CURRENT MARKET PERSPECTIVE | |

|

IT IS ALL ABOUT STOCK BUYBACKS!

WORKING AGAINST AN EVER SHRINKING STOCK POOL!?!

Click All Charts to Enlarge

| |

MATASII: "Sustained Corporate Buybacks have been driving stock prices for over a decade and half. Resulting reduced floats and stock pools are resulting in increasing buyback volumes having an inordinate impact of equity market price distortions". Gordon T Long | |

|

1 - SITUATIONAL ANALYSIS

NERVOUS BUT STILL BULLISH

Though the Fear-Greed Index has slid slightly from 74 to 72, it is still at the high end of the Greed Scale (chart right top). From a longer term Overbought perspective it is at a major high (chart right bottom).

The combination of PE and VIX continues to signal a bullish outlook though we are clearly over-due for a near term corrective consolidation (chart directly below).

| |

ONLY AN EVENT SHOCK WILL STOP EQUITIES FROM CONTINUING HIGHER IN THE INTERMEDIATE TERM!

FUND MANAGERS SURVEY

Fund Managers continue to overweight equities relative to staying on the sidelines in cash.

| |

|

|

MARKET CONFIDENCE BUILT ON EARNINGS GROWTH , FED PIVOT & NO RECESSION

Rising earnings outlooks is assisting in supporting a strong "Risk-On" sentiment (chart right).

Earnings is supported by increasing GDP growth outlooks and improving Leading Earnings Indicators (below left).

Morgan Stanley analysts (below right) are fairly representative of the Sell Side consensus.

| |

|

CORPORATE STOCK BUYBACKS

As the chart at the top of this "Current Market Perspective" section illustrates, it is Corporate Buybacks that have been playing a dominate role in rising equity prices over the last decade.

It is our view, as a result of a shrinking stock pool, corporate buybacks are having an even more pronounced impact. Increasingly, fewer stocks are available for Corporate Buyback thereby increasing upward pressure on prices.

See our warning video on the "Disappearing Equity & Float Pools".

CHART RIGHT - TOP

Corporations will continue to be the largest source of US equity demand in 2024. A surge in share buybacks and continued growth in cash M&A will be the primary drivers of corporate equity demand.

CHART RIGHT - BOTTOM

Though the available stock pool continues to shrink, the buyback volumes are only increasing!

The Mag-7 stocks have been major buyers of their stocks (notably AAPL).

| |

|

|

2 - FUNDAMENTAL ANALYSIS

US DOLLAR WEAKNESS IS NORMALLY GOOD FOR STOCKS!

The market is focused on the "Golden Cross" (50 DMA crossing upward through the 2000 DMA) that recent upward movement in the US Dollar has potentially triggered. A rising dollar is typically not good for stocks.

We are not in that camp since all three major moving averages (50,100 & 200 DMA) are all tightly banded. Instead we we are focused on the the fact that the 100 DMA has triggered a Death Cross with it recently crossing the 200 DMA to the downside.

| |

|

We suspect the Golden Cross will cause some consternation in the equity market before reversing downward. A weak US dollar will add support to equities during this election year.

Better activity data and sticky prices have provided support to US rates and the dollar through the early months of the year. However, the Fed has now told us it is not impressed by strong employment and that it thinks high early-year inflation may be down due to faulty seasonals.

A Fed signaling a commitment to cutting rates typically initiates a Dollar Bear Trend

- Having been held up through the first quarter on better growth and particularly higher inflation numbers, dollar support should soon start to fade.

- At its most recent press conference, Federal Reserve Chair, Jay Powell, made clear that the Fed is minded to cut rates. The Fed expects three cuts in 2024, some analysts expect five starting in June as the decaying employment situation becomes more evident.

- We look for the soft landing narrative to gain traction over coming months and expect a bullish steepening of the US yield curve and rate differentials moving against the dollar to see EUR/USD gently climb above the end-year consensus of 1.10.

- At the same time, we think a little too much is priced in for the European Central Bank cycle this year. We suspect just three cuts starting in June.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

3 - TECHNICAL ANALYSIS

US EQUITY MARKETS

MAGNIFICENT SEVEN -- Surging Again!

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a "control set".

- The S&P 500 (CHART LINK)

- The DJIA (CHART LINK)

- The Russell 2000 through the IWM ETF (CHART LINK),

- The MAGNIFICENT SEVEN (CHART ABOVE WITHOUT THE MATASII CROSS - LINK)

- Nvidia (NVDA) (CHART LINK)

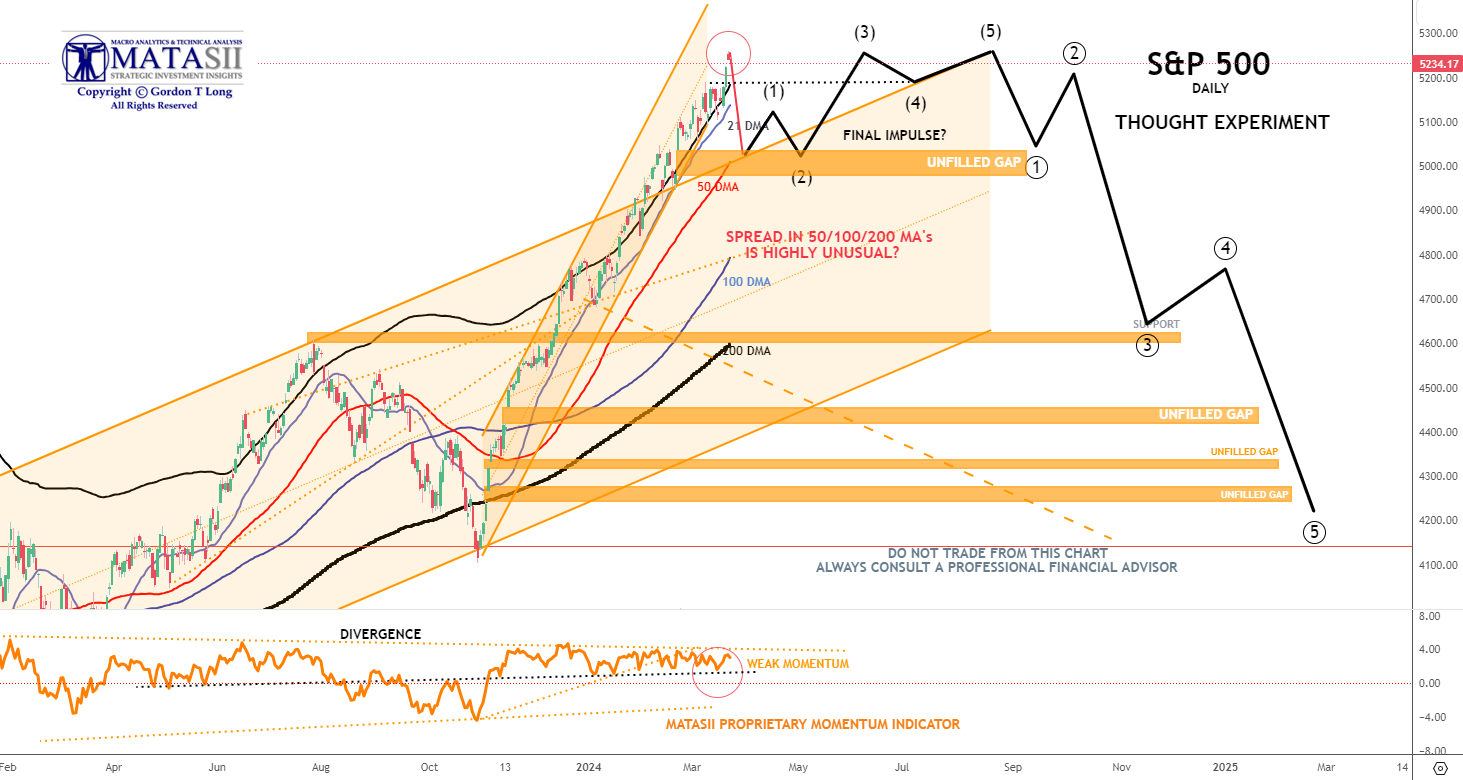

S&P 500 - Daily - Our Though Experiment

Our Though Experiment, which we continue to update, suggests we have put in a short term top (or very close to it) and will now consolidate before possibly completing one final small impulse higher OR put in a 1-2 Wave of a one higher degree. If the later occurs we could see the S&P north of 5500.

NOTE: To reiterate what I previously wrote - "the black labeled activity shown below, between now and July, looks like a "Killing Field", where the algos take Day Traders, "Dip Buyers", "Gamma Guys" and FOMO's all out on stretchers!" We are presently inclined to wait until late Q3 / early Q4 to potentially SHORT US equities.

|  | |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

STOCK MONITOR: What We Spotted

MONDAY

- Stocks rallied on Monday in a relatively quiet news flow session (from a macro perspective) with the Nasdaq leading the charge ahead of the Nvidia (NVDA) GTC event after the close.

- However, both the index and Nvidia closed well off best levels as participants positioned into the event.

- There was additional bullish momentum behind big tech stocks after Bloomberg reported Apple (AAPL) is to integrate Google's (GOOGL) Gemini AI app.

- Tesla (TSLA) and EV names also did well amid Biden's latest environmental endeavor.

- The Russell 2k saw notable weakness, however, while the equal weighted S&P was slightly lower.

- There was no major US data, although we did get a surprise rise in the NAHB housing market index.

- Treasuries continued to tumble with little catalysts ahead of the BoJ and FOMC, and on the former, note a new Nikkei sources article that the BoJ set to end yield curve control, ETF purchases, and end NIRP on Tuesday.

- That Nikkei article saw some fleeting strength in the Yen in an otherwise muted session for FX volatility.

- Even the solid Chinese industrial production and retail sales figures couldn't sustain any strength in the Yuan, nor the antipodeans, albeit it did support oil's continued breakout higher.

INFLATION BREAKEVENS: 5yr BEI -0.2bps at 2.370%, 10yr BEI -0.3bps at 2.326%, 30yr BEI -0.3bps at 2.276%.

REAL RATES: 10Y -- 1.9893%

STOCK SPECIFIC

- Apple (AAPL) +0.9%, Google (GOOG) +4%: AAPL is discussing integrating Google's (GOOGL) Gemini AI engine into the iPhone, according to Bloomberg.

- TSMC (TSM) +0.4%: TSMC is considering establishing advanced packaging capacity in Japan, potentially boosting Japan's semiconductor industry, Reuters reported.

- Cloudflare (NET) +3%: Stephanie Cohen, a senior exec at Goldman Sachs (GS), is leaving GS to join NET.

- Tesla (TSLA) +6%: To raise US prices for Model Y by USD 1,000 on 1st April (see autos section below for more).

- Boeing (BA) -1.5%: Federal prosecutors are investigating the mid-air blowout of a Boeing Co. door plug on an Alaska Airlines flight, using subpoenas and a grand jury in Seattle, Bloomberg reports.

- US Steel (X) flat: Said the acquisition by Nippon Steel is expected to close later this year. Meanwhile, X provided a Q1 guidance update, it sees adj. EBITDA at 425mln (exp. 468mln) and EPS between 0.80-0.84 (exp. 0.89).

- Shift4Payments (FOUR) -6.5%, Fiserv (FI) +1.5%: The FOUR CEO said bids from potential contenders have failed to sufficiently value the co., via Bloomberg. Note, Fiserv (FI) had been one of the bidders for the co.

- Nuvei (NVEI) +32%: Close to a buyout by PE firm Advent.

- Rivian (RIVN) +3.2%: Rivian vehicles are now compatible with the supercharger network.

- Soho House (SHCO) +21%: CC Capital is one of the parties in discussions to takeover Soho House (SHCO), according to Reuters sources.

- IPO's: Reddit's IPO is currently between 4-5x oversubscribed, making it more likely the social media platform will attain the USD 6.5bln valuation it seeks; the company is poised to at least reach its targeted price range of USD 31-34/shr when it prices on Wednesday.

- Autos: The Biden administration is poised to implement the strictest pollution limits for cars and light trucks, aiming to significantly boost electric vehicle sales, Bloomberg reports. Meanwhile, India announced a significant reduction in import duties on specific electric vehicles, targeting manufacturers investing at least USD 500mln in local production within three years, WSJ reports.

TUESDAY

- Stocks were ultimately firmer on Tuesday after earlier, tech-led weakness reversed into the close.

- Nvidia (NVDA) managed to close c. 1% firmer with some positive takeaways from its GTC event despite the lack of major surprises.

- Meanwhile, earlier weakness in tech/indices was catalyzed amid Super Micro (SMCI) announcing a c. USD 2bln share offering which saw shares tumble.

- Nonetheless, the pre-market weakness in the indices gradually pared through the rest of the session.

- In USTs, The front and belly led a rally amid the soft Canadian CPI figures ahead of Wednesday's FOMC, note that the long end lagged despite the solid 20yr auction.

- The lower yield environment gave some support to the rate-sensitive areas such as small caps.

- The DXY was firmer, testing 104, on account of a sell-the-news reaction in the Yen after the BoJ exited NIRP, with USD/JPY hitting four-month highs ahead of 151.

- Aside from the Fed, luxury names are on watch heading into Wednesday with Kering ADRs and the CAC seeing heavy selling on a negative sales update for its Gucci brand, with cited weakness in APAC, raising concerns on the Chinese consumer.

INFLATION BREAKEVENS: 5yr BEI -1bps at 2.361%, 10yr BEI -1.7bps at 2.310%, 30yr BEI -1.3bps at 2.263%.

REAL RATES: 10Y -- 2.0044%

STOCK SPECIFICS:

- Nvidia (NVDA) +1%: NVDA introduces the B200 plus a ton of partnerships with other companies, including, AMZN, DELL, GOOGL, META, MSFT, ORCL, TSLA, and many more. Sell-side commentary all remains very bullish on NVDA but they note there were no big surprises at the event. NVDA opened in the red but ultimately closed green with positive takeaways from the analyst call. Exec said the Blackwell chip will be priced between USD 30-40k (predecessor was USD 30k), and they plan to start shipping the chips later this year. The CEO also noted that the total addressable market for accelerated computing could cost a total USD 250bln per year, and NVDA is to get a larger chunk of that.

- Super Micro Computer (SMCI) -9%: Filed for a stock shelf offering of up to 2mln shares of common stock, raising the total common stock outstanding to 58.55mln. It later delayed the share sale until after the market close.

- Kering (KER FP/PPRUY) -9.5%: The French luxury name warned that Gucci comp revenues in Q1 are expected to be down nearly 20% Y/Y, with weakness in APAC markets, which will see group revenue -10% Y/Y vs Q1 23.

- Apple (AAPL) +1.4%, Meta (META) -0.2%: EU's Vestager, via Reuters, said Apple's new fee structure is the kind of thing she will be investigating, and when she was asked about Meta's new fees, said there are different ways to monetize its services.

- Macy's (M) +1.4%: Macy's reportedly agrees to open its books to Arkhouse and Brigade Capital, according to Reuters.

- Blackstone Mortgage Trust (BXMT) -2%: Muddy Waters' Block says the firm is 'more bearish' on Blackstone Mortgage Trust.

- AstraZeneca (AZN) flat/ Fusion (FUSN) +99%: AstraZeneca will acquire Fusion for USD 21/shr (vs prev. close 10.64/shr) in cash, plus a non-transferable CVR of USD 3/shr in a USD 2.4bln deal.

- International Flavors & Fragrances Inc. (IFF) -1%: IFF is to sell its pharma solutions business to Roquette in France in a deal valued at USD 2.85bln.

- Ford Motor (F) +1%: NHTSA is investigating a fatal Texas crash involving Ford's assisted-driving technology.

- KLA Corporation (KLAC) -1.4%: Announces the exit from the flat panel display business by the end of this year.

- TSMC (TSM) -1.3% / Intel (INTC) -1.6%: At least five suppliers to TSMC and Intel have delayed construction of facilities in Arizona, according to Nikkei.

- Nordstrom (JWN) +10%: JWN is reportedly working with Morgan Stanley and Centerview partners in an attempt to go private, according to sources via Reuters.

- Gildan Activewear (GIL) +10%: Co.'s board has put it up for sale amid prolonged battle for control of the company, according to Globe and Mail.

WEDNESDAY

- Stocks rallied to new closing highs on Wednesday after the Fed reaffirmed its three rate cuts in 2024 projection, despite higher longer-term dots, and as Powell played down the hot January and February inflation data.

- The rate-sensitive sectors outperformed, with the small-caps Russell 2k leading the SPX and NDX.

- Treasuries bull-steepened after the FOMC and Dot Plot, with the higher longer-run dots weighing more out the curve.

- Fed pricing has seen 2024 total cut pricing ramp up to 80bps from 75bps before the Fed, with the first fully priced cut remaining in July while the implied probability of a June cut has risen to 80% from 70%.

- The Dollar was sold post-Fed, and the Yen pared a lot of the earlier weakness after a Nikkei sources article released at the time warned of more hikes to come, noting the next hike is seen in July or October, according to the BoJ source.

- However, the Yen still closed weaker on the session.

- The Pound was an underperformer earlier in the session on the weak UK CPI figures ahead of Thursday's BoE, but reversed losses after the Fed.

- Oil prices took a tumble, in lack of an obvious catalyst, as benchmarks retreated from their multi-month peaks gradually through the session.

INFLATION BREAKEVENS: 5yr BEI +2.5bps at 2.384%, 10yr BEI +2.5bps at 2.333%, 30yr BEI +2.2bps at 2.285%.

REAL RATES: 10Y -- 1.9339%

STOCK SPECIFICS:

- Huawei: US mulls sanctioning Huawei's chipmaking network by including them in its entity list, according to Bloomberg.

- Intel (INTC) +2.4%: The Biden administration has awarded Intel (INTC) almost USD 20bln in grants and loans to subsidize chip production in the US.

- JPMorgan (JPM) +1.3%: Hikes its dividend to USD 1.15/shr (prev. USD 1.05/shr).

- Amazon (AMZN) +1.3%: Developing a new AI search tool that can create images based on shopper queries and product photos, according to Business Insider.

- Super Micro (SMCI) +1%: Super Micro priced its sale of 2mln shares at USD 875/shr, below an earlier marketed range of USD 900-1,000.68.

- Mobileye (MBLY) +7.5%: Volkswagen's (VOW3 GY) intensified its partnership with MBLY.

- Broadcom (AVGO) +3.5%: Reportedly announced a relationship with a third customer in the consumer AI space.

- Equinix (EQIX) -2.3%: Named a new short at Hindenburg.

- Tesla (TSLA) +2.5%: Raises Model Y prices in China.

- Nasdaq (NDAQ) -2.5%: Borse Dubai to sell shares in Nasdaq worth USD 1.6bln, reducing its stake to 10.8% from 15.5%.

- Boeing (BA) +3.6%%: Boeing is looking into how it can sever Spirit AeroSystems' ties with Airbus to facilitate Boeing's bid to reacquire its former subsidiary, Reuters reported. Separately, the CFO expects FCF usage of USD 4-4.5bln this quarter after the door plug blowout crisis, Co. has also made the decision to keep 737 production below 38/mth.

- Chipotle (CMG) +3.5%: The board has approved a 50 - 1 stock split, shareholders vote on the proposal on June 6th.

- Topgolf Callaway (MODG) +8.8%: Announced it is not aware of any talks of a sale of the business after media speculation earlier.

- Rockwell Automation (ROK) +1.3%: Expects FY results to track around the low end of its current guidance for both sales and EPS.

- TKO (TKO) +7.8%: Reached settlement agreements with all claims asserted in both class action lawsuits (Le and Johnson) for an aggregate amount of USD 335mln, payable by the Co. and its subsidiaries in instalments over an agreed-upon period of time.

EARNINGS:

- General Mills (GIS) +1.2%: Beat on EPS and revenue whilst it reaffirmed guidance.

- PDD Inc. (PDD) +3.5%: Saw huge beats on EPS and revenue although guidance was mixed.

- Signet Jewelers (SIG) -12%: EPS beat but revenue missed while revenue guidance was light of expectations.

THURSDAY

- Stocks were firmer on Thursday albeit the SPX and NDX closed well off best levels with Apple (AAPL) extending losses beyond 4% after the DoJ filed a landmark antitrust lawsuit against it.

- Micron (MU) was a standout outperformer (+14%) after its solid earnings and AI-friendly guidance, lifting the broader semiconductor space.

- The equal-weight S&P 500 and the small-caps Russell 2k held up much better.

- There was a slew of hot US data, including below-forecast jobless claims, a smaller fall than expected in the Philly Fed survey, ebullient existing home sales, and a mixed set of Flash PMIs (solid manufacturing, weaker services) which warned of inflationary pressures in the pipeline.

- Treasuries twisted flatter on the day, with a strong bid out of Europe after the surprise SNB rate cut and mixed PMI data fading through the US session; curve spreads pulled back after the strong steepening post-FOMC.

- The Dollar surged on the day, paring its post-Fed losses, while the Swissy tumbled post-SNB.

- The Pound also saw notable weakness after the BoE left rates unchanged, although the vote split shifted dovishly.

- There was a slew of other rate decisions in focus too with Norges on hold, CBRT hiking, Banxico cutting, and BCB cutting.

INFLATION BREAKEVENS: 5yr BEI +1.9bps at 2.412%, 10yr BEI +1.4bps at 2.359%, 30yr BEI +0.8bps at 2.303%

REAL RATES: 10Y -- 1.9087%

STOCK SPECIFICS:

- Apple (AAPL) -4.2%: DoJ filed an antitrust lawsuit against AAPL for monopolization of the smartphone market.

- Micron (MU) +14%: Posted a surprise profit per share, beat on revenue, above forecast Q3 EPS, revenue and gross margin guidance.

- Chewy (CHWY) -10%: Top and bottom line beat expectations but guidance disappointed.

- Guess (GES) +20%: Earnings beat with strong FY revenue guidance, it also declared a special dividend of USD 2.25/shr.

- Accenture (ACN) -9.5%: Beat on EPS but missed on revenue with weak revenue guidance.

- Darden (DRI) -6%: EPS was in line but revenue missed expectations, SSS also posted a surprise decline and it cut its FY SSS view but announced a new USD 1bln buyback.

- Nvidia (NVDA) +1.3%: Announced that Q1 2025 earnings would be published on May 22nd, 2024. Separately, the CEO told CNBC that Nvidia has created markets that did not exist before, rather than take share from existing markets. Added that the most important thing for a country is to create its own sovereign AI.

- Synopsis (SNPS) +2%: CEO said on Wednesday the co. had narrowed down potential suitors for its security software unit to about half a dozen.

- Reddit (RDDT) +47%: Reddit opened at USD 47/shr vs IPO price of USD 34/shr.

- Paramount (PARA) -5.2%: Controlling shareholder Shari Redstone is reportedly unconvinced by Apollo's (APO) USD 11bln offer and prefers the deal with David Ellison, according to FT. CNBC's Faber later said that PARA is not expected to sell its studio separately,

- Amazon (AMZN) +0.3%: NBC News found more than a dozen companies were marketing devices for online sales that regulators say could severely disrupt communications systems. FCC said it has several ongoing investigations into outlawed products, like jammers, on platforms including Amazon.

- Li Auto (LI) -7%: Cut its Q1 delivery forecasts.

- Capital One Financial (COF) +1.2%: Told bank regulators the Discover (DFS) deal will be pro-competitive and allow it to take on Visa (V) and Mastercard (MA), via Reuters citing sources. Says the deal will not harm credit card competition based on the share of card purchases.

- Rush Street Interactive (RSI) +4.2%, DraftKings (DKNG) +4.1%: Rush Street is reportedly considering a sale and have approached DraftKings (DKNG), according to Bloomberg.

FRIDAY

- Stocks were choppy on Friday with a lack of tier 1 US data to go off, while question marks were raised on the state of the consumer on the back of poor reports from Nike (NKE) and Lululemon (LULU).

- Large cap tech was an outperformer, with Apple (AAPL) paring some of Thursday's big losses post-DoJ lawsuit; Tesla (TSLA) pared its earlier large losses after BBG reports it had trimmed its Chinese output amid slow sales.

- Small caps (Russell 2k), on the other hand, saw large losses that were sustained.

- Treasuries bull-flattened amid dovish ECB momentum (EGBs outperformed, weighing on the Euro) and suspected month-end flows, with geopolitics simmering.

- On the latter, the Russia/Ukraine situation is deteriorating after Russian officials described to domestic press on Friday that the invasion of Ukraine was a "war" for the first time, more pointed than its usual description of it being a "special military operation".

- That was followed by what has been reported as a terrorist attack in Moscow (with 50+ reported dead currently), leading to speculation that the attack could preface a retaliation from Russia for whoever it deems responsible.

- The Dollar saw strong gains, with many central banks seemingly on a path to beating the Fed to the first rate cut.

- Yuan saw notable weakness after a big change in the fix as the currency breached 7.20 to the upside in what is being considered as appetite by Chinese officials to let the currency devalue.

INFLATION BREAKEVENS: 5yr BEI -1.2bps at 2.398%, 10yr BEI -1.2bps at 2.352%, 30yr BEI -1.2bps at 2.296%.

REAL RATES: 10Y -- 1.891%

STOCK SPECIFICS:

- Nike (NKE) -7%: Although shares initially rallied after its earnings report was published, they slipped into the red during the conference call. The quarter was strong although margins disappointed. On the call, execs acknowledged that the apparel maker had lost share in its running shoes category, sending shares into the red and announced it was to cut back on inventories of "classic" shoes to focus on upcoming launches and new product development.

- FedEx (FDX) +7%: Shares surged post-earnings after a strong EPS beat alongside strong margins while it also announced a new USD 5bln buyback program; revenue missed, however. Note, co. exec said that DRIVE was having a real impact, supporting both operating income growth and margin expansion

- Lululemon Athletica (LULU) -16%: Shares tumbled over 11% in after hours trade on soft comps and weak FY guidance.

- Tesla (TSLA) -1%: Is reportedly trimming Chinese output amid slow EV sales, according to Bloomberg.

- Apple (AAPL) +0.5%: The Co. has reportedly held talks with Baidu (BIDU) over AI for its devices; Apple talks with Baidu are still exploratory, according to WSJ.

- Booking Holdings (BKNG) -0.6%: Italy's antitrust regulator is to probe Booking.com (BKNG) for potential abuse of its dominant position.

- Amazon (AMZN) +0.4%: Competitive focus at Amazon (AMZN) has reportedly shifted to Chinese e-commerce players Temu (PDD) and Shein instead of Walmart (WMT) and Target (TGT), according to WSJ.

- MorphoSys (MOR) +0.8%: Announced US antitrust clearance of its proposed acquisition by Novartis; MorphoSys continues to expect the sale to close in H1.

- Adobe (ADBE) -2.3%: OpenAI (MSFT) is reportedly meeting with Hollywood (CMCSA, DIS) to pitch an AI video generator, according to Bloomberg.

- Joby (JOBY) -0.7%: Co. targets commercial service in Dubai as soon as late 2025; notes air taxi services likely to start in Dubai before US, according to Bloomberg.

- FedEx Corp (FDX) - Q3 2024 (USD): Adj. EPS 3.86 (exp. 3.45), Revenue 21.7bln (exp. 22.06bln); Authorizes a new USD 5bln buyback program. Narrows FY earnings outlook range; sees FY24 adj. EPS of 17.25-18.25 (prev. 17.00-18.50, exp. 17.40). Adj. OM 6.2% (exp. 5.63%). Reduces Capital spending forecast to USD 5.4bln from USD 5.7bln. Still sees a low-single-digit percentage drop in FY revenue. CFO says “DRIVE is having a real impact, supporting both operating income growth and margin expansion,”. Says if a new deal is not reached with USPS, the Co can't adjust FedEx express costs after expiration of contract (September 2024) and profitability could be negatively affected. Says will know in days or weeks if it has a new contact with the US Postal Service which is its biggest customer and with the current contract to expire September 29th. (Newswires) Shares +12.3% pre-market

- Nike (NKE) - Although shares initially rallied after its earnings report was published, they slipped into the red during the conference call, ending the extended trading session down 5.7%. It reported Q3 EPS 0.77 (exp. 0.74), Q3 revenue USD 12.43bln (exp. 12.28bln). On call, execs acknowledged that the apparel maker had lost share in its running shoes category. NKE is prudently planning for revenue in the first half of the FY25 to be down low single digits. Shares -6.6% pre-market

- Tesla (TSLA) reportedly trims Chinese output amid slow EV sales, according to Bloomberg. Shares -3.2% pre-market

| |

BOND MARKET

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a "control set".

- The 10Y TREASURY NOTE YIELD - TNX - HOURLY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - DAILY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - WEEKLY (CHART LINK)

- The 30Y TREASURY BOND YIELD - TNX - WEEKLY (CHART LINK)

- REAL RATES (CHART LINK)

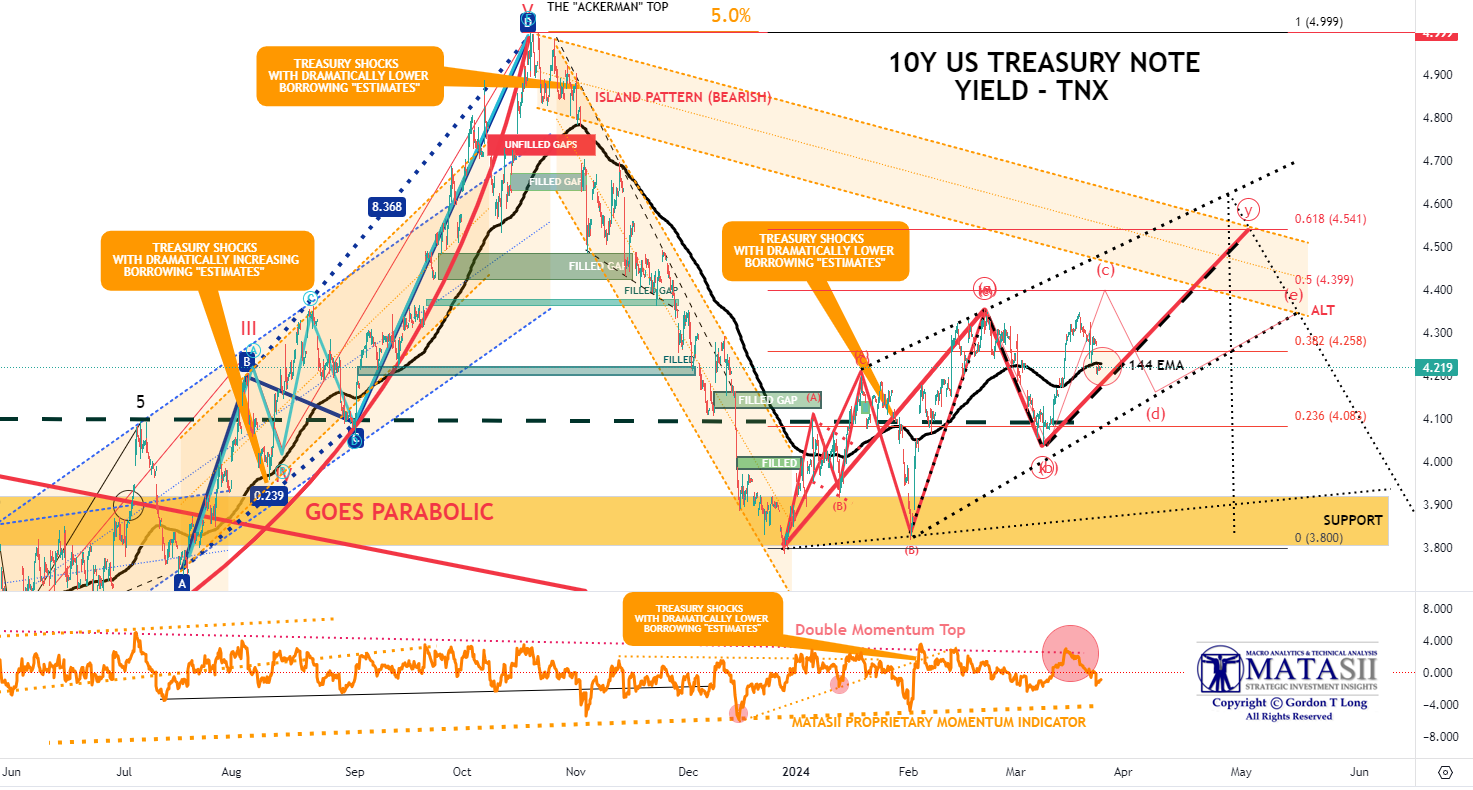

FISHER'S EQUATION = 10Y Yield =10Y INFLATION BE% +REAL % = 2.35% + 1.89% = 4.24%

As rate-cut expectations fell from 6 this year to 3, Treasury yields rose... non-stop... all week with the belly of the curve underperforming (5Y yields up 28bps on the week). Yields all ended back up, below but near their year-to-date highs.

Wholesale Gasoline prices are rising and will soon be seen at the pumps. Service Inflation is sticky with upward pressure as are food prices. With Inflation Break-Evens rising and Y-o-Y inflation comparisons becoming harder we see potentially slightly higher bond yields before Year-End,

|  | |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

========

| |

IDENTIFICATION OF HIGH PROBABILITY TARGET ZONES | |

Learn the HPTZ Methodology!

Identify areas of High Probability for market movements

Set up your charts with accurate Market Road Maps

Available at Amazon.com

| |

The Most Insightful Macro Analytics On The Web | | | | |