|

Gordon T Long Research exclusively distributed at MATASII.com

Subscribe to Gordon T Long Research - $35 / Month - LINK

Complete MATASII.com Offerings - $55/Month - LINK

SEND YOUR INSIGHTFUL COMMENTS - WE READ THEM ALL - lcmgroupe2@comcast.net

| |

|

CURRENT MARKET PERSPECTIVE

(NOTE: You missed our Subscriber Mid-Week Update - You Are working with only half the info!)

| |

|

THE USD "DEATH CROSS" NEEDS TO BE HEEDED!

THE MARKET NOW TURNS TO NEXT WEEK'S CPI / PPI REPORTS

Click All Charts to Enlarge

| |

2Y YIELD - FED FUNDS RATE: Rates continued to fall this week in anticipation of a Sept 16th FOMC rate cut. The market is screaming the Fed is 100 bps behind the curve, as the Yield Curve has re-inverted historically signaling that a recession has started.The Fed likely wants to see QT take the Fed Balance sheet down closer to the $7T level to better ensure it has the firepower to handle what is surely ahead over the next three years. | |

|

SENTIMENT - Sentiment & Complacency Reaching Dangerous Levels (But More to Go)

AN EPIC FLUSH: Everything - like literally everything - and certainly anything with a high beta or even a trace of momentum, imploded with a sheer violence that made Aug 5 look like amateur hour. And unlike Aug 5, the puke was only at the beginning with stocks spiking from the first moment of trading. This time it was the other way around, with stocks pushing higher to start the day before falling apart, and ending a catastrophic week in the worst way possible on a downtick.

CHART RIGHT ABOVE:

FEAR-GREED INDICATOR: With a reading of 39, the Fear & Greed Index currently suggests a level of fear in the U.S. stock market, indicating that investors are now cautious.

CHART RIGHT BOTTOM

EUPHORIAMETER: Despite significant volatility in August, bullish sentiment among investors in the U.S. stock market remains strong and has even reached new all-time highs.

CHART BELOW

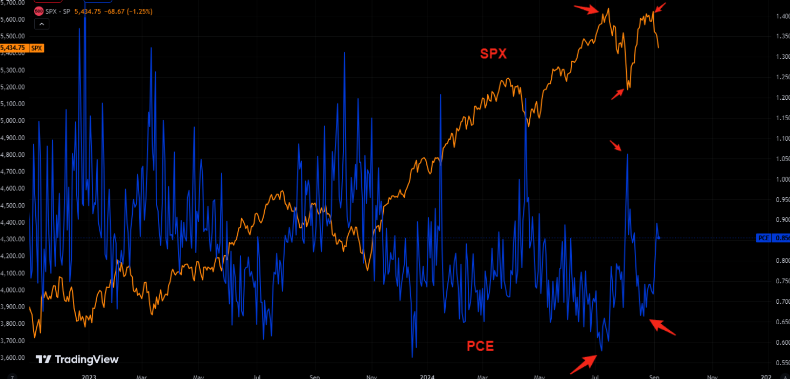

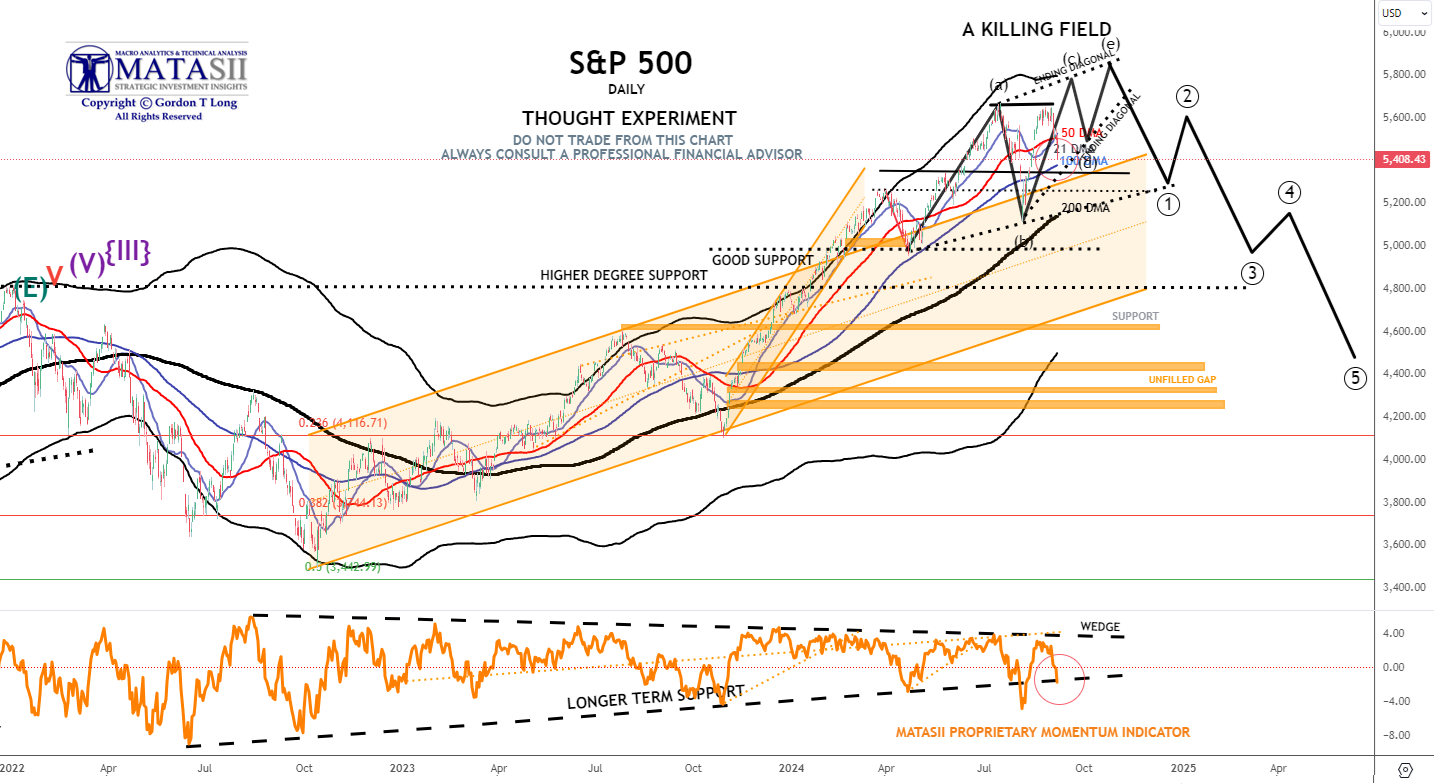

THE KILLING FIELD: The crowd is called the "crowd" for a reason! They loaded up on puts post the crash in August. They also managed "puking puts" in time for the most recent market highs....and are now back to chasing puts. This is why I called the current market environment "The Killing Field". (See S&P "Thought Experiment" near bottom of this report.)

|  | |

|

BULLISH-BEARISH INDICATOR: The 15 Year BofA Bullish-Bearish indicator is hitting its highest level in nearly 2.5 years. Though the indicator is still in “Neutral” territory, it is inching closer to a contrarian “Sell” signal. Following last month’s increase, the SSI is the closest it has been to “Sell” since January 2022. | |  |

|

12 MONTH FEAR-GREED INDEX: From extreme fear to "well" into greed land in a few weeks, (AND NOW ABRUPTLY LOWER AGAIN).

These are often signs of a long term market top.

| | |

AAII BULL-BEAR: Triangle Set up typically indicates FEAR Ahead. | |  |

DOWNSIDE PROTECTION: We are seeing a constant bid for downside protection. Skew remains very well bid and has been rising since mid June. This is the inverse to what we saw play out last year when skew was constantly "sold". The crowd is long and in need of downside protection. | | |

|

LEVERAGE IS ALWAYS OVERDONE - BEFORE FEAR SUDDENLY ARRIVES

Leverage works both ways, and AUM in leveraged ETFs has exploded. These funds magnify all moves- both ways!

| |

|

CASH-IS-TRASH IS ALWAYS IN VOGUE - BEFORE FEAR SUDDENLY ARRIVES

Cash-is-trash is back in vogue. Cash allocations were unchanged m/m - near survey history low.

| |

Nothing for the short term trading mind, but the spread between market cap and net income has widened a lot. | |

|

SEPTEMBER IS HISTORICALLY A TOUGH MONTH

September has been the worst month for the US stock market historically with an average return of -1.2% since 1928. We're seeing weakness again this year with the S&P 500 already down over 4% on the month.

September is the only month that has seen positive returns less than 50% of the time.

Second half of September isn't usually a good month for stocks, but remember it is the second half when the real trouble starts.

| |

|

BUYBACK BLACKOUTS

On the buybacks front, the buyback bid remains robust, but will start to wane into 9/13 blackout when 50% of corporates will enter blackout.

Estimates are ~$6.62bn in passive demand from this group until blackout begins.

UBS has a great way of charting the buyback "change" below. In finance it is all about the change, and this chart has a negative change!

| |

|

JUST TOO MANY MARKET "JAWS" - Historically Close The Gaps!

CHART BELOW: Is it time for stocks to catch back down to bonds' reality?

| |

SPX v FED RESERVES GAP: The gap between SPX and Fed reserves remains massive | |  |

SPX v 10Y YIELD (inv): Short term gap between SPX and the US 10 year (inv) is widening significantly!!! | | |

SPX v JPY GAP: Not part of the narrative at the moment, but the gap vs SPX is huge. BUT the Bank of Japan is expected to hike rates a third which typically pushes the Yen higher! | |

CHART RIGHT: NVDA v the dominant darling CSCO of the Dotcom Bubble (for those who recall). | |  |

| |

|

CHART RIGHT: NVDA has entered bear territory (-23% from intraday high on June 20th, 2024). Nvidia's market cap fell $279 billion Tuesday, the largest single-day decline for any company in history. That's bigger than the market cap of 474 companies in the S&P 500.

- Tuesday's record plunge in NVDA only became bigger Wednesday & Friday, as the stock was pushed below both 50 DMA & 100 DMA to below a 76.4% Fibonacci Retracement and just above a previously filled gap (will now act as support).

- The MATASII Proprietary Momentum Indicator (lower pane) decisively broke the lower support trend line (dotted black trend line) and will likely require the lower support trend line (dotted orange) to complete this down leg.

- The MATASII Proprietary Momentum Indicator, (lower pane below), has been signaling this sell-down was coming for some time now.

- Divergence is normally seen as a warning to the downside and is still ahead if the Divergence isn't removed by a movement higher in Momentum.

- At some point, the major unfilled gaps (at much lower levels) must be filled. NVDA therefore may no longer become a Short to Intermediate Long Term hold, but rather a position trading stock as other competitors enter the space and force margins and the earnings growth rate contracts.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

AS GOES NVDA SO GOES THE MAG-7

AS GOES THE MAG-7 SO GOES THE MARKET!

MAGNIFICENT 7

CONTROL PACKAGE

- APPLE - AAPL - DAILY (CHART LINK)

- AMAZON - AMZN - DAILY (CHART LINK)

- META - META - DAILY (CHART LINK)

- GOOGLE - GOOG - DAILY (CHART LINK)

- NVIDIA - NVDA - DAILY (CHART LINK)

- MICROSOFT - MSFT - DAILY (CHART LINK)

- TESLA - TSLA - DAILY (CHART LINK)

- The Intermediate Momentum Indicator trend line (lower pane) has decisively broken the lower support trend line (dotted black trend line).

- As we said in former reports: "A brief counter rally may ensue next week, but it is highly likely that Longer term Momentum Support (lower pane black dashed line) will soon be tested".

- Continued caution is advised since major global "Dark Pools" have been identified as presently operating behind the scenes on the Mag-7.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

APPLE - AAPL - DAILY

- AAPL continues to test its 50 DMA support level and is likely to test its upper channel line of its rising trend channel (shaded area).

- The MATASII Proprietary Momentum Indicator (middle pane) continues to show an overall downward bias with support a little lower (orange dotted trend line).

- We all know that Berkshire Hathaway sold over 389 million AAPL shares during the second quarter of 2024, cutting its position by nearly half. Despite this substantial sell-off, Apple remains Berkshire's largest public investment, still holding around 400 million AAPL shares. Will Buffett sell more or not? (as he continues to do with his Bank of America stock holdings) ....

- Apple will host a special event, "It's Glowtime," on September 9, 2024, when it is widely expected to announce new products for the iPhone 16, Apple Watch Series 10/Ultra 3/SE, and 4th-gen AirPods.

- Goldman points out that in the past 5 years, AAPL stock underperformed the S&P 500 by an average of 70 bps on the day of the iPhone announcement, and they expect this year's event to be similarly immaterial to the stock price. However, they note that upside surprises could include:

- The announcement of a price increase on iPhones,

- Earlier-than-expected AI features and apps,

- New iPad announcements, and

- Better-than-expected carrier promotions.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

AMAZON - AMZN - DAILY

- AMZN has again found support at the 200 DMA after previously surging to test the underside of its expanding wedge (dotted black lines).

- The 50 DMA crossed over and below the 100 DMA this week. This is a Bearish signal.

- The MATASII Proprietary Momentum Indicator (middle pane) pushed higher to test its overhead resistance trend line (dotted orange line) before also falling back. The Momentum Indicator is likely to want to test the lower support level (dotted black trend line).

- There is a strong possibility that AMZN will test its 400 DMA level over the next 60 days.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

META - META - DAILY

- META is showing weakness and is likely to test initial support at the 100 DMA support level. A test of the 200 DMA over the next 60 days is a high probability.

- The MATASII Proprietary Momentum Indicator (middle pane) continues to follow the "Divergence" trend line (black dotted line) lower... a Bearish signal.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

GOOGLE - GOOG - DAILY

- Though GOOG found support at the 200 DMA (again), it broke lower on Friday.

- The 50 DMA crossed the 100 DMA to the downside. This is a Bearish indication.

- The MATASII Proprietary Momentum Indicator (middle pane) continues to stay below the longer term "Divergence" trend line (orange dotted line). It also broke lower support on Friday.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

MICROSOFT - MSFT - DAILY

- MSFT found support again this week at the 200 DMA level before breaking slightly lower on Friday.

- The 50 DMA appears ready to cross over the 100 DMA to the downside. This is a Bearish indicator.

- The MATASII Proprietary Momentum Indicator (middle pane) continues to stay below the "Divergence" trend line (black dotted line) - a negative indication as it fails to attempt to test the divergence trend line.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

TESLA - TSLA - DAILY

- TSLA tested its overhead 50 DMA resistance level as well as its overhead trend line (sold black line) as of close Wednesday, then fell to the 400 DMA on Friday.

- The MATASII Proprietary Momentum Indicator (middle pane) and the RSI appear neutral.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

"CURRENCY" MARKET (Currency, Gold, Black Gold (Oil) & Bitcoin) | |

|

10Y REAL YIELD RATE (TIPS)

Real Rates bounced-off our lower support trend line, which gives us confidence with the two alternative counts that could occur, (shown in the chart to the right - as of close week ending 08/30/24). (LATEST)

NOTE: Gold is suggesting it will be resolved by the red line (chart right) with a fall in real rates (chart lower right) and rising Gold prices.

| |

CONTROL PACKAGE

There are TEN charts we have outlined in prior chart packages, which we will continue to watch closely as a CURRENT Control Set:

-

US DOLLAR -DXY - MONTHLY (CHART LINK)

-

US DOLLAR - DXY - DAILY (CHART LINK)

-

GOLD - DAILY (CHART LINK)

-

GOLD cfd's - DAILY (CHART LINK)

-

GOLD - Integrated - Barrick Gold (CHART LINK)

- SILVER - DAILY (CHART LINK)

-

OIL - XLE - MONTHLY (CHART LINK)

-

OIL - WTIC - MONTHLY - (CHART LINK)

-

BITCOIN - BTCUSD -WEEKLY (CHART LINK)

-

10y TIPS - Real Rates - Daily (CHART LINK)

US DOLLAR - DXY - DAILY

- We have a Death Cross (the 50 DMA crosses the 200 DMA to the downside) on the DXY.

- Expect the Dollar to break its long held support level (red band below).

- The MATASII Proprietary Momentum Indicator (lower pane) appears ready to break its longer term support level (dotted black trend line).

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

GOLD

CHART RIGHT:

The break out move higher refuses igniting properly. The longer term trend is intact, but the fact gold isn't able to trade above the upper short term trend is a sign of fading momentum. Let's see how this plays out, but gold bulls need the shiny metal to trade "well" above the upper trend line.

CHART BELOW

- Gold tested and broke through its overhead resistance line (black line), but has gained little since. It is showing weakness at this level.

- The potential rising triangle suggests gold (if true) may be reaching towards an Intermediate term high. However, the Macro suggests higher prices with the dollar continuing to fall and Real Rates weakening.

- The MATASII Proprietary Momentum Indicator (Lower pane) is within a "momentum wedge" that will soon be broken - with the probabilities likely to be to the upside if the Dollar begins falling.

| |

|

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

|

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

- The S&P 500 (CHART LINK)

- The DJIA (CHART LINK)

- The Russell 2000 through the IWM ETF (CHART LINK)

- The MAGNIFICENT SEVEN (CHART ABOVE WITH MATASII CROSS - LINK)

- Nvidia (NVDA) (CHART LINK)

| |

S&P 500 CFD

- We have a Double Top.

- The S&P 500 cfd has subsequently broken decidedly lower finding support at the 100 DMA.

- The MATASII Proprietary Momentum Indicator (middle pane) tested its overhead resistance "Divergence" level (as part of a large wedge that appears soon to end) and failed the test. It is presently retesting its support level (dotted black trend line).

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

S&P 500 - Daily - Our Thought Experiment

OUR CURRENT ASSESSMENT IS THAT THE INTERMEDIATE TERM IS LIKELY TO LOOK LIKE THE FOLLOWING:

NOTE: To reiterate - "the black labeled activity shown below, between now and September, looks like a "Killing Field", where the algos take Day Traders, "Dip Buyers", the "Gamma Guys" and FOMO's all out on stretchers!"

WHY DID I CALL IT A KILLING FIELD?: "We remain in short gamma land. Dealers had to sell deltas into the 5450 support area during the July 30 move lower. The same dealers had to chase all that sold delta and much more at higher prices as they became shorter and shorter deltas when the market ripped higher yesterday. Today is another brutal day for the short gamma community, as they have been forced to sell (at much lower prices) all that delta they bought yesterday. Add to it poor summer liquidity, and you realize why things are moving in an erratic way."

- We have a Double Top.

- The S&P 500 has subsequently broken decidedly lower this week finding initial support at Friday close just above the 100 DMA, (but at the Momentum support level).

- The MATASII Proprietary Momentum Indicator (middle pane) tested its overhead resistance "Divergence" level (as part of a large wedge that appears soon to end) and failed the test. It is presently retesting its lower support level (dotted black trend line).

- The longer term Momentum Indicator wedge (dashed black lines) is narrowing. It appears the S&P 500 is looking to test lower support levels.

|  | |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

STOCK MONITOR: What We Spotted

| |

LOWER BOND YIELDS CORRECTLY SPOT A WEAKER MACRO

CONTROL PACKAGE

There are FIVE charts we have outlined in prior chart packages that we will continue to watch closely as a CURRENT "control set":

- The 10Y TREASURY NOTE YIELD - TNX - HOURLY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - DAILY (CHART LINK)

- The 10Y TREASURY NOTE YIELD - TNX - WEEKLY (CHART LINK)

- The 30Y TREASURY BOND YIELD - TNX - WEEKLY (CHART LINK)

- REAL RATES (CHART LINK)

FISHER'S EQUATION = 10Y Yield = 10Y INFLATION BE% + REAL % = 2.036% + 1.68% = 3.716%

| |

- The TNX fell on Friday on the August Payroll Report putting in a potential Double Bottom.

- The Momentum Indicator (lower pane) is also showing a test of its lower support level.

- The Bond Vigilante's continue to send a clear message to the Fed that they are 100 bps behind the curve and yields are heading lower.

| |

YOUR DESKTOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

| |

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

========

| |

IDENTIFICATION OF HIGH PROBABILITY TARGET ZONES | |

Learn the HPTZ Methodology!

Identify areas of High Probability for market movements

Set up your charts with accurate Market Road Maps

Available at Amazon.com

| |

The Most Insightful Macro Analytics On The Web | | | | |