-than-expected with the headline M/M surprisingly declining 0.2% (exp. +0.1%, prev. +0.5%), and outside of the bottom end of the forecast range of -0.1%. Y/Y rose 2.2% (exp. 2.5%, prev. 2.3%). Core M/M was flat (exp. 0.3%, prev. 0.5%), also beneath the lower bound of 0.1%, while Y/Y rose 2.3% (exp. & prev. 2.4%).

- As such, it points towards core PCE coming in below the YTD average on June 28th.

- Regarding Fed pricing, money markets now price two full 25bps rate cuts in 2024 (vs. 44bps pre-data).

- For the record, initial jobless claims surprised to the upside. In wake of the data metrics, a dovish reaction was seen with Dollar falling to session lows of 104.640, before paring throughout the US afternoon to settle with firm gains and just off highs at around 105.20.

- T-Notes firmed after the data, before extending to fresh session peaks after the solid US 30yr auction.

- Elsewhere, it was a choppy day for the crude complex, albeit settling flat, amid continued geopolitical tensions as Hezbollah launched its largest attack since the start of the war.

- Looking ahead, Fed blackout ends tomorrow with Goolsbee (2025 voter) and Cook (voter) scheduled to speak, along with prelim UoM (Jun) data where attention will be on inflation expectations.

INFLATION BREAKEVENS: 5yr BEI -2.7bps at 2.164%, 10yr BEI -7.8bps at 2.213%, 30yr BEI -4.6bps at 2.255%

REAL RATES: 10Y -- 2.0489%

STOCK SPECIFIC

- Broadcom (AVGO) - Reported strong earnings highlighted by beating on adj. EPS and revenue alongside lifting its FY24 revenue view. Meanwhile, it announced a 10-for-1 forward stock split to commence on July 15th.

- Tesla (TSLA) - CEO Musk said that both Tesla "shareholder resolutions are currently passing by wide margins", regarding Musk's pay package and moving the headquarters to Texas.

- Virgin Galactic (SPCE) - Announced a 1-for-20 reverse stock split.

- Corning (GLW) - Downgraded at Morgan Stanley; said Corning’s stock has a more balanced risk-to-reward ratio after a notable rally this year.

- Pfizer (PFE) - Phase 3 CIFFREO study failed to meet the primary endpoint.

- JPMorgan Chase & Co (JPM) - Raised investment banking revenue outlook to 30% from 25%.

- Alphabet (GOOGL) - Austrian advocacy group NOYB filed a complaint against Google for allegedly monitoring users of its Chrome Web browser.

- Disney (DIS) - Reached agreement with Ron DeSantis to end their feud, clearing the way for the USD 17bln planned development at Walt Disney World, according to the NYT.

- Williams - Sonoma (WSM) - Declared a two-for-one stock split.

- Boeing (BA) - Investigating new quality problems on some undelivered 787 jets involving incorrect installation of fasteners, via Reuters citing sources.

- Healthcare names - Medicare will recalculate quality ratings of Medicare advantage plans, according to WSJ; plans with high ratings can get lucrative bonus payments. A redo would mean hundreds of millions of dollars in additional payments.

- Paramount (PARA) - Investor Mario Gabelli's legal threat to Paramount's (PARA) merger deal with Skydance, was a major factor in the termination of Shari Redstone's USD 8bln deal, according to NYPOST.

FRIDAY

- Stocks were mixed (SPX flat, NDX +0.4%) in broad risk-averse conditions with distinct underperformance in the small-cap Russell 2000 (-1.6%) as it continued on its sell-off from Thursday.

- Sectors were largely in the red, with only Tech and Communications firmer as Industrials lag after a downbeat MSC Industrial Direct (MSM) (-10.5%) earnings pre-announcement in addition to Boeing (BA) (-2%) telling suppliers it is delaying 737 production target by three months.

- As alluded to above, sentiment was dampened in the European morning after French Finance Minister Le Maire sparked a rout in European assets, after he answered "yes", when asked if the current political crisis could result in a financial crisis.

- As such, it sparked significant strength in non-OAT EGBs with some spillover to USTs.

- Treasuries bear flattened, and hit highs around further dovish US data, albeit not a consequence of, just more a coincidence, but did come off best levels after Mester (voter, retiring in June) said they want a few more months of ebbing inflation data.

- Goolsbee (2025 voter) later spoke noting if the Fed get more months like they just saw on inflation, the Fed can cut rates.

- On the data footing, US import/export provided the latest indication inflation may be cooling as they both surprisingly declined, while prelim UoM for June disappointed, with 1yr inflation expectations unchanged at 3.3% with the 5-10yr ticking higher to 3.1% from 3.0%.

- The crude complex saw two-way action on Friday, but ultimately ended flat, as geopolitical headlines took a back seat amid political angst out of Europe.

- Looking ahead, traders await a slew of Fed speak next week, amongst US Retail Sales (Tues), Flash PMIs (Fri), auctions, and a raft of central bank decisions.

INFLATION BREAKEVENS: 5yr BEI -3.3bps at 2.133%, 10yr BEI -2.6bps at 2.188%, 30yr BEI -2.1bps at 2.233%.

REAL RATES: 10Y -- 2.031%

STOCK SPECIFIC

-

Adobe (ADBE): EPS and revenue beat, with next quarter profit guidance better-than-expected and raising FY view.

- Tesla (TSLA): Shareholders supported CEO Musk's USD 56bln pay package.

- Zscaler (ZS): Upgraded at JPM; said Zscaler is “a best-of-breed Zero Trust Network Security vendor” and is trading at a discount.

- MSC Industrial Direct (MSM): Downside pre-announcement for the next quarter and also lowered FY guidance.

- RH (RH): Deeper loss per share than expected.

- Boeing (BA): FAA is investing in recently manufactured BA and Airbus (EADSY) jets for using titanium sold using counterfeit documentation to verify the titanium's authenticity, according to NYT.

- Nucor (NUE): Issued weak guidance for the next quarter - Q2 EPS between 2.20-2.30 (exp. 2.99). Added Q2 steel products segment are expected to have decreased vs. Q1.

- Meta Platforms (META): Said it will not launch Meta AI in Europe at the moment, adding it's a step backwards for European innovation and competition in AI development. Meta's decision is in response to a request from an Irish Privacy Regulator to delay training its LLM using public content shared by adults on Facebook and Instagram.

- Apple (AAPL) & Meta Platforms (META): Set to be the first Big Tech group to face charges under EU digital law, according to FT.

- Boeing (BA): Told suppliers it's delaying the key 737 production target by three months. The new BA supplier schedule calls for 737 output to reach 42 a month in September (prev. June).

- Arm Holdings (ARM): Nasdaq announced ARM will join the Nasdaq-100 index, and will replace Sirius XM Holdings (SIRI) on June 24th.

| |

CONTROL PACKAGE

Remember when "developed world" central banks pretended their inflation target was 2%? Well, that lie died a miserable death today - and will do so again for good measure tomorrow - after the BOC cut rates for the first time in 4 years, and less than a year after its last rate hike, from 5.0% to 4.75% even as Canada's inflation remains a very sticky 2.7%.

And just to underscore the death of the 2% inflation target, tomorrow the ECB will also cut rates for the first time since March 2016, (and 8 months after the last rate hike), even though core Eurozone CPI remains 3%.

Of course, despite all the posturing, the Fed won't be far behind especially once it becomes clear that the myth of strong US job growth was just a mirage, and either in July or September, the Fed will join the party despite core US inflation stuck at a blistering 2.8%.

It was this long overdue realization that the G7 central banks have officially raised their inflation target by about 1% that helped pushed bond yields to fresh two month lows, and down more some 35bps in just the past week, down for a 5th straight day as financial conditions have eased dramatically (see chart of Goldman Financial Conditions Index above), undoing any jawboned tightening the Fed tried to inject into the market in recent months: indeed, the latest rate pricing shows a sharp dovish shift in the Fed cut narrative for Sept, rising to 80% vs 45% just one week ago. As Goldman's trader notes, CTAs will become a focus if yields keep moving lower. -- Tyler Durden

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

- The 10Y TREASURY NOTE YIELD - TNX - HOURLY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - DAILY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - WEEKLY (CHART LINK)

- The 30Y TREASURY BOND YIELD - TNX - WEEKLY (CHART LINK)

- REAL RATES (CHART LINK)

FISHER'S EQUATION = 10Y Yield = 10Y INFLATION BE% +REAL % = 2.188% + 2.031% = 4.219%

3YR AUCTION: The US sold USD 53bln of 3yr notes at a high yield of 4.559%, tailing the When Issued by 1.1bps, much larger than the six auction average of a tail of 0.1bps and prior stop-through of 0.3bps. The B/C was also weak at 2.43x, beneath the 2.63x prior and 2.57 six auction average. The soft reception was led by a drop in direct demand which came in beneath the prior average, but indirect demand was relatively stable at 64%, albeit not enough to offset the drop in direct demand, seeing dealers take a chunky 20% of the auction. The soft 3yr auction added to the soft 2yr, 5yr, and 7yr supply recently, with participants perhaps sitting on the sidelines ahead of key risk events like the US CPI and FOMC on Wednesday.

10-YEAR REVIEW: A very strong 10-year note auction. The US sold USD 39bln of 10yr notes at a high yield of 4.438%, stopping through the 4.458% WI by 2bps vs the prior and six auction averages of a tail of 1.1bps, also showing the largest stop-through since February 2023. The B/C of 2.67x was also stronger than the prior and six auction average of c. 2.50x. The breakdown of bidders saw a huge increase in indirect demand, rising to 74.6% from 65.5%, well above the 65.4% average. Direct demand dipped to 13.8% from 18.7%, falling beneath the 17.53% average, but the huge Indirect takedown saw dealers (forced surplus buyers) left with just 11.6% of the auction, beneath the 15.7% prior and 17.03% average. The strong 10-year note auction is on the heels of a slew of disappointing short-end and belly auctions, perhaps with uncertainty around the Fed/inflation keeping participants on the sidelines in the more Fed-exposed part of the curve and opting for longer-dated supply instead. The strong demand comes despite the huge event risk on Wednesday - which tends to see buyers take a step back - with both US CPI and the FOMC rate decision with accompanying Dot Plots due. There is the 30-year Bond auction on Thursday too, post Fed and CPI. Note, that analysts also highlight with bond volatility at the low end of multi-year ranges. It is likely that supported some buyers to step in.

| |

10Y UST - TNX - Hourly

- The TNX plunged on the release of the My CPI finding support again at the descending long term trend channel's lower boundary line.

- Importantly in the near term is that Momentum (lower pane) appears to have reached a longer term support level.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

========

| |

IDENTIFICATION OF HIGH PROBABILITY TARGET ZONES | |

Learn the HPTZ Methodology!

Identify areas of High Probability for market movements

Set up your charts with accurate Market Road Maps

Available at Amazon.com

| |

The Most Insightful Macro Analytics On The Web | | | | |