CURRENT MARKET PERSPECTIVE | |

|

DISTRIBUTION & ROTATION ACCELERATES

WEAKENING TECH - SURGING SMALL CAP

Click All Charts to Enlarge

| |

THE RUSSELL SURGES: As earning season gets underway the market chases small caps while distribution in tech and the Mag-7. shows itself. Fund Managers are protecting themselves from possible negative earning surprises. | |

|

1 - SITUATIONAL ANALYSIS

STOCK ROTATION

As we enter the Q2 Earnings Season the market, which has been under quiet distribution, made a sudden move out of tech and into small caps.

- Small Caps literally exploding higher - up around 7% on the week!

- The Russell 2000's best week since November and broke it out to its highest since Jan 2022.

- Thursday's outperformance of Russell vs S&P 500 was the 5th largest in 45 years.

CHART RIGHT:

1. The Magnificent 7 erased a combined $600 billion of market cap Thursday.

2. It has been 48 days since all the Mag7 names closed red on the same day, the longest streak in > 10 years.

3. Despite the 3-4% pullbacks in Big Tech stocks today, AMZN, META, GOOGL, MSFT, NVDA are all still up +1-5% in the month of July and NDX up 3%, even after turn-around Thursday.

ONLY THE SECOND TIME IN HISTORICAL DATA

It was just the second time in history since inception in 1979 that the small-cap Russell 2,000 gained 3%+ while the S&P 500 fell on the day. The only other day that happened was back on 10/10/2008....very different market to today.

| |

|

Small caps outperforming Large caps on Thursday was a 6 standard deviation event. The possibility of a specific one happening are one in 506m days BUT the probability of any six sigma event occurring are far far less.

| |  |

|

Fun with Factors:

1. Biggest 1 day move in Nasdaq vs Russell since Jan 6th, 2021 driven by small caps rallying.

2. From a factor stand-point this is a very pro-risk on move with beta factor up and Size down 4.2 sigma.

| | |

|

A MEAN REVERSION TO THE EXTREME

Huge reversal from the recent trend. Here's a look at Thursday's performance compared to performance since the start of Q2.

| |

|

FUND MANAGERS CAPITULATING

I have a lot of respect for Dr Ed Yardeni, so when he goes public I pay attention. He is saying:

"This slow-motion melt-up has further to run and could see their 6000 SPX target for 2025 being too conservative.

Eric, Joe, and I aren’t raising our year-end target for the S&P 500 just yet. But we are learning to live with the S&P 500 outpacing even our bullish projections.

It did so last year: Our year-end target of 4600 was reached on July 31, 2023....Now we are rethinking whether our current projections of 6000 by the end of 2025, 6500 by the end of 2026, and 8000 by the end of the decade might be too conservative.

The market may be discounting our Roaring 2020s scenario faster than we expected?"

CHART TOP RIGHT: All this bull and still no greed?

CHART MIDDLE TOP RIGHT: The Put call ratio continues imploding.

CHART MIDDLE BOTTOM RIGHT: Implied Volatility is low, but since we aren't realizing much at all...things may not be as cheap as they "appear"?

CHART BOTTOM RIGHT: Choking on Theta - Dealers are running massive long gamma here, acting as a huge vol dampener. They have size deltas to sell if markets move up, and size deltas to buy in case we move lower. This is theta agony and everybody that has run big long gamma in dull summer trading knows the "Chinese water torture" feeling...usually a good time to buy vol/hedges, although "most" have already promised not to buy options again.

| |  |

| |

|

BULLISH SENTIMENT HIGHEST IN OVER 4 YEARS!

The percentage of Bulls in the Investors Intelligence survey has moved up to 63%, the highest we've seen since April 2021. This is above 97% of historical readings.

| |

|

HIGHER RATES??

Fed Chair Powell making it clear to the House Financial Services Committee that:

“The era of super low interest rates that occurred between the 2008 financial crisis and the pandemic is likely over

and that the neutral interest rate for hitting 2-percent annual inflation had probably risen.

Central bank interest rate policy was probably not going to return to the near-zero level that held between 2009 and 2017. We have our policy rate over 5 percent now and it feels like policy is restrictive but not intensely restrictive.

That suggests that the neutral rate of interest, at least as of now, will have risen somewhat, which means rates will get a little higher.”

| |

|

WARREN BUFFETT INDICATOR

Warren Buffett Indicator hits 195%, the highest level in history, surpassing the Dot Com bubble, the Global Financial Crisis, and the 2022 Bear Market

| |

LOOKS LIKE MARCH 2000

The only other time that the S&P 500 (cap-weighted) has outperformed the S&P 500 Equal-weight index by a wider margin over a six-month stretch was in late March 2000.

| |

|

MARKET DRIVERS

"AS GO THE FINANCIALS, SO GO THE BANKS: AS GO THE BANKS, SO GO THE MARKETS."

MATASII FINANCIAL STOCK INDEX

We continue to keep an eye on both the Bank and Financial stocks to give us an early signal of market direction. We have been showing the banks over the last few weeks, but the Financials now appear to be giving a clearer signal.

- The MATASII Financial Index is giving a clear sign of a potential break to the upside.

- The Elliott Wave analysis supports an "E" wave higher as part of a potential final ABCDE topping pattern.

- Momentum (bottom pane) has found long term support and it has broken the overhead resistance trend line, shown by a dotted descending orange momentum trend line.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

MATASII BANK STOCK INDEX

- The MATASII Bank Index has surged to its upper trend line (black dashed line).

- The "e" Wave may possibly be completed here, short of our original target price.

- Momentum (bottom pane) found long term support and is near potentially breaking the overhead resistance trend line to move higher (shown by a dotted descending orange momentum trend line).

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

As goes NVDA, so goes the MAG-7, As Goes Mag-7 so goes The Market. | |

NVDA - Daily

CHART RIGHT: NVDA v the darling of the Dotcom Bubble (for those who recall), CSCO was dominant. It appears that was nothing!

- NVDA sold-off hard on Thursday finding initial support at its 21 DMA.

- Momentum (Lower pane) has also noticeably weakened.

- The Dotted Black Trend line in the MATASII Proprietary Momentum Indicator (lower pane below) continues to show a Divergence.

| |

Divergence is normally seen as a warning to the downside and is still ahead if the Divergence isn't removed by a movement higher in Momentum.

- Until the dotted black Momentum line is decisively broken we can expect NVDA to again look for lower support levels.

- At some point the major unfilled gaps (at much lower levels) must be filled. NVDA therefore may no longer become a Short to Intermediate Long Term hold, but rather a position trading stock as others entering the space and force margins to contract.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

MAGNIFICENT 7

- The basket of 'Magnificent 7' stocks, after surging to new highs early this week, sold down on Thursday.

- The momentum Divergence signal has been clearly broken (bottom pane). but is likely to be tested as overhead resistance becomes support.

- Continued caution is advised since major global "Dark Pools" have been identified as presently operating behind the scenes on the Mag-7.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

"CURRENCY" MARKET (Currency, Gold, Black Gold (Oil) & Bitcoin) | |

|

10Y REAL YIELD RATE (TIPS)

Real Rates reached our initial overhead resistance level of 2.25% before falling off hard as part of our expected "x" leg lower (chart right).

We are approaching support and a potential turn upward in yields.

| |

CONTROL PACKAGE

There are TEN charts we have outlined in prior chart packages, which we will continue to watch closely as a CURRENT Control Set:

-

US DOLLAR -DXY - MONTHLY (CHART LINK)

-

US DOLLAR - DXY - DAILY (CHART LINK)

-

GOLD - DAILY (CHART LINK)

-

GOLD cfd's - DAILY (CHART LINK)

-

GOLD - Integrated - Barrick Gold (CHART LINK)

-

SILVER - DAILY (CHART LINK)

-

OIL - XLE - MONTHLY (CHART LINK)

-

OIL - WTIC - MONTHLY - (CHART LINK)

-

BITCOIN - BTCUSD - WEEKLY (CHART LINK)

-

10y TIPS - Real Rates - Daily (CHART LINK)

GOLD - DAILY

- Gold is showing increasing strength again and has given us a preliminary BUY signal. We still need to have this confirmed on a weekly basis.

- We do not believe the consolidation Wave "iv" has yet been completed.

- We need to see the momentum (lower pane) break its higher resistance level line (orange dotted trend) as well as a new high to feel strongly that the V wave is underway.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

-

The S&P 500 (CHART LINK)

-

The DJIA (CHART LINK)

-

The Russell 2000 through the IWM ETF (CHART LINK),

-

The MAGNIFICENT SEVEN (CHART ABOVE WITH MATASII CROSS - LINK)

-

Nvidia (NVDA) (CHART LINK)

| |

S&P 500 CFD

- The S&P 500 cfd broke to new highs as it broke through its overhead trend channel boundary.

- The MATASII Proprietary Momentum Indicator (middle pane) has not yet broken the concerning Divergence pattern shown by the descending orange dotted trend line.

- There is a strong possibility that this may be a "through over" before retesting the rising trend channel.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

S&P 500 - Daily - Our Thought Experiment

OUR CURRENT ASSESSMENT IS THAT THE INTERMEDIATE TERM IS LIKELY TO LOOK LIKE THE FOLLOWING:

NOTE: To reiterate - "the black labeled activity shown below, between now and July, looks like a "Killing Field", where the algos take Day Traders, "Dip Buyers", the "Gamma Guys" and FOMO's all out on stretchers!"

- The S&P 500 has broken to new highs.

- However, the MATASII Proprietary Momentum Indicator (middle pane) has not yet broken the concerning Divergence pattern shown by the descending orange dotted trend line.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

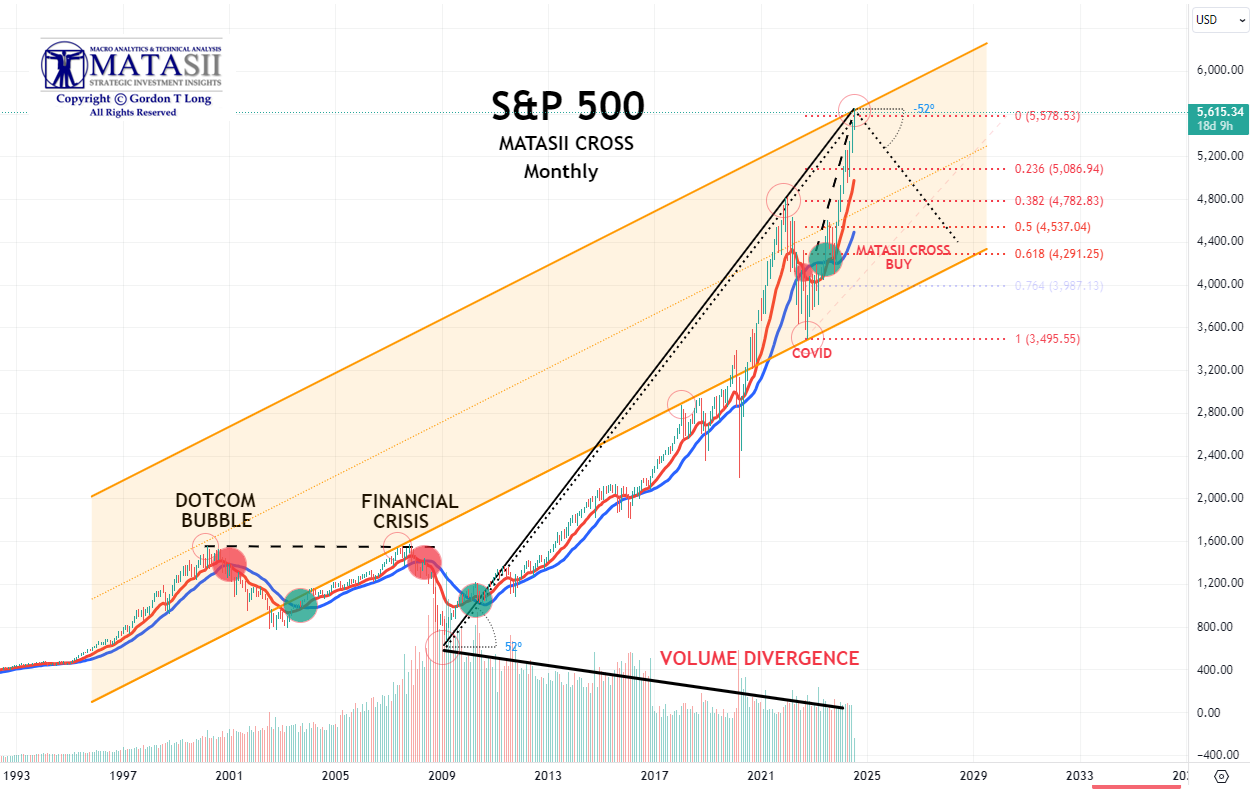

S&P 500 - Monthly - Our Thought Experiment

- We have broken our target of 5566 with a new high of ~ 5656.

|  | |

STOCK MONITOR: What We Spotted

MONDAY

- It was ultimately a rather uneventful session on Monday with the US highlight being mixed inflation expectations from the NY Fed SCE.

- Meanwhile, over the weekend, a surprise French election result initially weighed on the Euro and EGBs, and in sympathy Treasuries, but the moves gradually pared throughout the rest of the session.

- In FX, the DXY was ultimately flat and traded either side of 105.00 while the Yen initially saw strength on rising wages, but the move pared with USD/JPY briefly reclaiming 161.00.

- Gold prices unwound the post-NFP gains on the PBoC refraining from more gold buys for the second consecutive month while oil prices were sold on ceasefire hopes with Hurricane Beryl in focus as it hits Texas.

- Looking ahead, Fed Chair Powell is to testify in the Senate on Tuesday and House on Wednesday, with focus turning to US CPI on Thursday, with US 3, 10, and 30yr supply scheduled throughout the week ahead of the start of the Q2 earnings season on Friday.

INFLATION BREAKEVENS: 5yr BEI -0.5bps at 2.232%, 10yr BEI -0.7bps at 2.268%, 30yr BEI -1.1bps at 2.295%.

REAL RATES: 10Y -- 2.0489%

STOCK SPECIFIC

- Paramount Global (PARA) - Will merge with Skydance Media, ending Redstone family control.

- TSMC (TSM) - Morgan Stanley raised its target on the stock by about 9%, expecting the Co. to raise its FY sales estimate in its earnings next week.

- Corning (GLW) - Expects Q2 core sales to exceed guidance, with core EPS at the high end of the guided range.

- Tesla (TSLA) - China CPCA said Tesla exported 11,746 China-made vehicles in June (prev. 17,358 in May).

- Ford Motor (F) - Barron said Ford's shares were poised for a comeback, making it a good time to buy the stock.

- Morphic (MORF), Eli Lilly (LLY) - Eli Lilly to acquire Morphic for USD 3.2bln or USD 57/shr.

- Grifols (GRFS) - Brookfield and Grifols Family Shareholders reached an agreement to evaluate a possible joint takeover bid to acquire all the share capital of Grifols.

- Boeing (BA) - Will plead guilty to criminal conspiracy to defraud the US over the 737 Max crashes, according to Bloomberg.

- JPMorgan (JPM) - Downgraded at Wolfe as it is more exposed to NII headwinds from lower rates.

- Exxon Mobil (XOM) - Expects changes in oil prices to increase Q2 upstream earnings by USD 300-700mln vs Q1; expects changes in gas prices to decrease quarterly upstream earnings by USD 300-700mln.

TUESDAY

- US indices (SPX +0.1%, NDX +0.1%, DJIA -0.1%) were ultimately little changed on Tuesday, although the small-cap Russell 2000 (-0.5%) was the underperformer.

- Sectors were mixed with Materials and Energy the laggards, as the former was weighed on by slight losses in WTI and Brent amid progress in Cairo hostage deal talks.

- Financials was the distinct outperformed, seemingly buoyed by banks who saw notable upside amid Chair Powell testifying, saying it is a strongly held view of the Fed board that bank regulators should seek additional feedback on their efforts to hike bank capital, a move that the banking industry has been pushing for.

- Elsewhere, Powell largely stuck to the script, repeating that more good data would strengthen the Fed's confidence on inflation and that elevated inflation is not the only risk the Fed faces.

- Nonetheless, despite an initial dovish reaction to Chair Powell's text release, it soon faded and T-Notes were hit on the Chair's testimony but were off lows as Europe left while the US 3yr auction was well received.

- The Dollar eked marginal gains, albeit in very thin ranges, with the Yen the G10 underperformer and the cross back above 161 and reaching a peak of 161.51.

- Precious metals (XAU, XAG) were mildly divergent, as spot silver was flat and spot gold saw slight gains and pared some of the extensive losses seen on Monday.

INFLATION BREAKEVENS: 5yr BEI -0.3bps at 2.232%, 10yr BEI -0.3bps at 2.267%, 30yr BEI -0.7bps at 2.290%.

REAL RATES: 10Y - 1.9924%

STOCK SPECIFIC

- TSMC (TSM) - May revise its 2024 sales growth projection at its upcoming investor conference.

- Nike (NKE) - Rehired Veteran of the company Tom Peddle, to improve retail sales, Bloomberg reports.

- BP (BP) - Expects Q2 upstream production to be flat and realised refining margins to be significantly lower.

- Novo Nordisk (NVO) and Eli Lilly (LLY) - Publication of data analysis showed that Eli Lilly's Mounjaro leads to faster and greater weight loss than Novo's Wegovy.

- Indivior (INDV) - Cut Q2 and FY24 revenue guidance to reflect continued adverse market dynamics impacting the near term.

- Bank of America (BAC) - Upgraded at Piper Sandler, on NII to trough in Q2.

- Nvidia (NVDA) - KeyBanc raised PT to USD 180 from USD 130, amid upbeat commentary from the brokerage.

- Helen of Troy (HELE) - Q1 non-GAAP EPS and revenue missed, alongside lowering FY25 outlook. Sees Q2 sales down 4-7%.

- Oracle (ORCL) - Talks have broken down between the Co, and Elon Musk's xAI regarding their potential USD 10bln deal, according to the Information.

- Fifth Third Bancorp (FITB) - Faces CPFB action for illegal activities and it is to pay USD 20mln over wrongful repos and fake accounts.

WEDNESDAY

- Stocks pushed to fresh record highs again on Wednesday with outperformance in Tech leading the gains.

- Semis were buoyed by strong TSMC (TSM) sales numbers while Apple (AAPL) caught a bid on reports it is to boost its iPhone 16 shipments.

- Fed Chair Powell largely stuck to the script again on Wednesday, stressing the Fed needs more good data to be convinced that inflation is returning to target in a sustainable way, while he also repeated that risks to both sides of the mandate have come back into better balance.

- He also acknowledged the neutral rate has likely moved up a little bit.

- T-notes were little changed but with a flatter bias.

- Early trade tracked EGBs higher before paring from peaks into settlement amid Aramco issuance ahead of the 10yr auction.

- The auction was ultimately stronger than recent averages, but not quite as strong as the stellar June offering.

- Any upside in T-notes after the auction was pared as eyes turn to CPI on Thursday.

- Oil prices were bid on Middle East escalation fears and a chunky crude and gasoline stock draw on the weekly DoE inventory report, but distillates saw a notable build.

- The Dollar was flat with FX focus on the NZD, which underperformed after a dovish RBNZ while GBP outperformed after hawkish commentary from Pill and Mann, adding to the tone of a hawkish Haskel on Monday.

INFLATION BREAKEVENS: 5yr BEI +0.2bps at 2.234%, 10yr BEI +0.6bps at 2.275%, 30yr BEI +0.6bps at 2.295%.

REAL RATES: 10Y - 2.0136%

STOCK SPECIFIC

- Honeywell (HON) - Confirmed reports it has agreed to a USD 1.8bln deal for Air Products's (APD) LNG business, via WSJ citing sources

- TSMC (TSM) - Reported June sales of USD 6.42bln above expectations of 5.73bln and Q2 also beat.

- Microsoft (MSFT), Apple (AAPL) - Microsoft has given up its seat as an observer on the board of Open AI and Apple will not take up a similar position, FT reports.

- Novo Nordisk (NVO), Eli Lilly (LLY) - Only 1/4 US patients prescribed Novo Nordisk's Wegovy or Ozempic for weight loss were still taking the drug two years later, according to an analysis cited by Reuters.

- Cummins (CMI) - Increases its quarterly dividend by 8.3%.

- Chipotle (CMG) - Announced retirement of CFO Jack Hartung in 2025.

- LegalZoom (LZ) - Missed its Q2 revenue view, and cut its FY 24 revenue view well below expectations, Meanwhile, CEO Dan Wernikoff is to depart.

- Intuit (INTU) - To cut 10% of its workforce, impacting 1800 staff, via CNBC.

- Visa (V) and Mastercard (MA) - Downgraded at BofA on limited valuation upside.

- Apple (AAPL) - Aims to ship 10% more new iPhones in 2024 after a bumpy 2023, Bloomberg reports. Moreover, Apple Intelligence AI features are expected to boost iPhone demand, AAPL looks to ship 90mln iPhone 16 units in the latter half of the year.

- Marsh McLennan (MMC) - Raised its quarterly dividend 15% to USD 0.815/shr (prev. 0.710/shr)

- Healthcare names - FTC to sue Unitedhealth (UNH) Opturmx, Cigna Group's(CI) express scripts and CVS Health's (CVS) caremark over insulin prices, according to WSJ.

- Hubspot (HUBS) - Alphabet (GOOGL) is said to have shelved its interest in the Co. according to Bloomberg.

- Tesla (TSLA) - Raised prices of Model 3 in some European countries because of EU tariffs on China-made EVs

THURSDAY

- Stocks were mixed on Thursday as a cooler-than-expected CPI saw a rotation out of large-cap tech stocks into smaller-cap cyclicals with the Nasdaq plummeting but Russell surging.

- The SPX and NDX were consistently pushing record highs before today, and futures extended those levels after the cooler-than-expected CPI report.

- However, those gains were short-lived, perhaps with positioning over-extended after the recent rally.

- The Russell held onto its gains though given its recent underperformance and the index still has a few hundred points before testing the November 2021 record highs of 2,460.

- Looking at the spread between the R2K and NDX, it is currently just shy of 600bps, Goldman Sachs noted it is the largest 1-day spread since November 2020, and it's the second largest day of R2K>NDX performance in 20+ years.

- Meanwhile, the equal-weighted S&P also rallied while sectors were very mixed, with Tech, Communication, and Discretionary lagging, while Real Estate, Utilities, and Materials outperformed.

- The inflation data saw all headline and core M/M and Y/Y components beneath forecasts, which sparked a rally across Treasuries with the curve bull steepening as traders raised their Fed rate cut bets.

- Money markets are now fully pricing a 25bp rate cut in September, and 60bps of easing by year-end, which implies a 100% probability of two rate cuts this year, and a 40% probability of a third.

- The Dollar also took a nose dive to the dovish data with DXY testing 104.00 at the lows from a peak of 104.99.

- The Yen was the clear outperformer following the data, but a quick move 10 minutes after CPI sparked some fresh Yentervention speculation, with reports in TV Asahi and Mainichi later on suggesting Japan did intervene, but officials were reluctant to admit it.

- Elsewhere, DAL and PEP guidance disappointed with focus turning to the big banks on Friday as the Q2 earnings season gets underway.

INFLATION BREAKEVENS: 5yr BEI -5.1bps at 2.190%, 10yr BEI -3.2bps at 2.251%, 30yr BEI -1.9bps at 2.280%.

REAL RATES: 10Y - 1.9254%

STOCK SPECIFIC

- Delta Airlines (DAL) - Missed on Q2 revenue and gave poor EPS guidance as well as a dim Q3 outlook.

- Pepsico (PEP) - Missed on Q2 top line and its FY Core EPS view came under expectations, though did beat on Q2 Core EPS.

- Costco (COST)- Will increase its annual membership fees by USD 5 and executive membership by USD 10. Co. also declared a quarterly cash dividend on its common stock of USD 1.16/shr.

- Conagra Brands (CAG) - Missed on Q4 revenue, and FY 25 EPS view.

- GLP-1 Names (Eli-Lilly (LLY), Novo Nordisk (NVO), Viking Therapeutics (VKTX)) - Pfizer (PFE) advances the development of a once-daily formulation of oral GLP-1 receptor against Danuglipron; ongoing study shows favourable pharmacokinetic profile for Danuglipron.

- MicroStrategy (MSTR) - Announced a 10-for-1 stock split.

- Apple (AAPL) - Settled EU antitrust probe over Tap-and-Pay tech, Co. avoided EU fine.

- Envestnet (ENV) - Confirmed that Bain Capital and Reverence offered USD 4.5bln to take the co. private, equating to USD 63.15/shr, in fitting with earlier Bloomberg sources.

- Alcoa (AA) - Reported a preliminary Q2 beat on revenue and adjusted income.

- Chevron (CVX) and Hess (HES) - Decision reportedly delayed by FTC to after Exxon (XOM) arbitration, according to Bloomberg. Expects the FTC's merger review process to be completed in Q3.

- Tesla (TSLA) - Plans to delay its robotaxi unveiling to October from August, according to Bloomberg, TSLA wants more prototypes before the event.

- Boeing (BA) - Nears deal to sell 20-30 777X jets to Korean Air (003490 KS), according to Reuters sources.

- Nike (NKE) - Moves senior executive to CEO advisor role; Thomas Clarke to advise CEO John Donahoe; John Joke to replace Tom Clarke as innovation head.

- Bunge's (BG) - USD 8bln deal for Viterra said to face risk of delays, according to Bloomberg. Bunge waits for approval from EU, China, and Canada and the acquisition is unlikely to be completed within Bunge's mid-2024 goal.

FRIDAY

- US indices (SPX +0.6%, NDX +0.6%, DJIA +0.6%) ended the day firmer, with outperformance in the small-cap Russell 2000 (+1.1%) which closed out the week with strong gains, although the SPX and NDX saw weakness into the close to settle off best levels.

- In the wake of the US PPI report, which was hot overall, there was a broad-based hawkish reaction, although this swiftly pared as participants digested the details of the report.

- Highlighting this, analysts at Bank of America stated that overall, the components of the PPI report that affect the PCE report, were softer.

- As such, so far analyst forecasts for Core PCE M/M are ranging between 0.15-0.20%.

- Elsewhere on the data footing, prelim UoM for July was weak with headline sentiment falling to the lowest level since November 2023, in addition to both conditions and expectations short of consensus, while both the 1yr and 5yr ahead dipped to 2.9% from 3.0%.

- The Dollar was eventually weaker, despite strength on the aforementioned PPI report, and printed a low of 104.04, keeping its head above the round 104.

- Yen was one of the G10 performers with possible intervention once again touted as USD/JPY hit a low of 157.39 against a peak of 159.44.

- The crude complex ended the day with marginal losses as they saw the first week of losses in four, and T-Notes were sold on hot PPI but pared as PCE components were soft.

- For the record, US earnings season begun on Friday with highlights from:

- JPMorgan (JPM) (-1.2%), who are a little bit more cautious on IB outlook,

- Wells Fargo (WFC) (-6%) NII and NIM coming in light, and

- Citi (C) (-1.8%) missing on IB and FICC sales and trading revenue.

- Looking ahead, participants await Fed Chair Powell at the Economic Club of Washington DC (Mon), Retail Sales (Tues), Waller (Wed), Williams (Fri), and a slew of earnings (all week).

INFLATION BREAKEVENS: 5yr BEI -2.6bps at 2.159%, 10yr BEI -1.4bps at 2.236%, 30yr BEI -0.6bps at 2.273%.

REAL RATES: 10Y - 2.0136%

STOCK SPECIFIC

- JPMorgan (JPM) - Beat on EPS, revenue, and NII with other metrics beating market expectations. In post-earnings commentary, CFO said he is a little more cautious about debt capital markets and IB outlook.

- Wells Fargo (WFC) - NII and NIM disappointed forecasts, with FY NII guidance marginally lower than expected. CFO expects FY NII decline to be in the upper half of the forecast range. CFO said revenue-related expenses drove costs higher and an growth 'weaker than we thought'

- Citigroup (C) - Beat on EPS and revenue, although missed on Investment Banking and FICC sales & trading revenue. Said over the medium term the bank expects net interest income growth; remain confident that the bank will meet medium term ROTCE target

- Bank of New York Mellon Corp (BK) - Surpassed top and bottom line expectations.

- AT&T (T) - Disclosed a massive hack of call data for most mobile users; does not believe the hack is reasonably likely to materially impact the Co's financial condition or results of operations.

- Fastenal (FAST) - EPS was in line with expectations, beat on revenue, and saw 'growth with larger customers' in Q2.

- Tesla (TSLA) - Downgraded at Citi, noting it's increasingly difficult to justify the valuation. Furthermore, Unveiled its Model 3 Long-Range RWD (rear-wheel-drive) in the US, priced at USD 42k.

- Teck Resources (TECK) - Rio Tinto (RIO) is said to have held talks with bankers to 'wargame' a potential USD 32bln offer for the Co., via Sky News.

- Arbor Realty (ABR) - Reportedly probed by DoJ over lending practices and loan book, according to Bloomberg.

- Vertiv Holdings (VRT) - Hedgeye names the Co. a new best short idea with 33% downside.

| |

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

- The 10Y TREASURY NOTE YIELD - TNX - HOURLY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - DAILY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - WEEKLY (CHART LINK)

- The 30Y TREASURY BOND YIELD - TNX - WEEKLY (CHART LINK)

- REAL RATES (CHART LINK)

FISHER'S EQUATION = 10Y Yield = 10Y INFLATION BE% + REAL % = 2.236% + 1.965% = 4.201%

3YR AUCTION:

The US sold USD 58bln of 3yr notes at a high yield of 4.399%, stopping through the 4.407% WI by 0.8bps, an improvement on the prior tail of 1.1bps and the six auction average of a stop through of 0.1bps. The Bid-to-Cover was also strong at 2.67x, vs. the prior 2.43x and above the six auction average of 2.57x. The strong demand was led by an increase in direct demand to 21.3% from 15.9% (above the 17.8% average), while indirect was relatively unchanged at c. 64%, a touch beneath averages. The strong direct demand and relatively unchanged indirect demand saw dealers take home a smaller chunk than average at 14.8%, well beneath the prior 20%.

10YR AUCTION:

Overall the 10yr auction was a strong one vs averages, but not quite as strong as the stellar auction seen in June. The USD 39bln supply of 10yr notes was sold with a high yield of 4.276%, stopping through the When Issued by 1bp, not quite as strong as the 2bp stop through previously, but better than the average tail of 0.4bps. The Bid-to-Cover slipped to 2.58x from 2.67x, but remained above the 2.52x average. Indirect bidders took a step back, taking 67.6% of the auction, down from the 74.6% in June but in line with the six auction average. Although Indirect demand was not as strong, the direct bidders took an above-average 20.86%, rising from the prior 13.8%. Dealers were left with a similar chunk of the supply, taking 11.6% again, beneath the 16% average.

30Y AUCTION

The 30yr bond auction was soft, seeing the USD 22bln offering sold at a high yield of 4.405%, tailing the When Issued by 2.2bps, the largest tail since November. The Bid-to-Cover was also soft at 2.3x, beneath the 2.49x prior and 2.42x average. The breakdown also was not great, with a decline in indirect demand to 60.76% from 68.5%, falling beneath the 67.6% average. There was a slight uptake in direct demand however above averages, but it still left dealers with an above average 15.88%.

| |

10Y UST - TNX - Hourly

- The TNX Feel strongly this week falling below its144 EMA and finding initial support at a smaller trending lower trend channel.

- Importantly in the near term is that Momentum (lower pane) appears to have reached a longer term resistance level.

- We have labeled an Alternative ALT ABCDE count.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

========

| |

IDENTIFICATION OF HIGH PROBABILITY TARGET ZONES | |

Learn the HPTZ Methodology!

Identify areas of High Probability for market movements

Set up your charts with accurate Market Road Maps

Available at Amazon.com

| |

The Most Insightful Macro Analytics On The Web | | | | |